The former Portuguese colony of Macau took in $45 billion in gambling revenues in 2013, up 20% from the prior year and nearly seven times the action on the Las Vegas strip. But in the last six months, China’s President Xi Jinping has devastated the “Monte Carlo of the Orient” as he accelerates his anti-corruption campaign against vast layers of entrenched officials. Xi hopes his purge will deflect blame away from the Communist Party as China suffers its worst economic crisis in two decades.

Macau’s 35 casinos specialized in lavish casinos that catered to, and the shady network of junket operators that advertise opulence and sex, but really specialize in drug and money laundering. From a base of just 800,000 mainland Chinese tourists in 1999, Chinese visitors hit about 12 million in 2008 and then 17 million in 2012. Another 11 million visitors came from Hong Kong and Taiwan, many with dual Chinese People’s Republic passports.

The junket operators act as gambling promoters to arrange visas and VIP accommodations in association with a number of publicly listed American and Asian casinos. As part of the business, the junket agents have had free reign “in the normal course” to legitimately ferry cash across borders to Macau from China and back.

China only allows individuals to legally move about $3,100 out of the mainland at any time and a total of $50,000 during any 12-month period. Chinese high rollers have been able to deposit money with junket operators in mainland China or they borrow from junket agents in Macau for later repayment in China.

“Triad”-organized crime families “dominate the junket industry,” according to Benjamin Carlson at Foreign Policy, since gambling is illegal in China and courts don’t recognize or enforce payments on casino debts. The arrangement allows customers to use the money to gamble while in Macau.

But once the supposed gamblers leave the casinos, the triads help them wash their remaining cash into U.S. funds or Hong Kong dollars. The money is then usually invested in property in American, Canadian, or Australian property, or deposited in offshore tax haven bank accounts.

The U.S. Congressional-Executive Commission on China Annual Report 2013 reported that $202 billion in “ill-gotten funds are channeled through Macau each year.” Based on diplomatic cables released by the WikiLeaks hackavist network, the investigation revealed that the casino and hospitality sector recently accounted for over 50% of Macau’s entire GDP, and “its phenomenal success is based on a formula that facilitates if not encourages money laundering.”

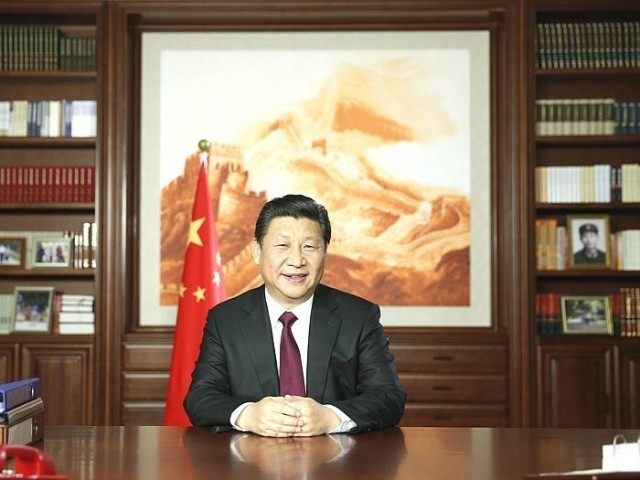

The Chinese Politburo Standing Committee moved last year to strengthen the party’s “fundamental political rule” by arresting both large and small corrupt officials in what President Xi calls a “fox hunt” to punish the “tigers and flies.” Over 10% of China’s most-senior leaders, along with a couple hundreds of thousands of local officials, have been punished so far, according to the South China Morning Post.

As the anti-graft probes widened, Macau casinos’ take has tumbled every month since June. With China’s anti-graft agency confirming this week that the security and intelligence apparatus with top official Ma Jian was placed under investigation for graft, police arrested Lisboa Hotels & Casinos Complex operator Alan Ho in connection with $56 million in cash payments to a list of 2,400 suspected prostitutes, according to the Macau Judiciary Police website.

The fallout from the Chinese anti-corruption purge is also undermining casino gambling in Las Vegas. According to my sources, Chinese undercover agents photographing mainland high rollers have scared away the junket trade to Sin City. On January 15, the operating subsidiary of Caesars Entertainment Corp, the largest U.S. casino company, filed for Chapter 11 bankruptcy after defaulting on $18.4 billion in debt.

As we are about to go to press, top executive Lou Fanghua of China Central Television (CCTV) state broadcaster became the newest “tiger” to be swept up in the “fox hunt.”

With China’s housing sector that indirectly accounts for up to 35% of China’s $8 trillion economy facing collapse, the Communist Party must consolidate huge industries like coal and steel that have 5,000-10,000 state-owned businesses. These entities have enjoyed massive government subsidies and serving as the source of vast amounts of corruption, according to Stratfor Global Intelligence.

China’s anti-corruption campaign successfully mobilized popular support that the Communist Party, especially the central leadership, continues to have a legitimate claim to rule China. But as economic stagnation and unemployment inflict real pain on the Chinese people, the credibility of the Communist Party will come under pressure.

COMMENTS

Please let us know if you're having issues with commenting.