This morning’s key headlines from GenerationalDynamics.com

- Iran blamed for terrorist bombing in Bahrain

- Puerto Rico expected to default on Saturday

- China’s government to continue buying stocks to stabilize markets

Iran blamed for terrorist bombing in Bahrain

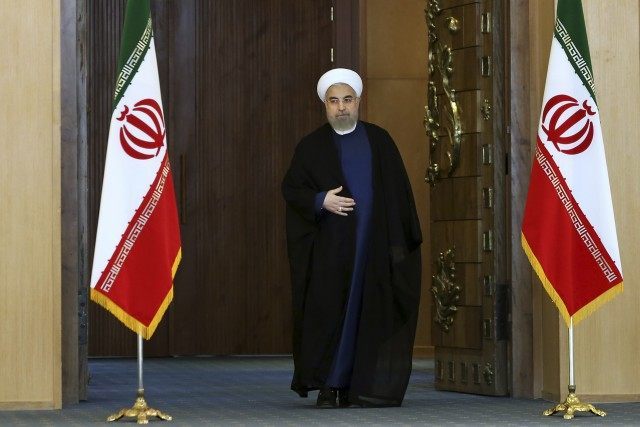

Comments by Iran’s Supreme Leader caused Bahrain to recall its ambassador (AP)

A bomb on Tuesday exploded outside a girls’ school in the Shia village of Sitra, killing two policemen and wounding six. This was the first bombing in Bahrain in several months, and the worst since March 2014.

Bahrain is governed by Sunni tribal leaders, although the population is 2/3 Shia. In February 2011, during the chaotic start of the “Arab Awakening,” peaceful Shia protesters in Bahrain were met by extreme violence, when police smashed into demonstrators with guns, clubs and teargas. (See “18-Feb-11 News — Bahrain’s government chooses the massacre scenario.”)

Iran has long been accused of interfering in Bahraini affairs, and in particular of supporting the Shia opposition. According to Bahrain media, “Early information suggests that the explosives used in today’s terrorist attack are of the same type that were recently intercepted coming from Iran.”

On Saturday, Bahrain had recalled its ambassador to Iran after Iran’s supreme leader Ayatollah Seyed Ali Khamenei said that the nuclear deal Tehran agreed on with the West would not alter its support for the governments of Syria and Iraq, nor its backing for “oppressed people” in Yemen and Bahrain, and the Palestinians. Khamenei’s comments provoked widespread outrage in Bahrain. Reuters and Gulf News and The National (UAE, 7/25)

Puerto Rico expected to default on Saturday

As expected, Puerto Rico is expected to be in default on Saturday, unable to make a $58 million payment due on Friday to bondholders.

Puerto Rico’s governor Alejandro García Padilla announced last month that the island territory will be unable to pay off its $72 billion in debts, so Saturday’s bankruptcy will not be a surprise.

Many people have invested in Puerto Rico bonds because they pay 10% interest (yields) and because under federal law they are “triple-tax free,” meaning that you can earn 10% interest every year and not have to pay federal, state or municipal tax on the interest you collect. It is a sweet deal, provided that Puerto Rico does not go bankrupt, because if it does, then you lose most or all of your initial investment.

A default will hurt a huge number of ordinary investors. 52% of all U.S. municipal bond funds hold credit tied to Puerto Rico. Even if individual investors do not individually own PR bonds, they own them through their 401k’s or other investment funds, which have been boosting returns by purchasing the PR bonds. These funds will all lose significant principal in a PR default.

The situation is expected to be chaotic and painful, since Puerto Rico cannot file for bankruptcy (as Detroit did) under U.S. law. CNBC and Prensa Latina

China’s government to continue buying stocks to stabilize markets

The Shanghai composite index on Tuesday fell 1.68%, after falling 8.48% on Monday, after massive intervention by the China Securities Regulatory Commission (CSRC). There were a variety of interventions, including massively buying shares, preventing some stocks from being traded, forbidding large companies from selling shares, and forbidding any Chinese media from using words like “plunge” that could cause people to panic. The plunge was a sign to many investors that the Chinese Communist Party is losing control of the stock market.

The CSRC announced that it will continue buying stock shares, in the hope of keeping the market from crashing.

Many ordinary Chinese investors are complaining that they’re “trapped in the stock market.” These means that they can’t sell without losing a lot of money, so they have to hope that government will intervene sufficiently to push up the market again, to the point where the CAN sell. This situation highlights the danger: Every time the CSRC intervenes so massively that they push the market up, many investors immediately sell, pushing the market down again. Xinhua and Reuters and CNN

KEYS: Generational Dynamics, Bahrain, Iran, Seyed Ali Khamenei, Puerto Rico, Alejandro García Padilla, China, Shanghai, China Securities Regulatory Commission, CSRC

Permanent web link to this article

Receive daily World View columns by e-mail

COMMENTS

Please let us know if you're having issues with commenting.