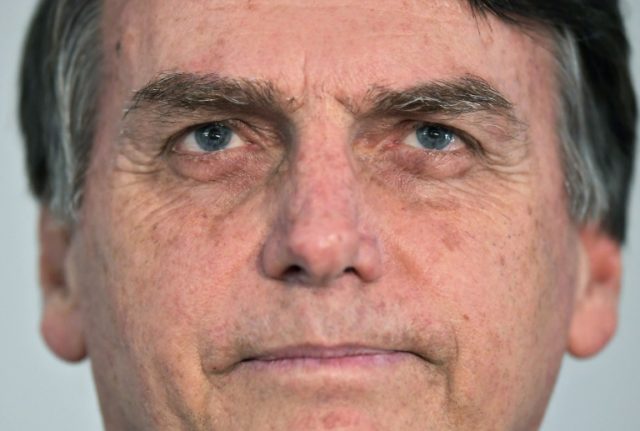

Rio de Janeiro (AFP) – Atrophying growth forecasts and waning confidence in President Jair Bolsonaro sent Brazil’s stocks and currency to their lowest level of the year this week, as analysts warned of further falls.

Since touching a record 100,000 points in mid-March, the Bovespa has fallen 10 percent and wiped out gains made since far-right Bolsonaro took power on January 1 on a promise to revive Latin America’s biggest economy.

The benchmark index closed just below 90,000 on Friday, while Brazil’s currency traded at its lowest level against the dollar in eight months, breaking through four reais.

The sharp declines have been fanned by uncertainty over US-China trade talks that has pummelled stocks and currencies in emerging markets, which are perceived as riskier bets.

But the “external headwinds” have been compounded by concerns over Brazil’s feeble economy, which has struggled to grow since emerging from the devastating 2015-2016 recession, said William Jackson of London-based Capital Economics.

“There was a lot of hope when Bolsonaro came to power that the economy would turnaround, but we have seen no evidence of this,” Jackson told AFP.

This week’s massive nationwide protests over education spending freezes, money laundering accusations against Bolsonaro’s eldest son and the slow pace of economic reforms were adding to the general malaise.

“The economy is really flirting with recession,” Jackson added.

The bleak outlook was underscored by economy minister Paulo Guedes, who warned this week that Brazil was “at the bottom of the well” as he slashed the government’s forecast for 2019 economic growth to 1.5 percent from 2.2 percent.

That was followed by central bank chief Roberto Campos Neto, who flagged a likely contraction in the economy in the first quarter following a slowdown at the end of 2018.

Market analysts have pared their full-year growth forecasts 11 weeks in a row and now expect the economy to expand by an anemic 1.45 percent, according to the latest central bank survey.

Some even saw that estimate as optimistic.

Marcos Casarin of Oxford Economics warned Brazil appeared headed for around one percent growth for the third year in a row.

“Brazil has never had such a slow recovery,” said Casarin, attributing lackluster activity to post-recession deleveraging by the Brazilian government, businesses and consumers, which has sapped spending, borrowing and investment in the country.

“Everyone had to pay back debt at the same time.”

But the risk of a technical recession — two straight quarters of contraction — was low.

“We are already at the bottom,” Casarin noted.

“We could potentially see a double dip, but that would have to be triggered by a domestic crisis” — such as failure to pass the pension reform bill.

– Uphill battle –

Bolsonaro has done little to help boost optimism among investors or voters.

The pro-market reform agenda that helped get the former army captain elected in October has stalled as he struggles to push his signature policy — an ambitious overhaul of the pension system that he says will bankrupt Brazil if not passed — through Congress.

There are fears the proposal could be significantly watered down by the time it is approved, probably later this year, eroding any positive impact on the economy.

“There was excessive optimism going on (with Bolsonaro’s victory) and now they are just more realistic,” said Casarin.

“It is pretty clear that he is struggling as president to make Congress do what he wants.”

One of the challenges for Bolsonaro is that his ultraconservative Social Liberal Party only holds around 10 percent of the 513 seats in the lower house of Congress.

That means he is relying on ad-hoc alliances with lawmakers in various parties who are part of his evangelical, pro-agribusiness, pro-gun base.

It does not bode well for his reforms, the economy or the markets.

“There’s a longer stretch to be run to revamp the economy,” Thomaz Favaro of Control Risks consultancy told AFP.

“I think the risk of further declines is very much real.”

COMMENTS

Please let us know if you're having issues with commenting.