Amazon just proved how powerful a combination it has in running a giant conglomeration of retail, advertising, and communications infrastructure business.

Amazon reported first-quarter results on Thursday afternoon, spectacularly beating Wall Street expectations.

The company earned $3.27 per share, more than twice the $1.26 expected. The company had $51.04 billion of revenue, compared with $49.78 billion forecast. Revenue was up 43 percent compared to the period a year ago.

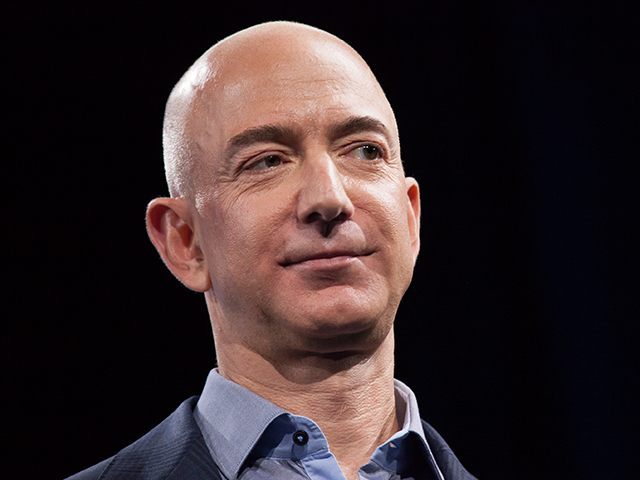

Jeff Bezos is not shy about his company enjoying huge advantages over its competitors, in large part because it connects its commerce business with its communications business.

“AWS had the unusual advantage of a seven-year head start before facing like-minded competition,” Bezos said in a statement. “As a result, the AWS services are by far the most evolved and most functionally rich.

The company is benefiting from the Trump economic boom. Revenue in North America soared 46 percent to $30.7 billion. International sales rose $34 percent to $14.8 billion.

The growth rate of AWS, Amazon’s business providing the backend storage for much of the internet, picked up pace. AWS revenue jumped up 49 percent compared with the year-ago period, to $5.44 billion. Wall Street had forecast $5.25 billion.

Amazon also has a category it calls “other” revenue. This is mostly an advertising business. This was once an insignificant business, but in the first-quarter it rose 139 percent year-over-year, to $2.03 billion in revenue.

Your Prime subscriptions are a huge business as well. Subscriptions brought in $3.1 billion. This is a business where people pay Amazon to more conveniently buy things from Amazon. It’s like a monopoly wrapped around a monopoly.

Wall Street momentarily sat gap-jawed at the results. Then traders started hitting the buy buttons as fast as possible. Shares are up seven percent in after-hours trading.

Investors do not appear to be concerned that results such as this may embolden the company’s critics, who say its structure and tactics give it unfair and anticompetitive advantages.

COMMENTS

Please let us know if you're having issues with commenting.