Hedge fund manager Kyle Bass on Tuesday lauded President Donald Trump’s trade policy towards China and said the world’s second-largest economy requires a “reset” to avoid further slowing growth.

During a fireside chat at the Reuters Global Investment 2019 Outlook Summit in New York, the Hayman Capital Management founder blamed China’s strained financial system on Beijing’s tight grip over its economy.

“He projected that China could lose more than $2.5 trillion of equity, more than triple the size of the U.S bank bailout during the 2008 financial crisis, and would have to print more than $25 trillion of renmimbi to counteract the impact of slowing economic growth and declining credit on its banks,” Reuters reports.

“It’s insane how levered this market has become,” the prominent short-seller told attendees. “You’re starting to see bankruptcies across the board in China that are hard to hide, if you look at the corporate default rate, the bankruptcy rate, M1 and M2 (money supply), the slowest money growth in over four decades.

“We’ll have a reset in China, and I think it will happen in the next couple of years,” he added.

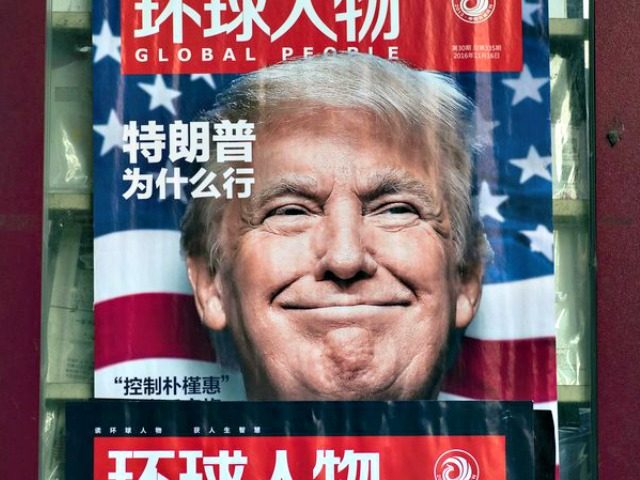

Bass’s comments come as top administration officials are attempting to find common ground on trade ahead of President Trump’s meeting with Chinese president Xi Jinping next month.

The Washington Examiner reports:

Treasury Secretary Steven Mnuchin spoke to his Chinese counterpart Friday, the Wall Street Journal reported.

Administration sources have leaked to news agencies last week that tariffs covering as much as $257 billion worth of Chinese goods could be announced next month. The U.S. has already hit $250 billion worth of Chinese goods with tariffs ranging from 10 to 25 percent. The tariffs are set to hit 25 percent across the board next year. Placing the total covered with tariffs at a half-trillion would cover all imports to the U.S.

The additional tariffs may come if little progress is made when Trump meets with Jinping at the G-20 summit in Argentina. The White House has expressed cautious optimism that the meeting could ease tension.

The Dallas-based money manager, who signaled he would support liberal billionaire and gun control proponent Michael Bloomberg’s 2020 White House bid, said he supports President Trump’s firm stance against Chinese dubious trade practices, calling it “100 percent healthy for the next 10 years.”

“Tariffs come and go,” said the investor whose firm is estimated to have $815 million in assets under management.“But how do you negotiate with someone… with the hopes that they would liberalize their economy and do the things they said they would do, and especially don’t do the things they said they wouldn’t do, and yet they’ve done everything exactly as they always have?”

COMMENTS

Please let us know if you're having issues with commenting.