The following article by Dylan Jovine is sponsored content from Behind the Markets.

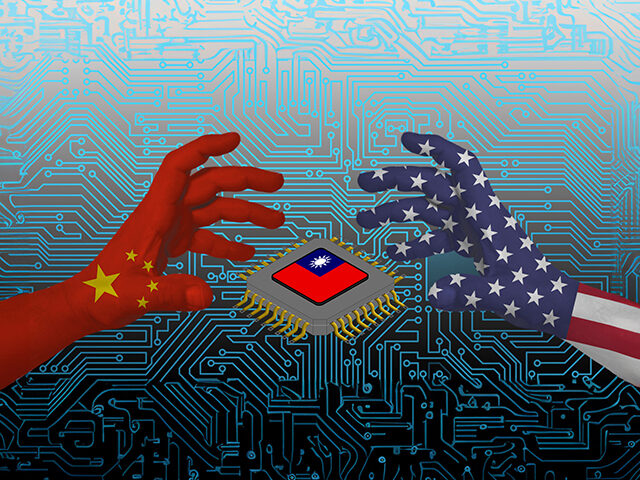

The Taiwan Strait — that’s where the military showdown between China and the U.S. is happening right now in real time.

The stakes couldn’t be higher. Whoever wins this contest could control the world.

Taiwan makes 66 percent of the semiconductors that power the world’s computers, smartphones, televisions, and even the brake sensors in our cars. A Chinese attack on Taiwan would be like cutting off 66 percent of the world’s oil supply.

This could cause a stock market crash and wreak havoc for firms like Apple, IBM, and Google. Prices for phones, cars, and computers could double, triple, or more overnight. World governments would scramble to hold onto chips critical to the military.

China could threaten to withhold chip shipments for anyone who doesn’t approve of their decision to invade Taiwan. By controlling the world’s advanced semiconductors, China would, in effect, control the world.

It gets even worse.

Taiwan also makes 90 percent of the most advanced semiconductors on earth. Their chips are at least between five to ten years ahead of ours.

Our entire infrastructure is built to use these advanced semiconductors. Even your smartphone is powered by these semiconductors. YouTube is able to serve videos because they use the fastest chips on earth. Zoom is able to host meetings worldwide because they use the fastest chips on earth.

What if firms like Apple lose access to these semiconductors? What will they put in their iPhones? Imagine running today’s applications on chips that are five years old. Most of your applications wouldn’t work anymore.

Think that’s bad? Now, apply that problem to the F-35 fighter jet. This weapons system uses the most advanced semiconductors on earth.

What if a fighter jet has a software update that requires new semiconductors?

A Chinese attack on Taiwan would put our very national security at risk.

As a matter of fact, no critical system or network you can think of — defense, power, transport, finance, communications, health care — can function without semiconductors.

The first move our military would have to make is to secure the 33 percent of semiconductor chips that are left, or we wouldn’t be able to support our own weapons systems. It’s a question of national security.

Whatever remaining chips are left for commercial use would skyrocket in price. That would cause the stock market to crash. Why? Look around your house.

Nearly one-third of everything in your house passes through the South China Sea. This includes smartphones, computers, furniture, car seats, clothing, hats, heaters, paint, shoes, rubber tires, washers, dryers, bicycles, microwaves, toasters, and more.

A Chinese attack on Taiwan could instantly freeze one-third of global trade.

Firms that sell furniture could find themselves with no furniture to sell, firms that sell car seats could have no car seats to sell, and firms that sell shoes could have no shoes to sell. This would send the stock market crashing, as global firms lose revenue and face bankruptcy.

To understand how the stock market would react to the outbreak of such a war, let’s take a look at history.

In 2002, the U.S. stock market dropped 28.5 percent as we prepared for war with Iraq. But a Chinese invasion would be different. Remember, Taiwan supplies 66 percent of the world’s semiconductors. And one-third of global trade passes through the South China Sea. A better analogy would be what happened during World War I and II.

On July 28, 1914, World War I broke out in Europe. The stock market closed for three days, and when it reopened, it dropped 33 percent. This was three years before the U.S. even entered the war.

In September of 1941, the country started to worry about entering the second World War. Afterwards came Pearl Harbor, the fall of Singapore, and the Bataan Death March. Within six months, the market was down 29 percent.

The national security implications of a Chinese attack on Taiwan give us three reasons to believe the market could drop 50 percent or more.

To begin, China is a near-peer competitor. This is not Saddam Hussein invading Kuwait. China doesn’t have old Soviet tanks. They now have the biggest navy on earth. This would make it very difficult for us to even get our aircraft carriers to Taiwan to help provide relief. China has also spent the last two decades building an A2/AD (anti-access/area denial) missile shield all around Taiwan.

Secondly, a Chinese takeover of Taiwan would put U.S. credibility on the line. Think about it this way: if our allies believe we can’t defend them from China, we will lose them. Our allies are like flowers, and they currently tilt toward the United States; but if China takes over Taiwan, they could all tilt toward China.

To understand how significant that would be, consider this: China could force all her new “allies” to use her semiconductors and internet firms. This could destroy all our U.S. companies.

Finally, a Chinese invasion of Taiwan could spiral into World War III in a heartbeat. The Japanese Deputy Prime Minister said as much recently. It could drag the United States, Japan, Australia, India, and South Korea into war as quickly as Europe slid into World War I. Wars are one of the greatest destroyers of capital, and there’s no reason to think this one would be any different.

The facts are clear: a Chinese attack on Taiwan is a threat to your financial security. One morning you could wake up and read that China attacked Taiwan overnight. $25 trillion in stock market value could be wiped out on the first day. Your IRA, 401k, mutual funds, and 529 plans could all be cut by 50 percent.

Can you imagine waking up one morning to see your retirement cut in half? That’s literally what’s in front of us.

The potential for a conflict over Taiwan to escalate into a global crisis is real. However, the biggest risk you face is not being prepared.

COMMENTS

Please let us know if you're having issues with commenting.