Breitbart Business Digest: Why Trump Won the Trade War Before the First Shot Was Fired

The rest of the world understands what many economists still don’t: the U.S. economy is keystone of the global trading system.

The rest of the world understands what many economists still don’t: the U.S. economy is keystone of the global trading system.

The May and June jobs revisions weren’t just large. They were historically large by any standard, representing statistical anomalies so far outside the bounds of normal variation that they are akin to black swans.

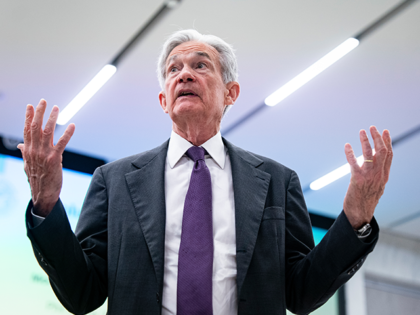

The July jobs report was a disaster for the American worker, the U.S. economy, the Federal Reserve, and Jerome Powell.

Democrats are now attacking Treasury Secretary Scott Bessent because the Trump administration created a program that progressive Democrats tried (and failed) to enact themselves.

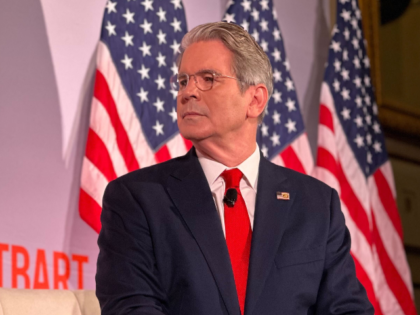

In a wide-ranging policy event hosted by Breitbart News, Treasury Secretary Scott Bessent touched on everything from trade negotiations with China, to the Fed’s “Tariff Derangement Syndrome” and New York City mayoral candidate Zohran Mamdani’s attempt to build a “Caracas on the Hudson.”

Even with the new tariffs, access to the U.S. market is still the best deal on the planet; and the Europe Union knows it.

The trade deal Donald Trump announced Sunday with the European Union is not just the death certificate of the old regime. It is also the birth certificate of a new era in international trade.

The Federal Reserve’s latest FOMC minutes offer a peek into the mind of an institution trying to explain why its insistence that tariffs would trigger inflation keeps misfiring.

The Congressional Budget Office has released a new report laying out how it will evaluate budgetary proposals to end the government’s control of Fannie Mae and Freddie Mac.

For decades, the elite consensus warned that any move toward tariff leverage would invite disaster. Trump has now signed three major deals in which the opposite happened.

One reason economists continue to be surprised by incoming data is that American households are stubbornly refusing to behave the way models expect.

The Republican base has rediscovered its roots as the party of America First economic nationalism.

Coca-Cola decision in 1984 to use high-fructose corn syrup instead of real cane sugar was caused by Cold War diplomacy, subsidized overproduction, and a technological leap that turned surplus grain into shelf-stable sweetener.

The June Producer Price Index (PPI) delivered another blow to the inflation hawks who insist tariffs are driving up prices.

June’s CPI data showed what tariffs can do and what they haven’t done. They’ve jiggled a few prices, but they haven’t unmoored the economy.

If you were trying to make tariffs look like a policy disaster, you’d do exactly what a team of economists at the Federal Reserve Bank of San Francisco just did: assume every trading partner hits back just as hard and that America just stands there and takes it.

One of the best kept secrets in the world today is that Americans are feeling far better about the economy than they have in years.

In a recent series of Truth Social posts, the president made the case that the strength of the U.S. economy justifies lower interest rates.

If you were wondering how Federal Reserve officials view Donald Trump’s tariff plans, the latest Federal Open Market Committee (FOMC) minutes make one thing perfectly clear: they all think tariffs are inflationary.

When Superman first appeared in Action Comics #1 in 1938, America wasn’t grappling with border policy or multiculturalism. It was staring down something more existential: a collapse in fertility.

The intellectual scaffolding for Trump’s tariff policy is now in place, built not by political appointees but by credentialed economists with publication records.

Strip away the noise and the June jobs report tells a clear story. The economy is still adding jobs. But it’s doing so in a new way.

Sen. Markwayne Mullin (R-OK) discusses the progress of President Trump’s One Big Beautiful Bill which is about to be passed by the House shortly and make its way to the president’s desk by the Fourth of July deadline.

The critics said tariffs would start a trade war. Instead, Donald Trump may have just ended one.

It’s been a good start to the year for Breitbart Business Digest.

The Home Depot–GMS deal shows us that forward-looking firms are planning for a world where labor is scarce, immigration is limited, and scale is king.

The Supreme Court’s decision on Friday in FCC v. Consumers’ Research didn’t just preserve a telecom subsidy—it delivered a serious setback to efforts to dismantle President Trump’s trade agenda.

The federal government has decided that your crypto portfolio—your Bitcoin, your Ethereum, your lingering Dogecoin bag—can help you qualify for a mortgage.

Fed Chair Jerome Powell’s belief that tariffs will push prices higher might be based on a new working paper from the Boston Fed that relies on a flawed model.

The Fed chair once warned against using speculative forecasts to drive policy. Now he’s doing exactly that.

For much of this year, the Federal Reserve has held interest rates steady after a series of cuts in late 2024. But that fragile consensus may be breaking.

President Trump has a rare opportunity to break the cycle of the Fed’s bureaucratic groupthink. Here are three decisive moves he can make.

or years, critics have warned that presidential use of tariff authority threatens the separation of powers.

The Federal Reserve announced definitively on Wednesday that President Trump’s tariff policies are forcing a more aggressive stance on inflation.

Retail sales fell in May, but beneath the surface, the picture of the American consumer remains solid—and in many categories, unexpectedly strong.

The critics of dollar dominance may speak loudly and often; but in practice, the dollar still rules.

Tariffs aren’t squeezing consumers. They’re squeezing foreign suppliers and protecting the American wage base.

Real wages are rising. Prices are not. The economy is healing—not in theory or through tortured revisions, but in real-time and at the household level.

The rare earths crisis was always going to arrive eventually. The surprise is not that it happened, but how little we did to prepare.

The One Big Beautiful Bill Act isn’t a break from conservative economic thought. It’s a return to first principles: a belief that growth, not austerity, is the engine of prosperity.