Farewell to Rate Cuts

The rate cut is going to be this year’s recession.

Last year, the specter of recession loomed large over the economic landscape, casting a pall of uncertainty that gripped market participants and policymakers alike. Many economic indicators pointed to an approaching slump, and some economic forecasters announced that there was a 100 percent chance the economy would slip into a recession.

We warned very early on that the data were coming in too strong for the economy to experience a recession and became more confident in the first few months of the year that there would be no recession at all. The rate hikes that everyone claimed had led to a very restrictive monetary policy never struck us as all that restrictive, and the Fed never raised rates to the six percent or higher we thought would have been required to send the economy into contraction.

As this year began, markets and policymakers—including Fed officials—were convinced that the Fed would cut rates this year. In many ways, this was just a continuation of the failed narrative of the prior year. It depended on the idea that the Fed’s policy is highly restrictive and therefore would need to be eased at some point.

What Is Fed Policy Restricting?

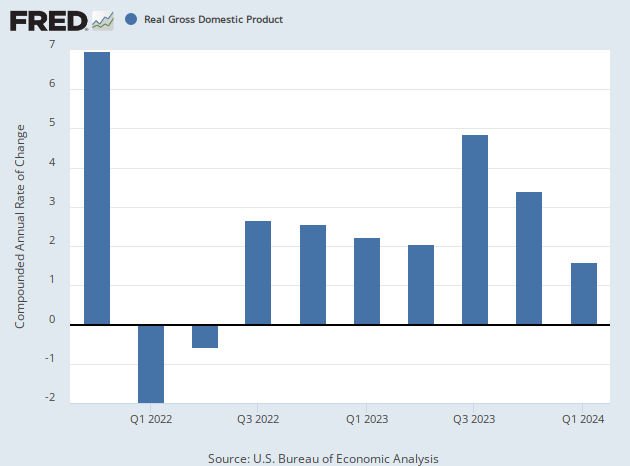

But where is the evidence that monetary policy is a significant drag on the economy? Nominal gross domestic product expanded at a 4.9 percent annualized rate in the fourth quarter of last year, 8.3 percent in the third quarter, 3.7 percent in the second quarter, and 6.3 percent in the first. Real GDP growth has come in above the Fed’s estimate of the sustainable long-term trend of six consecutive quarters.

Given this pace of growth, it’s safer to view the Fed policy as largely irrelevant at this point or perhaps even as accommodative.

The last refuge of the rate cutters is the idea that the famously “long and variable lags” of monetary policy are about to kick in real soon now. But this narrative is past its expiration date. The Fed has not raised rates since July of last year. Almost all of the rate hikes happened over two years ago, with just one hundred basis points of additional increases happening since December of 2022. If rates were going to drag down the economy, they would have done so by now.

The U.S. economy, pulsating with vigor, stands as a colossus, its strength defying the conventional wisdom that beckons for softer monetary stands. In this landscape of flourishing growth, consumer spending has remained very strong, supported by an ever expanding appetite for labor, rising incomes, and rising wealth in the form of home prices and stock prices.

Last month, the government reported that job vacancies climbed to nine million at the end of December. We’ll get the end of January figure on Wednesday. It is expected to show openings declining to 8.9 million. That’s still a very high number of vacant jobs. Even the most bearish forecast, at 8.7 million, calls for 1.2 million more openings than we saw at the height of the Trump jobs boom and 2.6 million more than the pre-Trump record high.

The nonfarm payrolls number shot up to 353,000 in January, sending shudders of doubt about rate cuts through the bond market. The consensus forecast for the February figure is 180,000, which would still be a strong number. But given the very low levels of unemployment claims seen last month, there’s a good chance for another upside surprise.

The No Cuts Renegade Army Is Growing

We are no longer alone in our view that the Fed will not cut rates this year. Jim Bianco of Bianco Research has been defending this position since last summer and did so again on CNBC on Monday. Last week, Torsten Slok of Apollo Management changed his view to one of no cuts this year. Larry Summers has warned that the Fed may actually hike rates, a view we share.

Me on CNBC talking no landing, inflation bottoming, China, the Fed and the bond market.

All our videos are herehttps://t.co/WO2AOPLIbu pic.twitter.com/loLev9jsnj

— Jim Bianco (@biancoresearch) March 4, 2024

Meanwhile, inflation continues to sit upon its stubborn perch, peering down at the Fed’s two percent target with contempt and threatening to take flight once again. We have argued that there are signs that inflation is already flapping its wings, with services sector prices rising rapidly and measures of underlying inflation—like median and trimmed mean inflation—rising.

Fed officials have made it very clear that they think it would be catastrophic to cut rates only to raise them again if inflation surges. So, we think that as long as there is a credible risk that inflation will start climbing again, the Fed will not cut.

Powell Before the House and Senate

This week Federal Reserve Chairman Jerome Powell steps into the congressional coliseum to deliver the chairman’s semi-annual testimony to the House and Senate. Powell is very likely to be met with an aggrieved chorus of Democratic lawmakers arguing that monetary loosening is long overdue. Republican lawmakers should very likely let the Democrats take center stage if just to establish further evidence that Joe Biden’s party does not really care that much about lowering inflation.

It’s very likely that the coming presidential race will be decided, at least in part, on the question of inflation. Despite the Biden administration’s attempt to blame corporate greed and foreign powers for inflation, a solid majority of the American people think his policies will result in even higher prices in the next presidential term. Why not let the Democrats openly advocate for looser monetary policy while inflation is still raging?

COMMENTS

Please let us know if you're having issues with commenting.