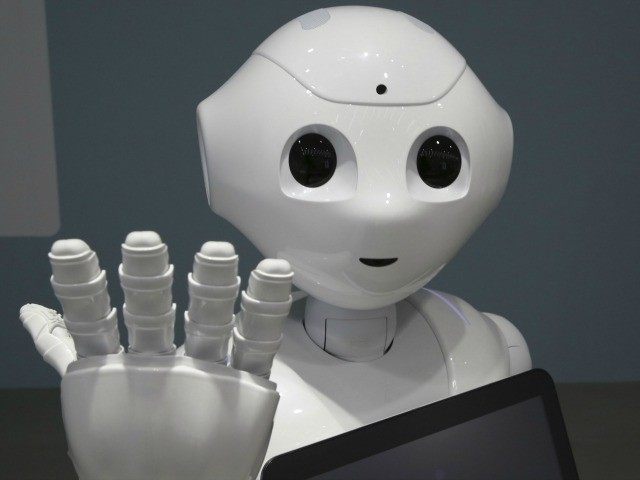

According to a new report by consulting firm Accenture, human bank tellers are on their way out.

Four out of five of the more than 600 bankers surveyed for the “Accenture Banking Technology Vision 2017” report believe that artificial intelligence will be responsible for most account holder interaction within the next three years. Ironically, over 75 percent of respondents believe that the introduction of AI will create a more human experience.

According to Accenture’s Head of Banking Practice, Alan McIntyre:

The big paradox here is that people think technology will lead to banking becoming more and more automated and less and less personalized, but what we’ve seen coming through here is the view that technology will actually help banking become a lot more personalized.

[It] will give people the impression that the bank knows them a lot better, and in many ways it will take banking back to the feeling that people had when there were more human interactions.

But the best reason for using AI as the middle-man between banks and their customers, according to a majority of respondents, was to “gain data analysis and insights.” Concerns about privacy issues also linger, but the report seems to suggest that one of the best ways for AI to aid potential investors is in an advisory capacity. Artificial intelligence would be able to easily analyze your financial situation, and help the bank to suggest investments that would work best for you. McIntyre concluded:

What you’re going to get on the bankers’ side is access to far better information, and that’s going to allow them to understand what your needs are and what the advice is that they need to give you.

Roberto Mancone, Deutsche Bank’s global head of “disruptive technologies and solutions,” added:

The advisory business of banking is a very costly model, and artificial intelligence can help to manage the data and to scale the advisory model in a way that was unforeseeable before.

It looks like banking is another business about to be revolutionized by the rise of intelligent machines. And while the efficiency of robotic tellers and financial advisers sounds like a positive change to industry insiders, it remains to be seen how customers will react to the reduction or removal of genuine human interaction.

Follow Nate Church @Get2Church on Twitter for the latest news in gaming and technology, and snarky opinions on both.

COMMENTS

Please let us know if you're having issues with commenting.