Yale University senior fellow and former Morgan Stanley chairman Stephen Roach says that “zero interest rates and quantitative easing are the time bomb that’s really ticking… that worries me a lot.”

Mr. Roach made his comments last week at a panel discussion for the Rand Corporation’s Politics Aside conference in Santa Monica, California.

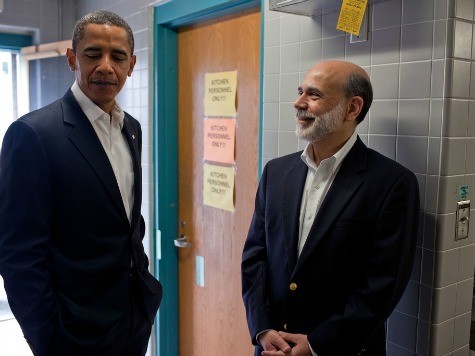

“The monetary policy and mistakes that were made beginning with Alan Greenspan and continuing with Ben Bernanke played a critical role in setting us up for this monster crisis,” he explained.

Mr. Roach said President Barack Obama should not have “ignored” the recommendations from the Simpson-Bowles Commission, which Roach says offered a “a formula that can get us out of the quagmire we’re in on the fiscal side.”

Asked whether he believed Mr. Obama and Congress can avert going over the fiscal cliff, Mr. Roach said he thinks the federal government will do what it does best and “kick the can down the road” by using “smoke and mirror gimmickry… I think this is all a bit of a publicity stunt to make us look like we’re going to the edge and then Washington comes in and rescues us from the brink. But I’m not optimistic that we’ll get the grand deal that will really solve our longer term problems and that’s disturbs me the most.”

COMMENTS

Please let us know if you're having issues with commenting.