The House passed the Tax Cuts and Jobs Act on Thursday, the bill features massive tax cuts for middle-class families and small businesses.

The House passed the Tax Cuts and Jobs Act 227-201, almost entirely on partisan lines. Thirteen Republicans voted against the bill, while 190 Democrats voted against the tax reform legislation.

The Tax Cuts and Jobs Act will collapse the income taxes’ four brackets into four: 12 percent, 25 percent, 35 percent, and 39.6 percent for the wealthiest Americans. The tax plan will also raise the standard deduction to $12,000 from $6,350 for individuals, and from $12,700 to $24,00 for married couples. The tax plan will also permanently and immediately cut the corporate tax rate from 35 percent to 20 percent. The House plan will also expand the child tax credit from $1,000 to $1,600 and the plan will eliminate the estate tax, also known as the death tax.

House Speaker Paul Ryan professed on the House floor on Thursday, “Passing the Tax Cuts and Jobs Act today is the single biggest thing we can do to help middle-income families in America.”

On Wednesday, House Ways and Means Chairman Kevin Brady (R-TX) proclaimed that the Tax Cuts and Jobs Act will reinvigorate the American economy.

Brady said, “Today, the full House begins consideration of the Tax Cuts and Jobs Act – historic tax reform legislation that will revitalize our economy and provide lasting tax relief to Americans of all walks of life.”

President Donald Trump said that the Republican tax plan will be “rocket fuel for our economy.”

President Trump spoke to the House Republican conference on Thursday morning about the need to cut taxes to revitalize the American economy.

House Speaker Paul Ryan have suggested that for the past week that they have the votes need to pass the tax reform legislation.

Rep. Dennis Ross (R-FL), a member of House Majority Whip Steve Scalise’s (R-SC) whip team, said that passing the tax plan will prove that Republicans can pass significant legislation.

Ross explained, “It’s more than just a tax bill. It will show that Republicans can get things done.”

The House Tax Cuts and Jobs Act initially faced resistance from Republicans that represented high-tax, mostly Democrat states, after the bill proposed to eliminate the state and local tax (SALT) deduction. Reps. Such as Tom MacArthur (R-NJ) signaled that they would vote for the bill after Republican leadership amended the bill to keep a $10,000 deduction for state and local property taxes.

MacArthur told reporters, “I did what I feel I had to do on the SALT front in the House bill, and now it’s time for me to vote ‘yes’ and then move into the next phase. I fought for the things that matter the most.”

On Wednesday, the House passed a rule that governed how the tax bill will come to the floor 235-191, mostly on party lines. The Republican whip team took that vote as a good sign that the tax legislation would gain at least 220 Republican votes when it would come to the floor on Thursday.

Now that the House passed their version of the Tax Cuts and Jobs Act, Senate Majority Leader Mitch McConnell will face more dire circumstances to pass the upper chamber’s version of the Tax Cuts and Jobs Act.

Sen. Ron Johnson (R-WI) became the first Republican senator to openly oppose the Tax Cuts and Jobs on Wednesday. Republicans hold a 52-seat majority in the Senate, McConnell can only afford to lose two Republican senators and have Vice President Mike Pence break the tie in the upper chamber.

House Majority Leader declared, “If we are successful today and in the weeks to come, you will keep more of the money you earned. You will have more in your paycheck. Your life will improve.”

President Donald Trump tweeted on Wednesday, “Big vote tomorrow in the House. Tax cuts are getting close!”

Big vote tomorrow in the House. Tax cuts are getting close!

— Donald J. Trump (@realDonaldTrump) November 16, 2017

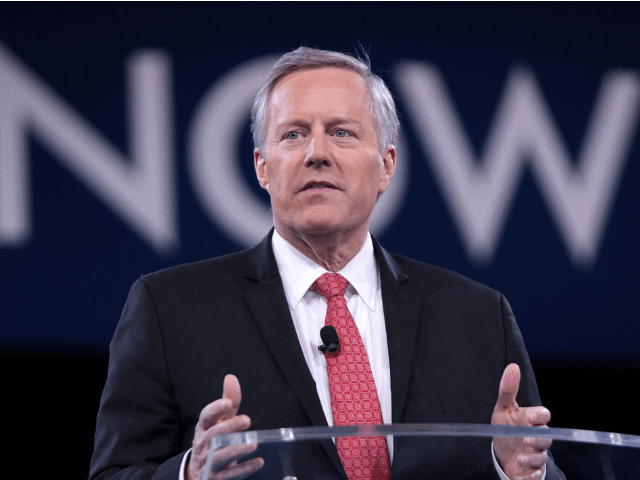

House Freedom Caucus Chairman Mark Meadows (R-NC) released a statement that cheered the Tax Cuts and Jobs Act’s passage through the House.

Chairman Meadows said, “Today, the House kept its promise to pass a historic tax reform proposal—and it’s a delivery that is long overdue. Moms, dads, small business owners, and working families across the country sent us to Congress to create a simpler and fairer tax code that grows our economy, works for American families rather than D.C. special interests, and returns power from bureaucrats in Washington back to the people of Main Street. Today is an monumental step toward fulfilling those promises.”

COMMENTS

Please let us know if you're having issues with commenting.