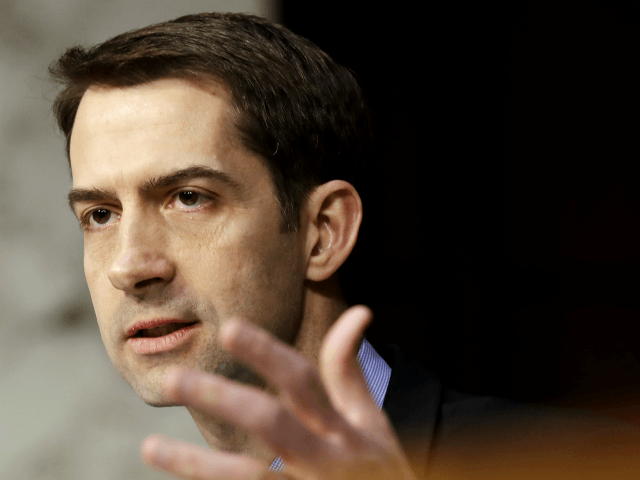

Senator Tom Cotton deserves credit for bringing Republicans around to a daring, controversial, and politically brilliant idea: repealing Obamacare’s individual mandate through the Republican tax overhaul.

Cotton “brought Obamacare repeal back from the dead,” Politico reports. He rallied his fellow Republican lawmakers behind the idea by showing them how the tax savings from ending the individual mandate could be used to broaden the tax cuts without blowing past debt limits imposed by Senate rules, according to Politico.

Far from complicating tax reform efforts, the inclusion of the repeal simplifies it. According to the Congressional Budget Office, the repeal will save the government $338 billion over the next decade. That made room for the expansion of child tax credits, local property tax credits, and small business tax credits without offending the sensibilities of deficit hawks.

The genius of Cotton’s plan, however, only begins with the budget. Far less noticed is how it derails a key talking point that helped undermine earlier attempts to repeal and replace Obamacare. Those efforts were crippled by misleading stories about how many Americans would “lose health insurance” under the proposals. But no one loses health insurance because the mandate goes away. It simply allows those who would prefer to go without insurance to avoid it.

That’s forced defenders of Obamacare to shift the grounds of their criticism onto far less safe territory. Now the critics say that removal of the individual mandate will “cripple” Obamacare and drive up health premiums. But this argument has a fatal weakness: it makes it clear that the purpose of the mandate was not to guarantee that people got the health insurance they need but to force younger and healthier workers to pay for the insurance of the sickly and elderly.

In other words, the mandate was never about getting needed health insurance to those who were hit by the mandate. It was about using the mandate to force people who did not believe they needed health insurance to pay for the insurance of those who do believe they need it.

This has never been a popular position with Americans, who are generally opposed to seeing people used as the means to accomplish the ends of others. It grinds against the grain of the moral sense of many Americans that people should be treated as individuals, ends in themselves, and not as tools for the goals of social engineers.

Not to say that Americans are not generous. But if the problem is simply that we think health care needs to be subsidized, the cleaner and ethical way to accomplish this is simply by directly subsidizing health insurance for those who cannot afford it. If health insurance pools need to be backed up by broader society, that is a burden that should be shared by all. Shifting the burden to a small portion of Americans isn’t generosity–it’s underhanded politics.

It’s important to remember who pays the price of the mandate. These are self-employed people, or people marginally attached to the workforce, or people who cannot gain insurance from their employer for one reason or another. Americans fortunate enough to have corporate sponsored healthcare avoid the burden–which is to say corporations avoid the burden.

This was part of the devilish genius of Obamacare. By concentrating the burden of propping up the individual health care market outside of the corporate insurance market, the plan was able to gain the support of corporate America.

Repealing the individual mandate will also make future health care reform easier. The next time the Congressional Budget Office calculates how many Americans will “lose” insurance from repeal, it will not be able to include the millions who only “lose” insurance because they aren’t required to have it. The numbers will shrink and the anti-healthcare reform forces will find it harder to lie about the consequences.

Nothing about repealing the mandate means anyone’s health insurance premiums will rise. It simply means that any subsidy to suppress the price of premiums will have to be a shared burden by all Americans. We can no longer hide the price of this policy behind the guise of an insurance mandate.

COMMENTS

Please let us know if you're having issues with commenting.