Breitbart Business Digest: What if We Had Listened to Pat Buchanan?

A new working paper asks what would have happened if the country had heeded Pat Buchanan’s warnings about unchecked globalization and adopted his trade policies sooner.

A new working paper asks what would have happened if the country had heeded Pat Buchanan’s warnings about unchecked globalization and adopted his trade policies sooner.

President Donald Trump’s tariff policy is about a lot more than raising import duties. This is the new “deal economy”—less about rates, more about commitments.

Economics has always wrestled with the limits of what can be known. The recent disproof of a famous mathematical conjecture has made those limits even sharper.

When, if ever, should a country impose tariffs? A working paper by economists Oleg Itskhoki and Dmitry Mukhin provides an answer that is both surprising and vindicating of the Trump administration’s trade agenda.

The legal case for Trump’s use of tariffs under IEEPA isn’t some novelty. It’s an originalist argument grounded in history, precedent, and the plain structure of constitutional power.

A new academic paper, published by three trade economists using microdata from China, shows that tariffs don’t have to raise prices. Sometimes, they bring them down.

President Donald Trump this week said he is planning to impose a 100 percent tariff on imported computer chips unless manufacturers are also investing in U.S. production.

President Donald Trump has selected Stephen Miran, chairman of the White House Council of Economic Advisers, to fill a vacant seat on the Federal Reserve Board, nominating a longtime ally and critic of recent central bank policy to serve out the remainder of an expiring term.

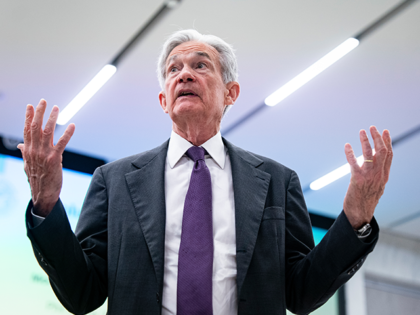

The central bank’s future may hinge on a forgotten legal quirk—and a historical echo from 1948.

The Fed needs someone at the helm who understands how growth happens, where policy fails, and why incentives matter more than slogans. That’s Scott Bessent.

Donald Trump’s advisers are divided over how to fill an upcoming vacancy on the Federal Reserve Board, with some pushing for a short‑term appointee and others urging the president to seat a credible successor to Fed Chair Jerome Powell.

The rest of the world understands what many economists still don’t: the U.S. economy is keystone of the global trading system.

U.S. services activity accelerated in July to its highest level since December, pointing to a solid rebound in business momentum as the third quarter got underway.

The May and June jobs revisions weren’t just large. They were historically large by any standard, representing statistical anomalies so far outside the bounds of normal variation that they are akin to black swans.

Outside the volatile transportation category, new orders rose 0.4 percent to $498.6 billion, a commonly watched proxy for underlying demand.

The July jobs report was a disaster for the American worker, the U.S. economy, the Federal Reserve, and Jerome Powell.

Hours after the Labor Department reported much weaker than expected jobs data, a Biden appointed Fed governor announced she would step aside.

The labor market appears to be far weaker than previously thought, with huge downward revisions to May and June, losses in manufacturing, and a rising unemployment rate.

Democrats are now attacking Treasury Secretary Scott Bessent because the Trump administration created a program that progressive Democrats tried (and failed) to enact themselves.

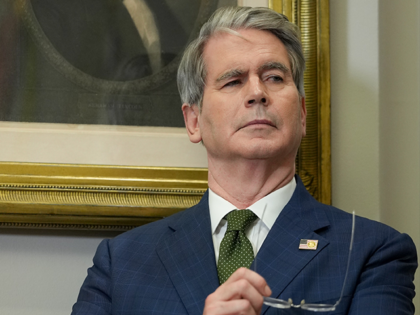

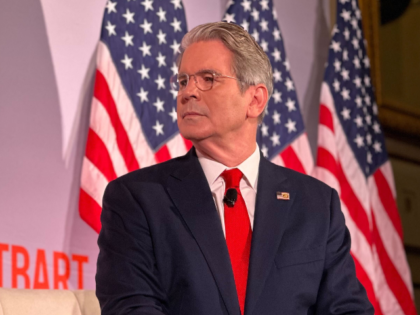

In a wide-ranging policy event hosted by Breitbart News, Treasury Secretary Scott Bessent touched on everything from trade negotiations with China, to the Fed’s “Tariff Derangement Syndrome” and New York City mayoral candidate Zohran Mamdani’s attempt to build a “Caracas on the Hudson.”

Even with the new tariffs, access to the U.S. market is still the best deal on the planet; and the Europe Union knows it.

The expectations index improved significantly as consumers became more hopeful about jobs and business conditions.

Steep drop in consumer goods imports likely to boost second-quarter GDP.

The trade deal Donald Trump announced Sunday with the European Union is not just the death certificate of the old regime. It is also the birth certificate of a new era in international trade.

Texas manufacturing activity rebounded sharply in July, with production hitting a three-year high.

The Federal Reserve’s latest FOMC minutes offer a peek into the mind of an institution trying to explain why its insistence that tariffs would trigger inflation keeps misfiring.

New orders for long-lasting manufactured goods fell sharply in June, dragged down by a steep drop in aircraft demand that reversed a spike the previous month. But orders outside the volatile transportation sector rose for a third straight month, signaling

The Congressional Budget Office has released a new report laying out how it will evaluate budgetary proposals to end the government’s control of Fannie Mae and Freddie Mac.

Sales of newly built single-family homes in the United States rose slightly in June but remained well below expectations, as elevated mortgage rates and affordability concerns continued to weigh on demand. The U.S. Census Bureau and the Department of Housing

For decades, the elite consensus warned that any move toward tariff leverage would invite disaster. Trump has now signed three major deals in which the opposite happened.

Sales of previously owned homes declined more than expected in June, as elevated mortgage rates continued to suppress buyer activity despite rising inventory levels.

One reason economists continue to be surprised by incoming data is that American households are stubbornly refusing to behave the way models expect.

Trump announces new pacts featuring zero tariffs on U.S. exports and 19% levies on imports.

Production of business equipment and capital expenditures are surging, indicating a major investment wave has begun, Treasury Secretary Scott Bessent said Tuesday morning. “Business equipment production jumped 11% annualized in Q2 after a huge 23% gain in Q1 — the

“There’s nothing that tells me that he should step down right now,” Bessent said during an interview with Maria Bartiromo on Fox Business. “His term ends in May.”

Federal Reserve chairman Jerome Powell should step down in order to protect Fed independence, according to Mohamed El-Erian. El-Erian is the former chief executive of Pimco and Harvard University’s investment arm. He is currently president of Queen’s College in the

The Republican base has rediscovered its roots as the party of America First economic nationalism.

Treasury Secretary Scott Bessent on Monday called for a deep and wide review of the Federal Reserve, questioning whether the central bank is failing at its central missions of conducting monetary policy, supervising the biggest banks, and ensuring financial stability.

Federal Reserve Governor Christopher Waller has signaled he may vote for a rate cut, a direct challenge the Fed’s sluggish response to evolving economic conditions.

The monolithic thinking about tariffs and inflation at the Fed has been shattered, as Fed Governor Chris Waller shows leadership by breaking with Jerome Powell.