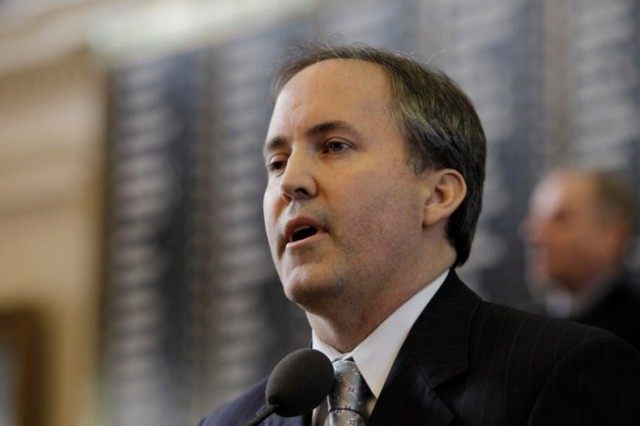

Texas Attorney General Ken Paxton has been charged with two first degree counts of securities fraud, and with a third degree felony for failing to register as a securities adviser with the Texas State Securities Board.

Paxton was booked, photographed, and charged on Monday morning, as reported by Breitbart Texas.

Texas’ top lawyer turned himself in at the Collin County, Texas, jail.

The indictments relate to actions and events in Collin County prior to the Attorney General (AG) taking office in January of 2015.

The First Indictment: Failure to Register

The circumstances surrounding the third degree failure to register charge has been a public and political issue since the Republican primary race for Attorney General in 2014. The issue was first raised by one of Paxton’s Republican primary opponents, Dan Branch.

In May of 2014, the Texas State Securities Board fined then-Texas Senator Paxton $1,000.

In July 2014, a letter calling for an investigation of Paxton was sent to the Travis County District Attorney by a left-of-center “watchdog” group. Paxton was at that time the Republican Party nominee for Attorney General. This letter was a catalyst for what would in 2015 become, as reported by Breitbart Texas, an investigation of Paxton wherein two special prosecutors would be appointed.

The letter from this group complained of circumstances surrounding a May 2014 order issued from the Texas State Securities Board. The securities board closed the matter without referring it to the Office of the Texas Attorney General for criminal prosecution, something within the power of the board to do. The board did not make a finding that Paxton knew or should have known he wasn’t properly registered.

Paxton has been charged with the offense of “Acting as an investment adviser representative without being registered by the Texas Securities Board in violation of Texas Securities Act, Section 29(1).” The offense is a felony of the third degree.

The indictment states that Paxton “did then and there knowingly and intentionally render services as an investment adviser representative to James and Freddie Henry and the aforesaid [Paxton], was then and there not duly registered as an investment adviser representative by and with the Securities Commissioner of the State of Texas.”

This charge relates to actions “on or about the 18th day of July, 2012.”

The order from the securities board “reprimanded” Paxton for acting as an investment adviser representative for one company (Mowery Capital Management, LLC, MCM) when that company was registered as an adviser with the state securities board when Paxton was not registered.

Paxton was actually properly registered as of December 2013, long before the initial inquiries into this matter were raised during the primary run-off by Dan Branch.

Now whether a company must register as an adviser with a state or the U.S. Securities and Exchange Commission (SEC) is an issue of how much money they manage. The Dodd-Frank Wall Street Reform and Consumer Protection Act created a bright-line rule requiring an investment adviser managing more than $100 million in client assets to register with the SEC. The act provides that any investment adviser managing less than $100 million must register with the state where they have their principal place of business.

Moreover, unlike state law, federal securities law only mandates the registration of an investment adviser. It does not require the registration of investment adviser representatives, or those acting as solicitors such as Paxton. Therefore, Paxton had no obligation and no duty to register as either a solicitor or investment adviser representative while MCM was federally registered and regulated by the SEC. Thus, the question is whether Paxton violated state securities laws and when.

As seen in its order, the Texas State Securities Board found that MCM was registered with the Securities Commissioner as an investment adviser from October 1, 2004 to November 6, 2008. It determined that “MCM transitioned from state registration to federal registration” in November of 2008 and that MCM registered with the SEC on November 6, 2008. It also found that on June 25, 2012, MCM transitioned back to state registration and was in 2014 registered as an investment adviser with the Securities Commissioner.

The Board found that Paxton solicited three clients at times when MCM was a state-registered investment adviser and Paxton was not registered as an investment adviser representative of MCM. These solicitations occurred years apart, one each in 2004 and 2005, and then in 2012. The statute of limitations precludes an indictment for any actions or non-actions associated with the 2004 and 2005 violations.

The state securities commissioner found that Paxton’s lack of registration was a violation of section 12.B of the Texas Securities Act. According to section 23-1.E of the act, any enforcement activities related to the administrative assessment of a fine must be “commenced within five years after the violation occurs.”

When the securities commissioner issued his conclusions of law in the order, it was determined that Paxton would be fined “[p]ursuant to Section 23-1.A(3).” Looking at section 23.1.A of the Texas Securities Act, the Commissioner found that Paxton “engaged in an act or practice that violates this Act or a Board rule or order.”

The Commissioner thus declined to find under sections 23.1.A(1), (2) and (4) that Paxton: “engaged in fraud;” “made an offer containing a statement that is materially misleading or is otherwise likely to deceive the public;” or had an “intent to deceive or defraud;” or had a “reckless disregard for the truth or the law.”

Section 3 of the act mandates that the “Commissioner shall at once lay before the District or County Attorney of the proper county any evidence which shall come to his knowledge of criminality under this Act.” The Commissioner did not do so.

Paxton waived the right to a hearing and consented to the Commissioner’s Disciplinary Order. A spokesman at the time told Breitbart Texas that the then-Senator took action immediately after being notified.

Importantly, any facts which exist which are not part of the Texas State Securities Board’s Disciplinary Order, and which may have been discovered during a subsequent investigation by the Texas Rangers, including any criminal actions found as a part of that investigation, is not part of the above analysis.

The Second and Third Indictments: Securities Fraud

The Attorney General was also charged with two first degree counts of securities fraud. The securities fraud counts come from Paxton’s association with a company called Servergy.

Servergy is a technology company located in McKinney, Texas. According to WFAA8-ABC in Dallas, the company “has been in the crosshairs of the Securities and Exchange Commission (SEC) for more than a year.” The media outlet reported that a lawsuit was filed by the SEC last year accusing founder Bill Mapp of “possibly fraudulent statements or omissions related to Servergy’s technology and purported business relationships.”

The two indictments for securities fraud are identical and charge Paxton with violations of section 29(C) of the Texas Securities Act.

The complainants are Joel Hochberg and Texas State Representative Byron Cook. Both charge Paxton with committing the crime on or about the 26th day of July, 2011.

Both indictments were signed by the foreman of the grand jury on July 28, 2015.

Paxton is charged as follows, “In connection with the sale, offering for sale or delivery of, the purchase, offer to purchase, invitation of offers to purchase, invitations of offers to sell, or dealing in any other manner in any security or securities, engaging in fraud or fraudulent practice in violation Texas Securities Act, Section 29(C).”

Specifically, the indictments state that the alleged fraud involved:

[T]he offer for sale and sale of common stock of Servergy, Inc., being a security to wit: stock, to [Joel Hochberg/Byron Cook], hereinafter styled the complainant, in an amount involving $100,000 or more, by intentionally failing to disclose to the complainant, to wit: that [Paxton] had not, in fact, personally invested in Servergy, Inc., and that [Paxton] would be compensated, and had, in fact, received compensation from Servergy, Inc., in the form of 100,000 shares of Servergy, Inc. stock, the said information being material fact.”

Under Texas securities law, crimes involving more than $100,000 are first degree felonies.

The indictments charge Paxton with failing to tell Hochberg or Cook that: (1) he had not invested in the company; and (2) that he had received 100,000 shares of stock from the company. These crimes usually involve acts of overt misrepresentation, not acts of omission.

Whether these omissions were material, will be a question of fact for a jury to decide.

Moreover, whether the fact that Paxton had not invested in the company when he received 100,000 shares of stock, seems to be a bit contradictory. He may not need to invest if he had already received 100,000 shares of stock.

Tarrant County district court Judge George Gallagher will be presiding over the high-profile case.

Judge Gallagher has served as a district court judge in that county for over 15 years. Prior to being elected, he served as a prosecutor in Tarrant County and was a partner in a criminal defense firm in Fort Worth for fourteen years. He is a graduate of Texas A&M University and St. Mary’s Law School.

Lana Shadwick is a contributing writer and legal analyst for Breitbart Texas. She has served in Texas as a prosecutor and associate judge. Follow her on Twitter @LanaShadwick2

COMMENTS

Please let us know if you're having issues with commenting.