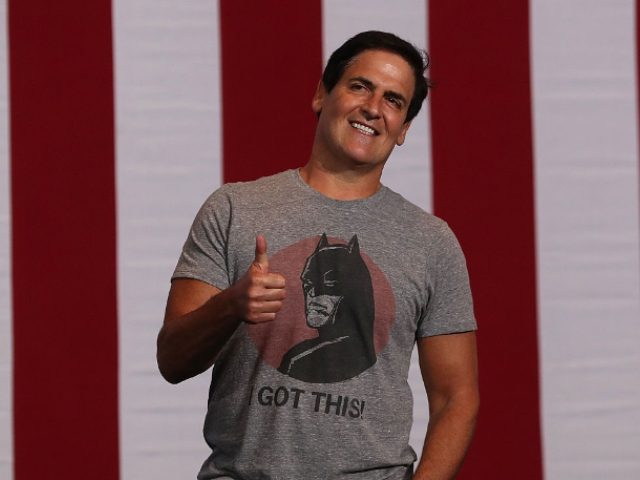

The WallStreetBets crowd has a big ally: billionaire investor and Dallas Mavericks owner Mark Cuban.

“If you can afford to hold the stock, you hold. I don’t own it, but that’s what I would do,” Cuban wrote in an “Ask Me Anything” exchange on the Reddit board.

He also advised the users to pick a brokerage with a strong balance sheet in order to avoid the kind of trading restrictions on heavily traficked stocks that customers of Robinhood and some other online brokerages have enountered.

- “Pick the brokerage with the strongest balance sheet. What ruined it on RH is that they didn’t have enough cash to deal with the growth in accounts, margin loans and volatility. The EXACT SAME THING will happen at the next broker if you don’t make sure they have a MULTI-TRILLION dollar balance sheet to be able to handle these kind of circumstances.”

- “The only question is what broker do you use. Do you stay with RH, who is going to have the same liquidity problems over and over again, or do you as a group find a broker with a far, far, far better balance sheet that won’t cut you off and then go ham on Wall Street.”

- “When I buy a stock I make sure I know why I’m buying it. Then I HOLD until I learn that something has changed. The price may go up or down, but if I still believe in the logic that made me buy the asset, I don’t sell. If something changed that I didn’t expect, then I look at selling.”

Cuban said the stock was more likely to go up than down when trading restrictions are lifted.

- “I have no idea. No one really does. I do think that once RH and others open up buying some of these will pop up. I just don’t know how much or if it will happen for sure.”

- “I think the stocks are getting shorted because the shorts know that the natural buyers, the folks on RH and others like it are being prevented from buying, so that will make it most likely the stock will go down.”

He said that he liked when companies he is invested in are shorted and told readers not to worry about “naked shorting.”

- “I actually love to see the companies I own shorted. If it’s a company I want to own, I know the shorts can be squeezed and if the company does really, really well, then the shorts will have to cover, creating more demand for the stock of the company I own, pushing the stock price up.”

- “As far as naked shorting, that’s not really a thing. Yes there can be more shares shorted than there are original float. That is by design. If I borrow a stock from you to short, and when I short it and your buddy buys it, then they can loan it to someone else to short, etc. All of those people who borrowed the stock paid to do so, and they realize that if enough people buy the stock and ask for the shares, they will get called in. So the chain of custody is there. The systems is doing what it’s designed to do.”

Cuban, who once* beat charges of insider trading brought by the U.S. government, was severely critical of regulators.

- “The SEC is a mess. I wouldn’t trust them to do the right thing ever. It’s an agency built by and for lawyers to be lawyers and win cases rather than do the right thing.”

His concluding post to the AMA thanked the WSBers for their efforts.

Final thought. First thanks for the great questions. Thanks for changing the game. Thanks for taking on Wall Street. Thanks for making kids around the country if not the world( including my son and daughter). WSB changed the game far more than everyone on this board will ever get credit for.

That said, you will do all this again. You will go after WS and the next time you will be smarter. There was only one thing that messed you all up: RobinHood and the other zero commission brokers that everyone used didnt have enough capital to fund the fight. They let you down in a big way.

When you load back up, fight a broker with TRILLIONS OF DOLLARS in assets on their balance sheet. Someone that can be there when the fight starts and wont blink an eye.

No disruption is easy or happens in a straight line. Stay with it. I am a believer

*In a sense, Cuban beat the charges twice. When the SEC initially charged him, a judge dismissed the case. After an appeals court reversed the dismissal, a jury acquitted Cuban. This was a stinging defeat for the U.S. government and became one of a series of cases that demonstrated to many that securities regulators had become overly-aggressive in their interpretation of insider trading rules.

COMMENTS

Please let us know if you're having issues with commenting.