GameStop Employee Arrested After Fatally Shooting Pokemon Card Theft Suspect

A GameStop employee in Pembroke, Florida, is under arrest after fatally shooting an alleged Pokemon card thief Tuesday night.

A GameStop employee in Pembroke, Florida, is under arrest after fatally shooting an alleged Pokemon card thief Tuesday night.

The creator of the WallStreetBets (WSB) subreddit, Jaime Rogozinski, which sparked the meme stock craze by rallying retail investors to stocks like GameStop, has filed a lawsuit against Reddit alleging breach of contract and trademark infringement.

The popular stock trading platform Robinhood, made infamous during the meme stock craze, is reportedly laying off about a quarter of its staff, according to company CEO Vlad Tenev.

MassMutual has been fined $4 million by the state of Massachusetts for failing to censor an employee who helped launch the GameStop squeeze.

The stock trading app Robinhood, notorious for its actions against GameStop and other “meme stock” investors, has kicked off a nationwide effort to convince students to trade stocks using its app, including a $20,000 giveaway offering to young people.

The popular stock and cryptocurrency trading platform Robinhood has reportedly paid a $70 million settlement to the Financial Industry Regulatory Authority (FINRA) on Wednesday after being accused of misleading customers.

A London hedge fund that bet against GameStop has become one of the first casualties in the populist internet revolt against Wall Street.

The company said that it had tapped Chewy.com co-founder Ryan Cohen to head up a new board committee to oversee GameStop’s shift to digital sales.

Stock trading app Robinhood has chosen Nasdaq as the exchange for its IPO this year, despite being embroiled in controversy over its treatment of its customers during the Gamestop trading frenzy and previous problems including trading outages.

A recent report from the New York Times states that the stock trading platform Robinhood is facing almost 50 lawsuits directly related to the recent GameStop trading frenzy.

The Dow Jones Industrial Average fell nearly 560 points, a 1.75 percent decline. The S&P 500 sank 2.45 percent. The Nasdaq Composite dropped 3.52 percent.

Shares of GameStop surged in the final hour of trading, rising nearly 104 percent to $91.70. Nearly all of those gains came in the final hour of trading when share prices moved up so quickly that they triggered a trading halt on the New York Stock Exchange.

The man at the center of the GameStop phenomenon, Keith Gill, began his testimony to a House panel by saying, “I’m not a cat.”

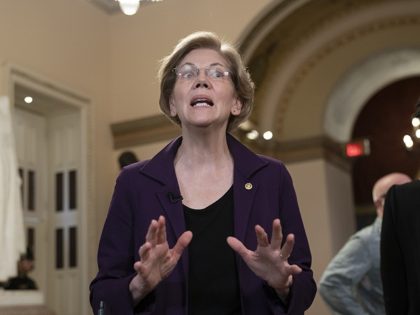

During a Thursday interview with MSNBC, Sen. Elizabeth Warren (D-MA) sounded off on the GameStop saga that saw the video game store’s stock skyrocket. The GameStop surge caused trading apps like Robinhood to restrict purchases of store’s shares on its platform.

The man at the center of the GameStop mania, Keith Gill, is set to testify to Congress on Thursday. He will explain why he’s bullish on GameStop and still thinks it is undervalued.

Brrrrrrrr.

Her enormous speaking fees from Citadel raise questions about conflicts of interest.

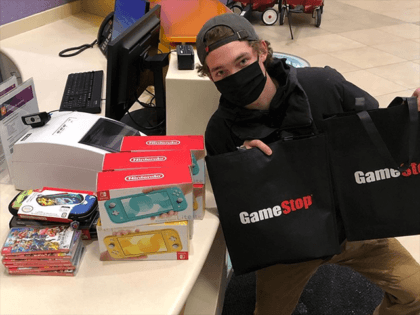

A college student who went all in on the GameStop stock craze used his windfall to buy Nintendo Switches and donated them to a children’s hospital this weekend.

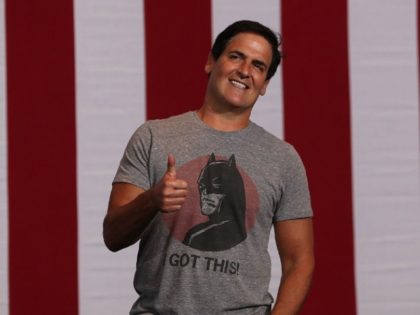

“No disruption is easy or happens in a straight line. Stay with it. I am a believer,” Mark Cuban told the GameStop army.

Tuesday, Jaime Rogozinski, the founder of the WallStreetBets subreddit forum on Reddit, commented on the WallStreetBets and GameStop saga that has caused financial elites to question the retail investor’s role in financial markets.

Shares of GameStop and other “meme stocks” plunged sharply on Tuesday morning.

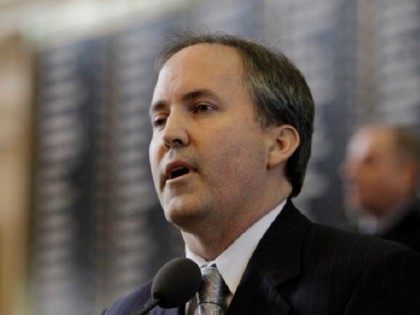

Texas attorney general Ken Paxton, who is investigating Google in a multi-state antitrust case and recently launched an investigation into the trading app RobinHood, joined Breitbart News editor-in-chief Alex Marlow on Breitbart News Daily on SiriusXM Monday morning.

China’s state-run Global Times on Sunday celebrated the GameStop stock-shorting saga as a failure of free market capitalism, boasting that such a wild ride could never be taken in China’s tightly-controlled financial system.

Popeyes Chicken launched a “Free Tendies Offer” on Monday as part of a promotional campaign built upon the recent GameStop stock surge.

The surge in trading around GameStop has created a need for the company to provide more collateral to trading partners

ABC’s late-night host Jimmy Kimmel speculated Reddit investors are “Russian disruptors” Friday night during his opening monologue on his show “Jimmy Kimmel Live.”

Members of the New York Young Republicans staged a “Re-Occupy Wall Street” demonstration Sunday over the financial sector’s manipulation of GameStop stock after a Reddit group launched a buying surge.

Malaysian retail investors rallied on social media to drive up stocks of Malaysian rubber glove manufacturers on Friday, in a move modeled on the GameStop trading surge witnessed in the U.S. this week.

Nigel Farage has hailed the GameStop rebellion as the natural successor to the populist movement which carried Brexit and Donald Trump to victory in 2016.

The little guys won this week in their epic battle against hedge funds and the Wall Street establishment.

Shares of GameStop and AMC saw tremendous gains this week as an army of small retailer investors beat back sophisticated hedge funds that had bet against the stocks.

One of the strangest things about the GameStop saga this week is how the mainstream media and prominent financiers have reacted, often with something bordering on panic.

During a Friday appearance on FNC’s “Fox & Friends,” Sen. Josh Hawley (R-MO) criticized Wall Street for freezing out traders in the wake of trading app Robinhood restricting purchases of GameStop shares on its platform.

Sen. Elizabeth Warren (D-MA), who has long billed herself as an enemy of Wall Street, is urging the United States Securities and Exchange Commission (SEC) to review the recent surge in stock for video game retail company GameStop that was spurred by an online Reddit community.

On Thursday, the trading app Robinhood infuriated users after blocking purchases of stocks popularized by trading communities on Reddit.

Former late-night host Jon Stewart made his first-ever Twitter post Thursday to voice support for WallStreetBets and the populist wave of investors fighting hedge funds over shares of GameStop, Nokia, BlackBerry, and other highly-shorted companies.

Janet Yellen, the former chairwoman of the Federal Reserve who is now His Fraudulency Joe Biden’s Treasury Secretary, made millions off Wall Street “speaking fees” over the past two years. In some cases, she didn’t even have to show up to speak. Her appearance was “virtual.”

He’s a 34-year old financial advisor from Massachusetts.

Yellen will speak to the president after the trading app Robinhood infuriated users for blocking purchases Thursday of stocks popularized by Reddit such as GameStop.

Thursday, Fox News Channel’s Tucker Carlson opened his program with his thoughts on the fallout of the GameStop short-squeeze situation unfolding that has caused financial elites to question the retail investor’s role in financial markets.