Inflationary pressures continued to raise Texas manufacturing prices strongly in October, a survey released Monday showed.

The Federal Reserve Bank of Dallas said that a record 50.5 percent of manufacturers had raised prices on their finished goods in October, while just 0.7 percent cut prices. That brought the dispersion index, which weighs price hikes against price cuts, to a record high 49.8, up 5.8 points from a month earlier. The longterm average for this measure is 7.4.

The gauge of raw materials prices remained near an all-time high but edged down to 76.3. This is extremely elevated compared to the long-term average of 26.4.

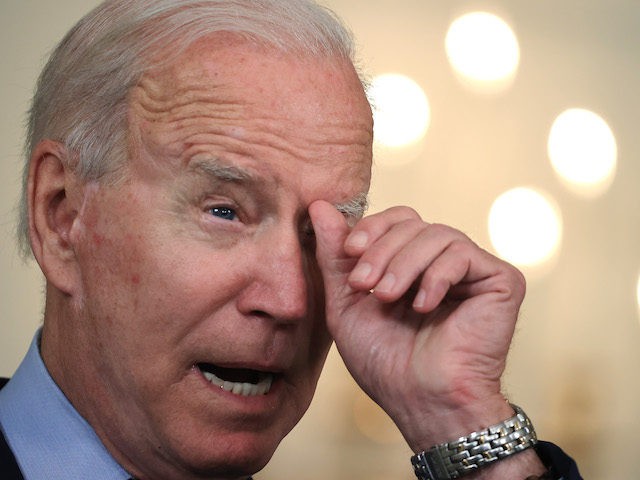

The data comes from the Dallas Fed’s monthly survey of Texas manufacturers. Comments from manufacturers pinned the blame for higher prices on the Biden administration’s fiscal policy.

“Fiscal policy by the government is continuing to create supply-chain concerns and leading to increased raw materials prices along with lower customer confidence for finished goods, which is severely weakening the forecast for the long-term viability of the U.S. economy. The potential for recession is ever increasing without major fiscal policy improvement,” a chemicals manufacturing executive said.It is beginning to feel like we are headed to a slowdown in a few months with inflation kicking in.

The outlook is for even more inflation, although the forward looking indexes backed down a bit from September. The measure of price increases for finished goods six-month ahead slipped 4 points to 40.6 but remains more than double the long-term average of 20.2.

The raw materials gauge slipped 6.4 points to 48.9. The average score on this measure is 34,2

“It is beginning to feel like we are headed to a slowdown in a few months with inflation kicking in,” a primary metals manufacturer said.

“Supply-chain disruptions continued to plague many manufacturers,” the Dallas Fed said. The unfilled orders index, which average negatives 1.8 (a negative level would indicate unfilled orders were shrinking), rose to 20.9. The delivery time index rose to 25.9, the fourth highest level ever recorded.

The wages and benefits index held near its own series high at 44.1, an indication of an extremely tight labor market. Many of the comments in the report indicated difficulty finding workers.

“Even though Biden terminated some of the incentives to promote folks not to work, there still seems little interest in working. We can teach [the job] if we could interest mostly anyone to get off their bottoms and respond to help-wanted signs. Are we really moving toward a socialist country?” a fabricated metals manufacturer said.

“We cannot find skilled employees, or nonskilled for that matter,” another manufacturer said.

Factory activity in the state continued to increase in October, although the pace of growth slowed slightly. The production index, a key measure of state manufacturing conditions, fell six points to 18.3. That is still well above average and indicative of solid output growth, the Dallas Fed said.

The general business activity index jumped 10 points to 14.6. That was well above expectations for a score 10 points lower.

The company outlook index rebounded to 2.4 after slipping into slightly negative territory last month. Uncertainty continued to rise, however, with the outlook uncertainty index reaching 29.0, its highest reading since April 2020 amid the onset of the pandemic.

“Inflationary pressures had caused us to raise the price on our production. We routinely pass on raw material costs based on a price index widely used in the industry. This is the first non-raw-material price increase we have had in the 15 years that I have owned this company. This increase and the inflationary implication have added to the customers’ belief that they must order against future price increases. Our customers are deluged with price increases. It doesn’t take long for the inflationary concept to take hold. Labor is unavailable at virtually any level; $13- to $15-per-hour jobseekers (if you can find any) now want $18. No experience. It is chaotic,” a printer said.

COMMENTS

Please let us know if you're having issues with commenting.