There is likely to be a lot of discussion around the idea that March was “peak inflation” if the Consumer Price Index (CPI) for April comes in as expected on Wednesday.

Consumer prices are expected to rise 0.2 percent from March, which would represent a significant slowing of the pace of inflation. The 12-month measure is expected to come in at 8.1 percent, down from 8.5 percent. We now begin to lap the big price increases of last year, which should mean the year-over-year figures will look smaller because current prices are being compared against a high baseline. In April of last year, prices rose 0.8 percent compared with the prior month and were up 4.2 percent before seasonal adjustment. At the time, that was the fastest pace of inflation since September of 2008.

Core CPI, which excludes food and fuel, is expected to come in at a slightly hotter 0.4 percent, up from 0.3 percent in March. Prices are seen as rising six percent compared with a year ago, a slowdown from the 6.5 percent annual gain recorded in March. That’s also evidence of the base effect. A year ago in April, core prices jumped 0.9 percent from March and were three percent higher than April of 2020. The prices of used cars are expected to have fallen in April, dragging down both headline and core CPI.

The Cleveland Fed’s 16 percent trimmed-mean CPI is probably a better guide to underlying inflationary pressures than either headline or core CPI. It is calculated by excluding, or trimming, items whose expenditure weights fall in the top 8 percent and bottom 8 percent of the price change distribution. This was up 0.5 percent in March compared with February, and the annual figure was up 6.1 percent. Because it omits outliers with wild price swings up and down, the 16 percent trimmed-mean CPI is thought to be a better signal of price changes. This is typically published a few hours after the main CPI figures are released. We should look to the trimmed-mean CPI to answer the question whether inflation has peaked, and we shouldn’t necessarily count on a steep descent even if inflation has peaked.

Workers and volunteers stand outside a compound where residents are tested for COVID-19 during a lockdown in Jing’ an district in Shanghai on April 1, 2022. (Hector RETAMAL/Getty Images)

The hoped-for relief to supply chains looks like it might be stymied by China’s relentless pursuit of zero-COVID and the lockdowns of major economic centers, especially Shanghai. The war in Ukraine and sanctions on Russia could put renewed pressure on fuel prices (although China lockdowns could be a counterbalance by decreasing demand) and global food prices. Most importantly, the labor market shows signs that it is increasingly tight, indicating that rising wages are likely to put upward pressure on prices.

Recall that the economy added 428,000 jobs in April after job openings hit a record high in March. The ratio of job openings to unemployed people is approaching two-to-one, the highest ever. Three percent of the labor force quit their job, easily topping the historic high of 2.4 percent. Quits are typically a sign that a worker is switching jobs, and a high level of job switching increases wage pressure. Employers say they’ve never had such a tough time finding workers, according to the regional Fed surveys and the NFIB small business survey. This will likely only intensify as the year goes on.

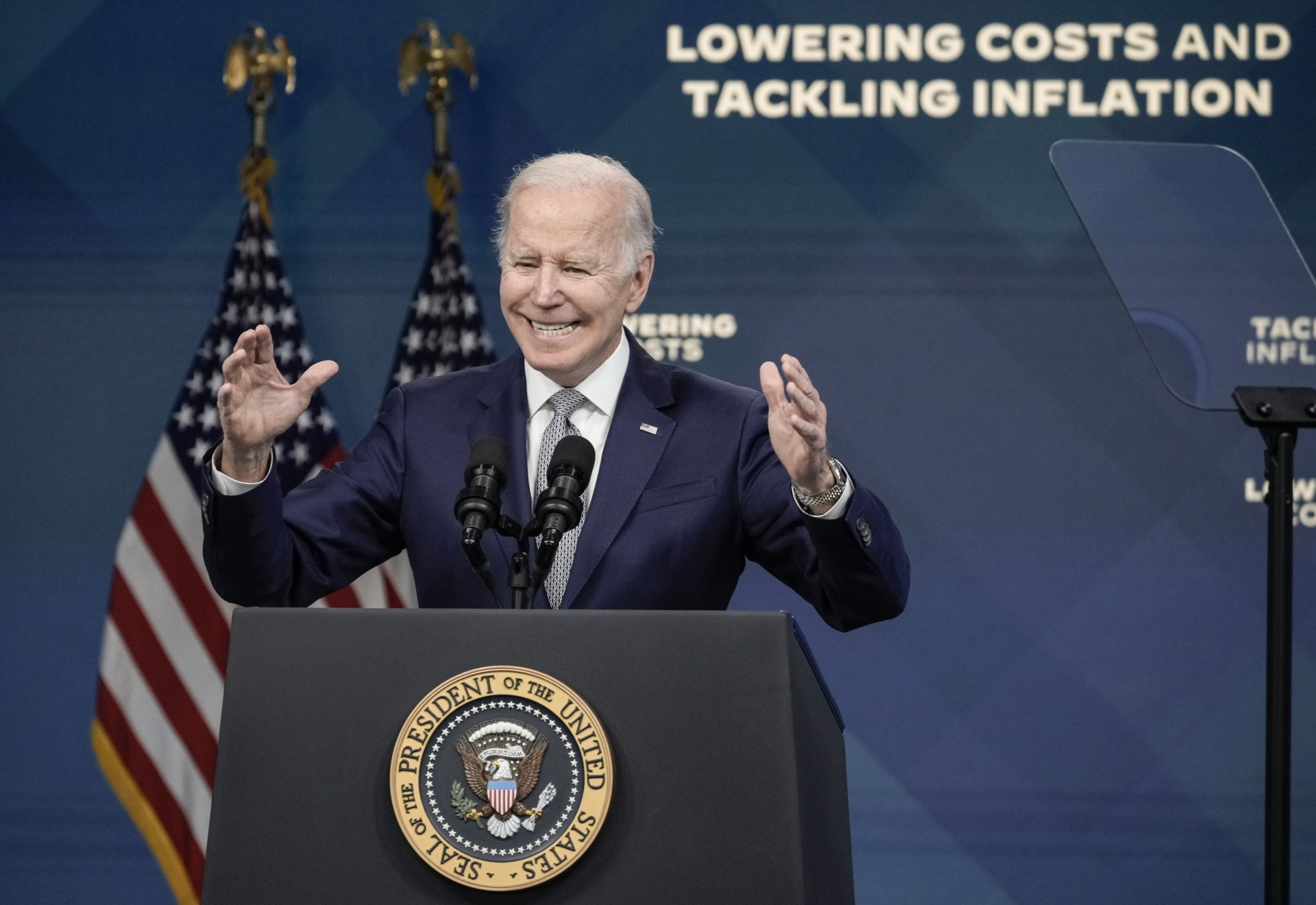

President Joe Biden speaks about inflation and the economy at the White House on May 10, 2022. (Drew Angerer/Getty Images)

We suppose we should say something about President Joe Biden’s big inflation speech, but we’re flummoxed by the fact that there’s so little to say about it. He blamed the pandemic and Putin, of course, a position that will look increasingly ridiculous as wage-driven inflation becomes more apparent later this year. He said he respected the independence of the Federal Reserve but was sure they are just as worried about inflation as he is. Under questioning from reporters, he denied that his big spending bills last year contributed to the problem. We doubt he did his poll ratings any favors with this speech, but he does not seem to have caused any economic damage with his remarks.

Come to think of it, that’s an improvement from last year’s performance when Biden’s denials that inflation was a problem made inflation worse by sapping the public’s faith that the ship of state was in the hands of a credible navigator.

COMMENTS

Please let us know if you're having issues with commenting.