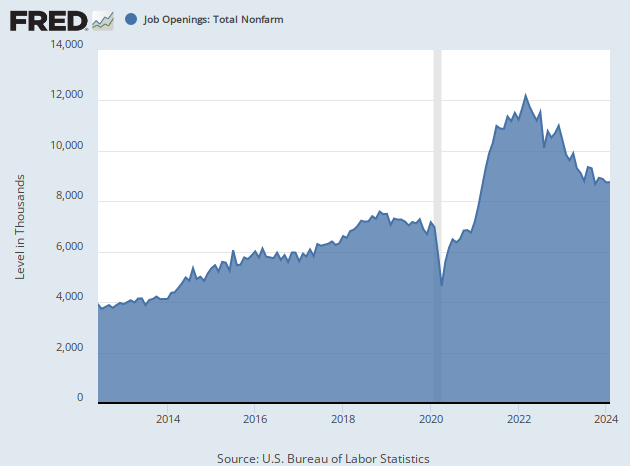

The number of job openings in the United States fell sharply in June as the Federal Reserve hiked interest rates, gas prices hit record highs, inflation soared, and growth in consumer spending slowed.

There were 10.7 million postings for job openings on the last business day in June, the U.S. Bureau of Labor Statistics said Tuesday, down from an upwardly revised 11.3 million a month earlier.

Economists had been expecting 11.1 million jobs in the June report on the government’s Job Openings and Labor Turnover Survey, or JOLTS. The sharper than expected decline indicates that demand for labor has plunged faster than economists expected.

The Federal Reserve has been trying to cool off the labor market by raising interest rates. In mid-June, the Fed hiked its interest rate target by 0.75 basis points, the largest increase since 1994. Tighter financial conditions can slow business expansion, lowering the demand for workers. Fed chairman Jerome Powell has said he would welcome a decline in job vacancies as a sign that the Fed’s efforts to tame inflation are working.

Openings declined sharply in both retail and construction, two areas that have showed signs of softening in recent months. Consumer spending rose 1.1 percent in June before adjusting for inflation, according to the Commerce Department’s tally of consumer expenditures released last week. Real expenditures, after adjusting for inflation, were just 0.4 percent higher—and much of that increase reflected higher prices of food and groceries. Spending on discretionary goods and services likely fell in inflation-adjusted terms.

Hiring rates fell at large businesses with more than one thousand employees, the government said. This suggests that businesses are preparing for an economic downturn by pulling back from bringing on new employees.

3. Large companies with 1,000–4,999 employees have already dialed back hiring, registering a 27% drop in new hires. Companies in that class have been some of the most heavily affected by the recent stock market rout and are hardening themselves against the risk of a recession.✂️

— Julia Pollak (@juliaonjobs) August 2, 2022

The number of openings hit a record high in March at 11.7 million. The ratio of open jobs to unemployed people—which economists regard as a signal of labor market tightness—hit a record high of nearly two to one in March. It has ticked down in each subsequent month, although declining unemployment has blunted some of the effect of lower openings. The decline in openings in June was somewhat offset by the decline in unemployment, reducing this ratio from nearly 1.9 in May to 1.8. This indicates the labor market remains extremely tight by historical standards.

The reduction in job openings came from employers withdrawing positions. Hires were little changed at 6.4 million. Quits also held steady at 4.2 million. The quits rate was unchanged at 2.8 percent.

Layoffs were little changed at 1.3 million. The layoffs rate held steady at 0.9 percent.

Openings at retail stores fell significantly from 1.185 million to 842,000, a nearly 29 percent drop. Hires edged up to 803,000 from 791,000. This suggests a significant pullback in hiring among retailers.

Job postings from manufacturers declined from 816,000 in May to 790,000. Hires moved up to 475,000 from 468,000. Durable goods manufacturing openings climbed from 505,000 to 510,000 but hires declined from 249,000 to 242,000. Nondurable good manufacturers were seeking 280,000 workers at the end of June, down from 311,000. Hires picked up to 233,000 from 219,000.

Openings in leisure and hospitality fell from 1.542 million to 1.451 million, a sharp 5.9 percent drop. In the accommodations and food services sector openings fell from 1,385 to 1,304. Hires in leisure and hospitality rose from 1.148 million, with restaurants and hotel hires rising to 1.004 million from 976,000.

The accommodations and food services sector has the highest rate of quits but this declined in June to 5.7 percent from 5.9 percent. In February, the quits rate hit 6.1 percent. Quits are interpreted as a sign of worker confidence and strength in the labor market as workers typically voluntarily leave jobs when they expect to find a new position easily.

Job openings in construction fell from 405,000 to 334,000, a 17 percent drop. On Monday, the government reported that spending on construction fell 1.1 percent in June. Spending on building single-family homes—a sector particularly sensitive to interest rate increases—fell 3.1 percent. Hires in construction declined to 346,000 from 359,000. Quits dropped from 230,000, or 3.0 percent, to 179,000, a rate of 2.3 percent. Openings in real estate fell to 132,000 from 154,000.

Openings moved up somewhat in finance and insurance, education, health care, and information technology.

Federal government openings dropped from 121,000 to 85,000. State and local openings dropped from 907,000 to 847,000 as postings for positions at schools dropped from 362,000 to 300,000. Hiring at schools rose to 200,000 from 188,000 a month earlier.

COMMENTS

Please let us know if you're having issues with commenting.