Anheuser-Busch-owned companies — even beyond Bud Light and Budweiser — are seeing declines in in-store beer sales compared to last year on the heels of Bud Light’s partnership with transgender TikToker Dylan Mulvaney, a man who claims to be a woman.

At the same time, beer sales for Molson Coors-owned companies such as Miller Lite and Coors Light have soared, according to NielsonIQ data on beer case sales over recent weeks that Bump Williams Consulting, a Connecticut-based firm with expertise in the alcohol industry, analyzed and shared with Breitbart News.

Since Bud Light committed brand assassination by partnering with trans influencer Dylan Mulvaney, the beer is TANKING from a massive boycott and has already taken a $7 billion loss.

What actually happened? pic.twitter.com/ft1qYsvnvW

— Benny Johnson (@bennyjohnson) April 12, 2023

On April 1, Mulvaney posted a video to Instagram where he cracked open a Bud Light and noted, “This month I celebrated my Day 365 of womanhood” before showing off a custom can the company provided Mulvaney that bore his likeness. The hashtag “budlightpartner” accompanied the video, following another “#budlightpartner” post in February where Mulvaney is seen next to the blue beer cans as he blows bubbles in a bathtub. Bud Light caught considerable backlash for the partnership leading to a boycott of the company and substantial case sales losses, according to Bump Williams’ Consulting analysis.

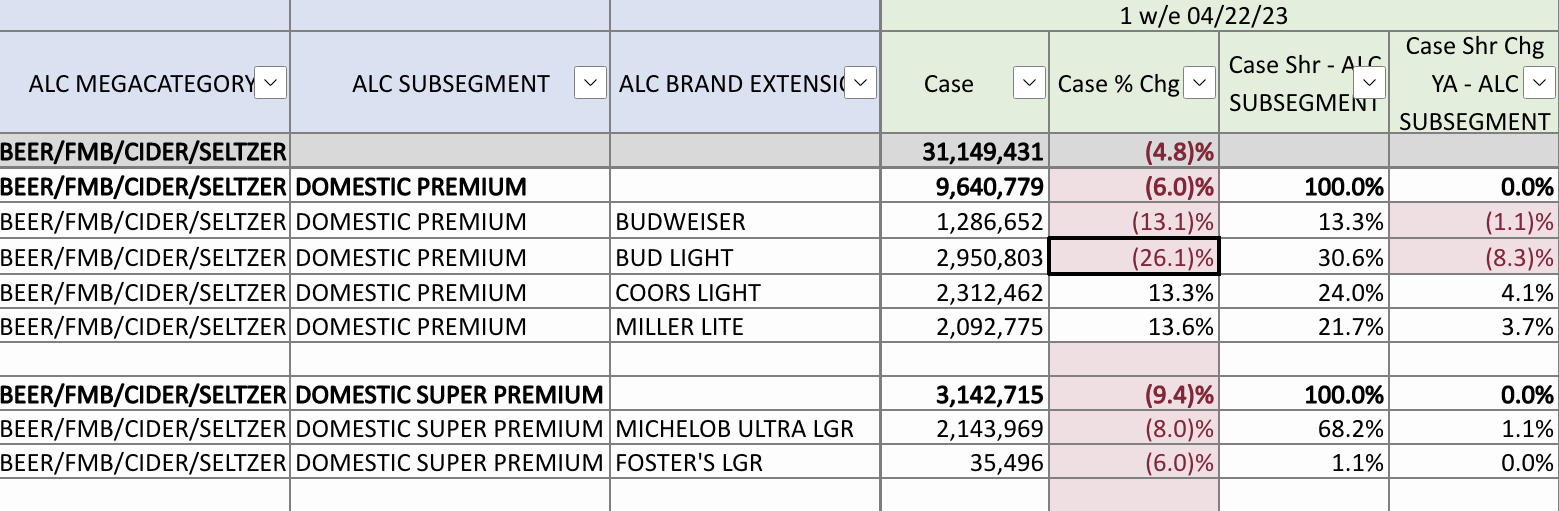

For the week ending April 22, Bud Light’s in-store volume sales registered at 2,950,803 cases — a 26.1 percent drop compared to the same period last year — meaning it only hawked three cases of beer for every four it sold a year ago.

Domestic premium in-store beer case sales for the week ending April 22. Source: Bump Williams Consulting

This followed a 21.1 percent year-over-year drop for the week ending April 15. Moreover, Bud Light saw an 8.3 percent year-over-year market share decline for the week ending April 22 among “Domestic Premium” beer rivals, following a 6.5 percent slide the previous week. Its market share shrunk from 32.3 percent to 30.6 percent weekly.

Now, Bud Light plans to give away cases of beer to employees of its distributors, who have also taken heat for the company’s marketing decisions, the Wall Street Journal’s Jennifer Maloney reported Thursday.

WATCH: Maher: We’ve Gone from Title IX Giving Women an Equal Shot to “Let’s Put a Male in the Swimming Pool with the Women”:

Bud Light’s sister company Budweiser’s in-store case sales were 1,286,652 during the week of April 16-22, marking a 13.1 percent drop in volume and a 1 percent market share loss in the “Premium Domestic” industry — down to 13.3 percent — compared to the same period last year. Bud Light’s year-to-date dwindled eight percent compared to the same time frame in 2022, and Budweiser’s are just over five percent in the red.

While the Anheuser-Busch companies have suffered a substantial hit amid the boycott, direct competitors in the “Premium Domestic” beer sector — such as Molson Coors-owned companies Coors Light and Miller Lite — have seen sales soar in recent weeks. Between April 16-22, Coors enjoyed a 13.3 percent increase in case sales compared to last year, hawking 2,312,462 cases. Miller Lite had nearly identical gains, selling 2,092,775 — a 13.6 percent year-over-year increase. The week prior, Coors sold 10.6 percent more units versus the same period last year, while Miller Lite climbed 11.5 percent.

Market shares for both companies have grown following the Mulvaney partnership. Miller Lite’s market share among “Domestic Premium” beer for the week ending April 22 was 21.7 percent — a 3.7 percent increase compared to the same period last year, and a .6 percent increase in reference to the previous week, while Coors’s market share increased 4.1 percent versus last year to 24 percent late last month. Week-over-week, it gained .8 percent in market share.

The trends continued outside of the “Premium Domestic” beer category. Among “Domestic Super Premiums,” case sales of Anheuser-Busch-owned Michelob Ultra dwindled eight percent for the week ending April 22 compared to the same period last year.

Concerning “Below Premium” beers, Anheuser-Busch-owned companies Busch Light and Natural Light suffered 7.5 percent and 6.5 percent year-over-year dips in sales, respectively, between April 15-22. Conversely, case sales of Molson Coors-owned Keystone Light rose 8.1 percent compared to last year, while Miller High Life case sales grew 2.4 percent. Pabst Blue Ribbon, not owned by Anheuser-Busch, rocketed 20.2 percent.

RELATED: Vivek Ramaswamy: How Economic Hardship Could Be Pulling Companies Away from Wokeness:

Jack Knudsen / Breitbart News

COMMENTS

Please let us know if you're having issues with commenting.