LONDON (AP) — The Bank of England revised up its economic growth forecasts for the British economy for the coming three years, crediting much of the improvement to the government’s decision to ease up on austerity in the wake of the country’s vote to leave the European Union.

The rosier projections were widely anticipated given the British economy has proven more resilient than many feared following June’s Brexit vote. The bank increased its growth forecasts to 2 percent this year, 1.6 percent in 2018 and 1.7 percent in 2019. Those are up from November’s predictions of 1.4 percent, 1.5 percent and 1.6 percent.

Growth has held up because of a combination of factors including the sharp fall in the pound following the vote, which boosts exports, and the Bank’s own efforts to stimulate the economy. In the fourth quarter of 2016, the British economy expanded by a quarterly rate of 0.6 percent, making it one of the fastest-growing major economies.

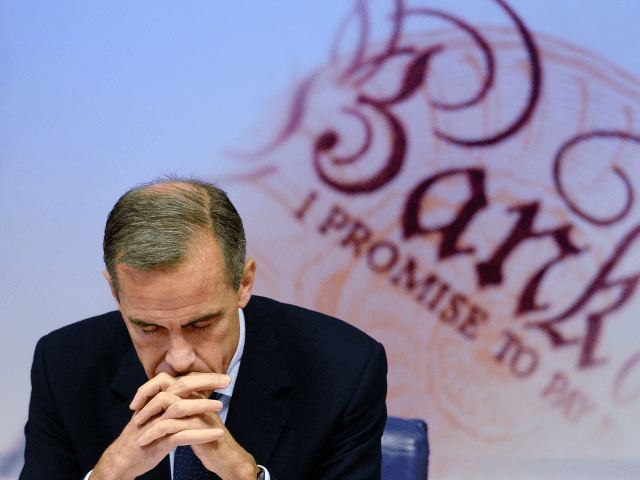

“The Brexit journey is really just beginning,” Bank of England Governor Mark Carney said in his opening remarks. “While the direction of travel is clear, there will be twists and turns along the way.”

Carney was speaking after the bank kept interest rates on hold – again as expected. How long they will stay on hold will likely depend on how long rate-setters can overlook rising inflation. Rate-setters have a difficult balancing act – how to set policy to meet a legal mandate to keep inflation at 2 percent against the need to support economic growth.

Consumer price inflation is expected to reach 2.8 percent early next year due to the pound’s sharp decline since the referendum, the bank said in its quarterly economic projections. The lower pound, while helping exporters, makes imports, such as oil and raw materials, more expensive.

That projection, all other things being equal, would likely prompt the bank to raise interest rates. However, growth, despite the upgrades, is set to remain below the British economy’s long-run average and that could keep a lid on such things as wage rises. Even with the improved outlook, the central bank said GDP will still be 1.5 percent lower in two years than was forecast before the referendum.

Still, Carney said the improved growth outlook compared with last November was underpinned by four factors, chiefly looser budgetary policy by the government, announced last November.

In addition, he credited the bank’s stimulus package in August, which included a cut in the benchmark interest rate to the record low, as well as a stronger global economy and the continued willingness of U.K. consumers to spend despite a predicted squeeze on incomes.

The minutes to the committee meeting suggested some policymakers may find it hard to justify keeping rates at their present levels despite the current “exceptional circumstances.”

“There are limits to the extent that above-target inflation can be tolerated,” the minutes said. “The continuing suitability of the current policy stance depends on the trade-off between above-target inflation and slack in the economy.”

Inflation, which currently stands at an annual rate of 1.6 percent, has picked up over recent months and is expected to continue to do.

While analysts interpreted Thursday’s report as a signal that the central bank’s next move will be to raise interest rates, they also said that move is likely to be a long way off.

Concerns about inflation “clearly are not severe enough for any member to think higher rates are warranted immediately,” said Samuel Tombs, chief U.K. economist at Pantheon Macroeconomics.

“The core view at the bank remains that domestically-generated inflation, especially wage growth, will remain too weak to justify raising rates over the next year, a view we share.”

COMMENTS

Please let us know if you're having issues with commenting.