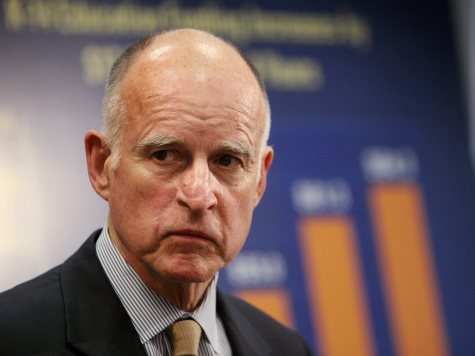

Arthur Laffer made his name as the USC professor who helped give credibility to the Reagan Administration’s supply-side economics, based on the idea that higher tax rates inadvertently result in lower taxes collected. But California Governor Jerry Brown’s recent State of the State address claimed raising taxes to the highest level of any state in the nation has led to what Brown calls the “California Comeback.” Laffer has taken to the opinion page of the Orange County Register week to defend supply-side principles and call Brown lucky that a hot stock market and mega-IPOs temporarily postponed California’s road to financial ruin.

Laffer chuckles at Brown’s statement in a debate with his Republican opponent Neil Kashkari: “Two years ago, they were writing our obituary. Well, it didn’t happen. California is back.” Laffer says the secret sauce that has financially refloated the state to regain 1.3 million jobs lost during the recession, a multi-billion budget surplus and the ability to throw more money at education is due to “several strong showings out of the tech industry from companies like Facebook, which went public in 2012, and WhatsApp, which was acquired for $16 billion this year.”

Laffer also points out that not all jobs regain have been comparable. Much of the post-recession job market is “one with lower pay and fewer full-time opportunities.” He points out that the 2014 Labor Day Report from the California Budget Project indicates that “hourly earnings for low- and middle-wage California workers endured drops of 5.4 and 5.1 percent, respectively, from 2006-13,” after adjusting for inflation. The report also documented that “workers were already coping with decades of wage stagnation and an economy in which low-wage work was increasingly common.”

Laffer adds that while the “California Comeback” might seem obvious around San Francisco, Napa or Sacramento, the unemployment rates in Fresno, Bakersfield and El Centro tell a different story. Laffer points out that one of the reason unemployment percentages have dropped is that a record 38.1% of working-age Californians, the worst in forty years, have given up even looking for a job. Put the 5% that have dropped out of the workforce back into the economy, and California’s unemployment would look like a national depression.

Laffer calls the result an “hour-glass economy” where the rich get richer, the poor get more subsidies and the middle class gets squeezed into poverty. He points out that U.S. Census Bureau’s Supplemental Poverty Measure gives California the crown as the state with the highest poverty rate in the nation–nearly 24 percent.

As a numbers guy, Laffer pounds away at Brown’s “touted progress” on turning a $27 billion deficit three years ago into “a solid surplus” today according to the California Legislative Analyst’s Office. Laffer notes that estimates of future surplus depend on a steady “growth in stock prices,” among other unrealistic conditions.

Laffer finds it hilarious to base revenue projections on the requirement that the stock market raise “steadily” after a blistering +197.3% in stock prices over the past five years. He also says it is unlikely that politicians will choose to pay down the state’s $458 billion underfunded liabilities rather than spending more money. Historically, the ;egislature has always erred on the side of more crony capitalism spending.

Laffer does compliment Brown on his clever 2012 passage of Proposition 30, which set a retroactive tax increase on higher-income Californians. The beauty of what Laffer calls “an ex post facto confiscation of wealth” is that it did not allow the rich to rearrange their affairs by seeking loopholes or moving their money to another state. This “trap” may have temporarily beat the Laffer Curve, but he is confident the rich are now voting with their feet by moving and restructuring right to avoid actually paying the higher taxes.

Laffer believes Brown’s huge “one-off” revenue boosters from “tax windfalls from the Facebook, Zillow, and Yelp IPOs, Tesla stock sales and the WhatsApp acquisition to name a few,” will soon be a thing of the past.

Laffer is warning that when the stock market pauses, the “California Comeback” will be a path toward financial hell.

Chriss Street suggests that if you are interested in California’s version of Obamacare, please click on Obamacare Causing Big Layoffs for Union Nurses.

COMMENTS

Please let us know if you're having issues with commenting.