Major pro-EU corporates are using Britain’s membership of the European Union and the single market to deprive the country of £10 billion of tax revenue each year, a new report has suggested.

The debate on free movement and the European Union (EU) typically hinges on free movement of people, which allows EU nationals to come to Britain in unlimited numbers without any meaningful background checks and even without passports.

This open borders policy has helped drive the official immigration figures to their present all-time high of 650,000 – and there is compelling evidence that EU immigration may be 2.5 times higher than the official figures suggest.

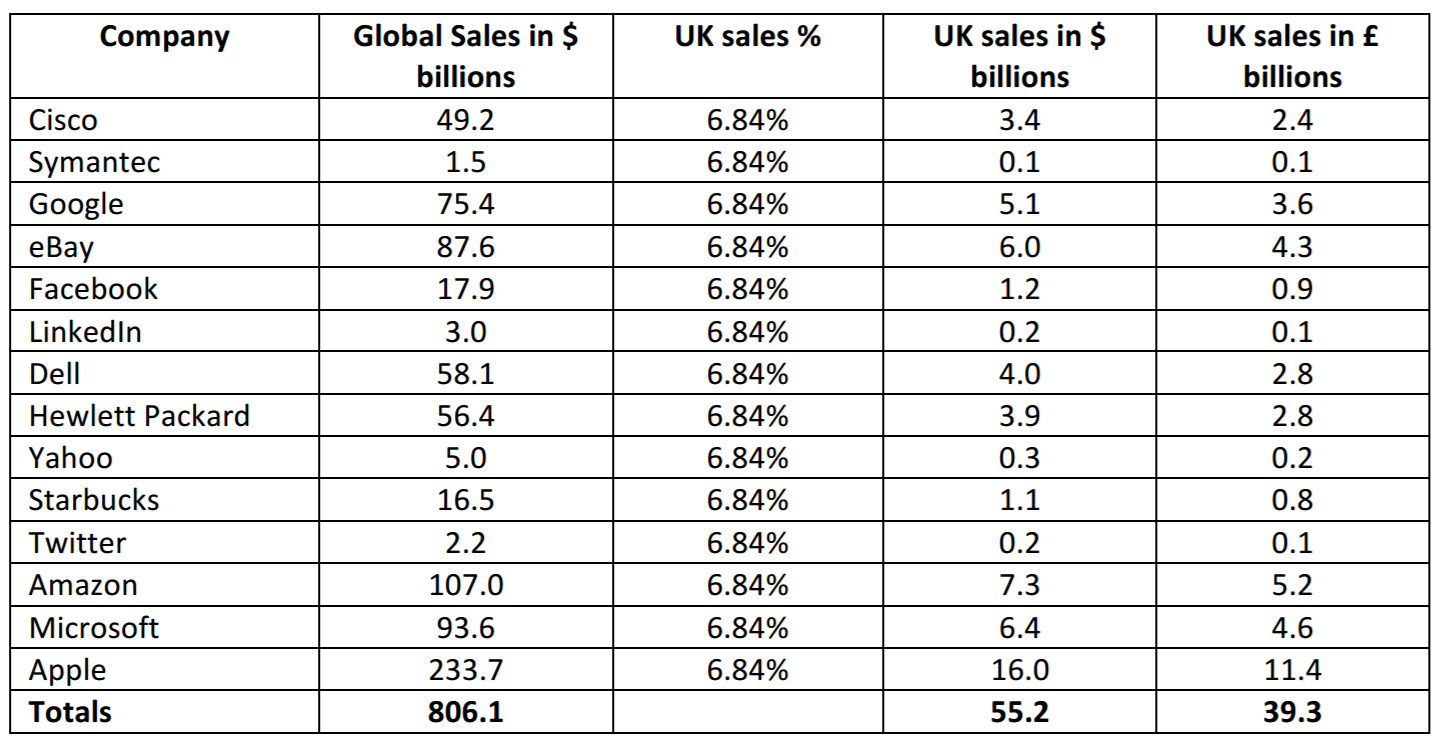

However, a report released by the Global Britain think tank suggests other aspects of the free movement regime – namely the free movement of capital and freedom of establishment rules – may be equally serious causes for concern, allowing multi-national corporations which invested heavily in the Remain campaign to rob Britain of £10 billion in tax revenues which could otherwise be invested in public services or go towards cutting Britain’s budget deficit.

“Multi-nationals are working in tandem with the governments of the smaller EU Member States – Ireland and Luxembourg in the forefront – to book their UK sales revenues into European bases in those countries, pay next to no Corporation Tax here, and staff their UK supply chains with low-skill, low-wage labour,” according to Bob Lyddon, the City expert who authored the report.

“The high-value jobs and the majority of the spending go to the Member State where the European base is located.”

The report names corporate giants such as Apple, Google, Facebook, Starbucks, Twitter, Amazon, and Microsoft as potentially benefiting from the European Union rules that have been flagged up by left-wing tax campaigners previously without highlighting the EU element.

The EU allows multi-nationals to behave as though their UK operations are merely “agents”, selling their goods and services “on behalf” of their “bases” in tax havens such as Luxembourg, where the President of the European Commission was prime minister for almost twenty years.

Profits are off-shored to the states where these bases are headquartered, with the UK “agent” receiving a sales commission under the so-called Commissionaire Sales Model. Businesses which turn over billions of pounds in revenue are treated, according to Lyddon, “as if they were selling cosmetics door-to-door”. The end result is that around 90% of sales revenues are not taxed in the UK, depriving the country of £10.3 billion in taxes.

Speaking on the issue, Brendan Chilton, a Labour councillor and director of the Labour Future group told Breitbart London: “Labour supporters who voted Remain need to understand that it’s the ‘freedom’ to move capital around the Single Market which has been providing corporations with enormous tax avoidance opportunities for all these years.”

“If progressives want to clamp down on tax avoidance and tax evasion, then leaving the Single Market would be a very good start.”

The lost taxes are equivalent to 17% of the UK’s public spending deficit of £60 billion, meaning that a Brexit deal which extricated the UK from the Single Market would not just allow for genuine control over immigration, but also provide for the deficit to be cut by 33% straight away.

“If ever there were a reason to leave the Single Market, this is it,” says Lyddon, “I believe it is known as ‘a real no-brainer’.”

COMMENTS

Please let us know if you're having issues with commenting.