China claims to be interested in free and fair “win-win” trade deals but, in reality, its economic practices have always been unfair and predatory.

Some of the worst examples include:

Mercantilism: The great economic crime of China, the sin from which all of its other sins flow, is a state-controlled economy that requires a whole boatload of “isms” to properly describe: communism, of course, but also corporatism, authoritarianism, nationalism, fascism, and mercantilism.

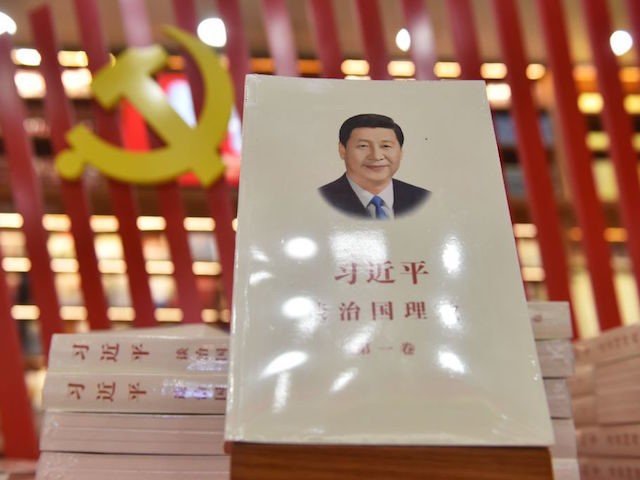

Ironically, “communism” is probably the least important factor in the Chinese system as of Communist Party leader Xi Jinping’s ascendancy, a fact that is not lost on hardcore Chinese Marxists who grumble about Xi’s departure from the true communist faith. Unfortunately for them, Xi Jinping’s philosophy kept all of Maoist China’s authoritarianism, so they must grumble quietly lest they disappear.

The single term that best describes Xi’s government is probably fascism since it relies upon the core fascist concept of capitalist energy harnessed by the all-powerful central government for nationalist ends. Those who do business with China try very hard to avoid noticing that the boundaries between the Communist Party, the government bureaucracy, and “private” Chinese industry are very thin. In a communist system, the government would own all of the big companies outright. Under fascism, the corporations have “private” owners who are careful to keep their Communist Party memberships in good order and the government tells them what to do, either openly or behind the scenes.

In return for strict obedience, the Chinese government uses its power and money to benefit its corporations and suppress foreign competition. When business tycoons who are also effectively Communist Party royalty get in trouble, Beijing swings into action.

This aspect of China’s system can be described as mercantilism, a system where the government interferes with markets to protect favored companies, rigging the marketplace with aggressive and unfair practices to increase national economic power. The historic definition of mercantilism involves using government power to maximize exports and minimize imports. That is not a bad way to understand every other aspect of China’s economic villainy. Almost everything modern China does is a step toward that goal of maximized exports. The Chinese definitely see international markets as a zero-sum game where some nations “win” at the expense of others, as the classical mercantilists did.

Some of President Donald Trump’s actions towards China have also been denounced as mercantilism – which, if we can take a step back from the heat of current partisan debate, raises the interesting question of whether it is possible to compete with an aggressively mercantilist Great Power without becoming one. Nations as large and powerful as China have vast resources to bring to bear against foreign companies, as the rest of this article will demonstrate. Truly independent market-based capitalist business entities have great difficulty standing against the coercive might of a nation-state without protection from their own governments.

Ironically, historians of the 20th Century saw mercantilism as a primitive and wrongheaded philosophy, a discarded relic from an earlier age when avaricious monarchies required bloated income streams to finance endless imperial wars. Instead, mercantilism is the defining element of geopolitics in the 21st Century. The entire developed world is caught in a mercantilist arms race, while Third Worlders find themselves drafted into the mercantilist wars as conscripts and imperial conquests, in part because their own ruling elites are very easy to bribe.

Intellectual property theft: Crucial to China’s brand of mercantilism is intellectual property theft on a breathtaking scale. President Trump’s National Security Strategy identified IP theft as one of the primary threats to American national security and our competitive strength in the global economy.

Former Director of National Intelligence Dennis C. Blair and former National Security Agency Director Keith Alexander captured the scale of China’s banditry for the New York Times in August 2017:

Chinese companies, with the encouragement of official Chinese policy and often the active participation of government personnel, have been pillaging the intellectual property of American companies. All together, intellectual-property theft costs America up to $600 billion a year, the greatest transfer of wealth in history. China accounts for most of that loss.

Intellectual-property theft covers a wide spectrum: counterfeiting American fashion designs, pirating movies and video games, patent infringement, and stealing proprietary technology and software. This assault saps economic growth, costs Americans jobs, weakens our military capability, and undercuts a key American competitive advantage — innovation.

Chinese companies have stolen trade secrets from virtually every sector of the American economy: automobiles, auto tires, aviation, chemicals, consumer electronics, electronic trading, industrial software, biotech, and pharmaceuticals. Last year, U.S. Steel accused Chinese hackers of stealing trade secrets related to the production of lightweight steel, then turning them over to Chinese steelmakers.

Some of these thefts are outright pillage, aided and abetted by China’s famously weak intellectual property laws – a situation President Donald Trump appears to have pressured Beijing into correcting at long last, assuming the laws recently considered by the National People’s Congress are passed and the Chinese bureaucracy actually enforces them.

Much of China’s intellectual property theft is, however, entirely legal and actively aided by the Chinese government. Sometimes foreign companies are required to hand over technology as a condition of doing business in China. Other times they are forced into “partnerships” with Chinese companies that copy their designs and appropriate their proprietary data.

Chinese military and intelligence agencies insist on intrusive “security reviews” of foreign technology that look suspiciously like Chinese government agents making copies of inbound trade secrets. The prospect of suffering through these intrusive inspections intimidates some overseas competitors out of entering China’s vast marketplace, which is not a bad consolation prize for protected indigenous industries.

Such forced technology transfers account for at least half of the economic damage inflicted upon U.S. companies every year by Chinese intellectual property theft. The central government in Beijing insists these practices are officially frowned upon and forced transfers would be the work of rogue local agencies if they were happening at all, which they aren’t. The national government is currently pretending to frown harder in order to placate the Trump administration.

Cyber-espionage: The half of Chinese intellectual property theft that does boil down to outright highway robbery is largely perpetrated on the information superhighway.

The U.S. Justice Department recently filed charges against two Chinese nationals for running an enormous global hacking scheme linked to the People’s Liberation Army that targeted companies in the United States and around the world, stealing everything from technology and financial information to personal data.

The U.S. action prompted Australia to declare its own “serious concerns” about Chinese espionage, which Foreign Affairs Minister Marise Payne said could “undermine global economic growth, national security, and international stability.”

“The fact that this is the first time we have ever actually named China as responsible for one of these kinds of activities is enough of a serious indication of how acute an issue we feel this is,” said Australian Ambassador for Cyber Affairs Tobias Feakin.

Britain and New Zealand leveled similar complaints and Chinese hackers appear to be working on Japan’s last nerve. The U.S. indictments in December appear to have opened a floodgate of pent-up international anger at China’s cyber-espionage campaign. Beijing, of course, resolutely denies such a campaign exists and claims China is an equally aggrieved victim of hackers, without advancing a shred of verifiable evidence to back up that claim.

Another method of high-tech theft employed by China with increasing frequency involves planting employees at foreign firms, often in offices they have established on Chinese soil. The Chinese employees proceed to steal trade secrets from their employers and either immediately pass the pilfered data along to Chinese contacts, or bring the knowledge with them when they quit and go to work for Chinese firms.

The Justice Department indicted a Chinese national in late December for stealing over a billion dollars’ worth of trade secrets from his former employer, American energy firm Phillips 66, and attempting to pass the data along to a Chinese firm that offered him a job. A similar and highly sensitive case of insider technology theft was revealed in Germany in November.

The Pentagon published a report in September expressing concern about the large number of Chinese researchers and technology experts hired by American universities and corporations, a practice that began as an effort by American employers to game the system and obtain highly-skilled labor at bargain prices but may have created an enormous institutional security vulnerability – and one that directly affects U.S. defense strategy, since so many of the employers in question perform work for the military.

Sharp power: China pioneered the use of economic leverage against foreign companies to make them obey Beijing’s political commands, a practice dubbed “sharp power” to position it between the soft power of diplomacy and the hard power of military force.

The most common application of sharp power involves the Chinese government telling private business entities from other countries they must implement certain policies or they will be locked out of Chinese markets, potentially costing them billions of dollars in lost revenue and seized or worthless business assets.

Headline-grabbing exercises of sharp power have involved the Chinese government enforcing its speech codes on foreign companies, even for advertising material and websites that are not directed at Chinese customers. The most spectacular victory for China in 2018 was the three biggest U.S. airlines agreeing to change their websites to eliminate references to Taiwan as an independent state, despite hearty encouragement from the Trump administration to resist.

A good deal of China’s sharp power targets Taiwan, in concert with election-meddling tactics and a diplomatic campaign to isolate the island. There is no reason to think sharp power techniques will be limited to banning T-shirts and fashion shows the Chinese disapprove of. Some analysts view sharp power as a subset of information war – commerce is, after all, a form of information transfer and money is a powerful medium of communication. It is already clear the 21st Century will be dominated by information warfare, and it will probably vex the 22nd Century as well.

China’s growing influence in Hollywood is changing American films in increasingly obvious ways, as Beijing uses a combination of direct investment in film projects and the threat of banning movies from the huge Chinese market to influence an industry that once prided itself on defiant independence from government censorship and propaganda. It turns out the film industry is quite willing to indulge censorship and propaganda from the aggressive Chinese government, which is shameless about telling filmmakers what will not be tolerated in Chinese theaters and is not even slightly intimidated by criticism from movie stars.

Debt imperialism: Western governments have denounced China’s vast Belt and Road infrastructure project as a form of debt imperialism. Stated simply, China proposes enormous transportation and energy projects in developing nations, pressures them into taking out loans from Chinese banks they can never repay, and creates permanent dependency upon Chinese firms and their engineers to keep the projects running. Critics, including local opposition in the targeted countries, compare the practice to old-fashioned colonialism.

A key element of debt imperialism is that the projects China sells to its “partners” are unsustainable – they cannot possibly generate enough revenue to repay the Chinese loans, or even cover their operating costs over the long run. Often these projects are much more appealing to the avaricious political elite of targeted countries than to ordinary citizens, who cannot help noticing that most of the good jobs created by the projects go to imported Chinese workers, while the bad jobs are very bad indeed.

Debt imperialism is a purely mercantilist strategy. It works because the Chinese government puts its muscle behind development deals that have little appeal for profit-minded free-market enterprises. CEOs worried about their shareholders do not aggressively pursue contracts to build railroads that will never turn a profit, but authoritarian states looking to purchase political influence, strategic power, and protected marketplaces do.

“China is using economic inducements and penalties, influence operations, and implied military threats to persuade other states to heed its political and security agenda. China’s infrastructure investments and trade strategies reinforce its geopolitical aspirations,” President Trump’s National Security Strategy warned.

Protectionism: The current trade war between the U.S. and China draws much criticism from economists who dislike the United States employing protectionist and mercantilist techniques, but the Trump administration essentially maintains there is no other way to adequately respond to China’s predatory practices. In Trump’s view, independent U.S. corporations have been sheep at the mercy of China’s state-sponsored and protected industries for too long.

The White House lists “dumping, discriminatory non-tariff barriers, forced technology transfer, overcapacity, and industrial subsidies” as some of the unfair practices that make it impossible for many American companies to “compete on a level playing field.”

The White House accuses China of subsidizing and dumping numerous industrial products and overproducing vital resources such as steel and aluminum. Critics of China’s practices argue it has relentlessly abused its membership in the World Trade Organization. Some of its most objectionable tactics are designed to cripple foreign competitors by flooding the market with cheap government-subsidized products, an illicit short-term investment that pays long-term dividends by giving China a dominant position in targeted industries.

The political confusion over China’s trade practices was captured in a marvelously tortured sentence in CBS News’ attempt to defend Beijing: “Is China’s trade behavior as wicked as President Trump says? Not quite. In short, it’s not as bad as it used to be and in some regards has improved. But its bias remains pretty blatant, with plenty of one-sided policies and high tariffs.” In other words, Trump is wrong, except he is right.

Comparably convoluted reasoning can be found in the argument over whether China unfairly manipulates its currency to advance its mercantilist agenda. What most of these critics are really saying is that China was less obnoxious in its protectionist practices before Trump took action against it, or they think China’s unfair practices were less injurious to the global economy than Trump’s response.

The goal of the trade war is to force China to abandon its unfair practices. The Trump administration’s pessimistic assessment of progress in November complicated the task of critics who would prefer to minimize China’s offenses or accuse Trump of launching an economic war, since the war clearly started a long time ago, and the watchdogs of globalism simply preferred to sleep through China’s trespasses.

The Chinese have not invented any new tactics since 2017. They have simply become so obvious about using those tactics that it has become impossible to ignore them, especially as Beijing’s rhetoric about fair trade and win-win global cooperation is increasingly difficult to reconcile with its actions. Beijing has been remarkably successful at pitching itself as the new champion of globalism to the international press, which is strange because the media’s work product is more tightly controlled and heavily blockaded than almost anything else imported to China.

COMMENTS

Please let us know if you're having issues with commenting.