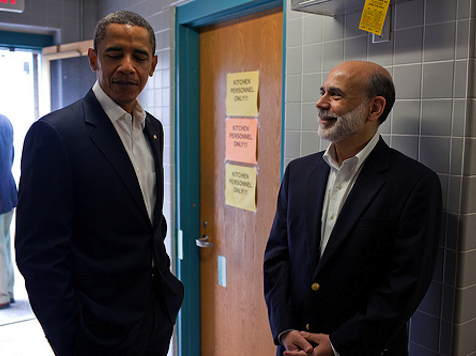

Today, Fed Chair Ben Bernanke announced his new inflation policy, euphemistically titled Quantitative Easing 3 – just in time for the November elections. With the economy declining back into recession and America facing a fiscal cliff come January 2013, President Obama’s economic record has never looked worse. Good thing he’s got Bernanke there ready to inflate him.

In a press conference, Bernanke announced that the Federal Reserve would be buying a huge round of bonds, pumping cash into the economy – and the program’s open-ended. Short-term interest rates, which have been near zero, will be extended all the way through mid-2015. The move is designed to calm markets, which are concerned about Obama’s taxation and regulatory policy removing too much cash from businesses, slowing the economy, depressing prices, and leading to deflation.

Well, deflation won’t be our big worry anytime soon. Buying billions in mortgage bonds to artificially inflate the real estate market and the stock market isn’t good policy – it robs responsible Americans of their savings. But Bernanke loves it. And after this four-year record of untarnished success, who would question him? “I don’t think it’s a panacea,” he said. “I don’t think it’s going to solve the problem. But I do think it’s going to have enough force to move the economy in the right direction.” The Fed stated, “If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability.”

Currently, according to the Federal Reserve, there is $1.13 trillion in US currency in circulation. In 2008, there was just $824 billion in US currency in circulation. Wait for billions upon billions more to enter the money supply. Prices will jump. Savers will pay. Spenders will revel. Remember how the inflationary 1990s turned out during the 2000 recession? Try multiplying that exponentially.

Inflation always looks good at the beginning. The first holders of newly-pumped cash can hire and buy. But in the end, inflation merely hides economic decay, as Jimmy Carter found out. The problem is that Obama doesn’t have to worry about what happens six months down the line. All he has to worry about is what happens over the next seven weeks.

COMMENTS

Please let us know if you're having issues with commenting.