Illinois, operating without a budget for more than a year, faces an enormous backlog of unpaid bills for products and services.

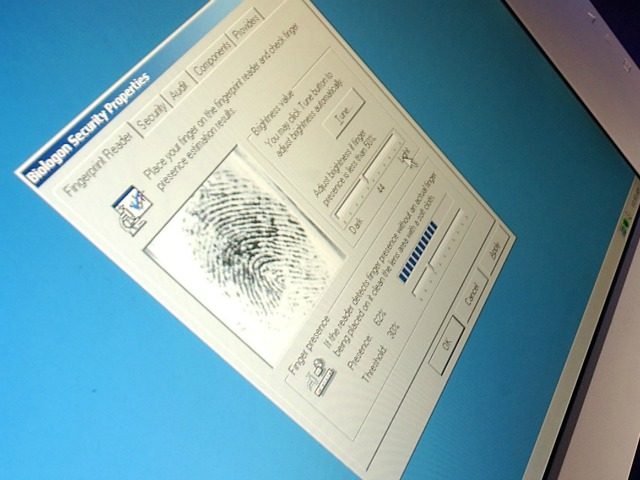

Most embarrassing, perhaps, is the $3 million it owes the FBI for processing background checks and fingerprint scans. The FBI may turn the unpaid bill over to the Treasury Department for collection.

The FBI processes more than 260,000 sets of fingerprint every year for the state of Illinois, conducting background checks on state and local job applicants and applications for concealed-carry permits and other state licenses. The FBI does this for all the states and, according to the agency, has never received a payment more than 4 months late.

Illinois’ fiscal mismanagement grabs the Land of Lincoln another dubious distinction.

Illinois last paid its bill to the FBI last July, to cover services performed last June. Its current tab has been running unpaid since then, as the Republican governor and Democrat-controlled legislature have been unable to agree on a spending plan.

In total, the state of Illinois has more than $7 billion in unpaid bills, owed to a variety of companies, universities and organizations. The legislature completed its current session on May 31, failing to agree to a budget for last year or a budget for the year ahead.

Unsurprisingly, Illinois has the worst credit rating of any state in the country. The last several years have witnessed a steady downgrade in the state’s creditworthiness by all credit rating agencies. Illinois is roughly one-notch above junk bond status.

The state is planning to sell around $550 million in new bonds next week, actually, for capital projects. The state also sold almost $500 million in new debt at the beginning of the year in January. On Wednesday, BlackRock, the largest money manager in the world, called for a possible market lock-out against Illinois.

“We as municipal market participants should really be penalizing in some way, by almost not giving them any access to the market,” Peter Hayes, who oversees $119 billion as head of munis at BlackRock, said. “Think about it — they’re a state without a budget, they refuse to pass a budget, they have the lowest funded ratio on their pension of any state, and yet they’re going to come to market and borrow money.”

According to research from the University of Illinois, the state paid more than $50 million in “penalty costs” on the January debt issue because of its bad credit rating. With the planned debt issue, Illinois will be paying more than $100 million a year simply because it can’t keep its fiscal house in order.

This analysis, however, was before it was revealed that the state is stiffing the FBI for unpaid services. If one were prioritizing one’s outstanding bills, determining the most important creditors to keep current, it is likely the Federal Bureau of Investigation would top that list.

Theoretically, one can put off paying certain bills. A bill from the FBI seems unlikely to be one of those.

COMMENTS

Please let us know if you're having issues with commenting.