House Financial Services Committee Ranking Member Patrick McHenry (R-NC) reportedly will focus on becoming the committee chairman next year if Republicans take the House, instead of jockeying for a leadership position.

McHenry told colleagues he found it more appealing to work on passing the Republican agenda through the House Financial Services Committee than vie for a potential position as the House Majority Whip.

McHenry has been in office for 20 years and served as the House Republican chief deputy whip when House Republicans were last in the majority.

McHenry’s move to stay as the top Republican on the committee will serve as a disappointment to Reps. Blaine Luetkemeyer (R-MO), Bill Huizenga (R-MI), and Andy Barr (R-KY), who all had hoped to take the post.

McHenry has $2.4 million in his campaign account and $750,000 in his leadership PAC. The North Carolina conservative has also unveiled many bills that could signal what sort of legislation he could champion as the chairman of the Financial Services Committee.

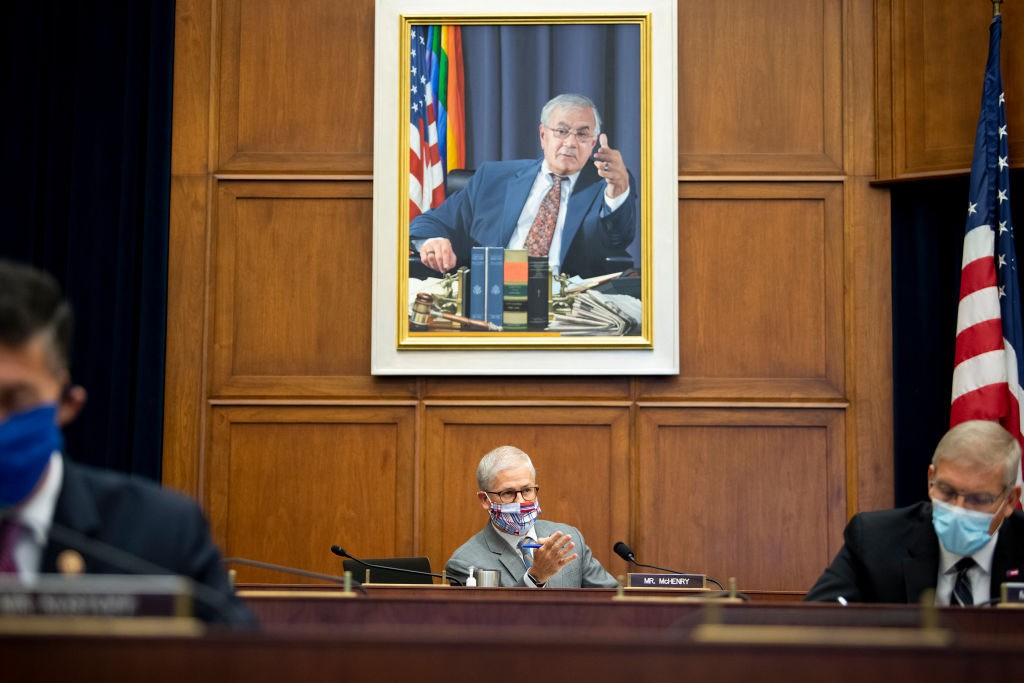

Ranking member Rep. Patrick McHenry, (R-NC), speaks during a House Financial Services Committee hearing on the Treasury Department’s and Federal Reserve’s coronavirus pandemic response at the U.S. Capitol on September 22, 2020 in Washington, DC. Brehman-Pool/Getty)

McHenry has led Republican opposition to the Democrats’ anti-China bill, the America COMPETES Act, contending that the bill would do nothing to combat a rising China and that Democrats remain “desperate” for a win.

House Financial Services Republicans, led by McHenry, noted that they have released many proposals they believe would actually counter China, including:

- The Chinese Military Company Sanctions Act, introduced by Rep. Andy Barr (KY-06), closes loopholes in U.S. restrictions on publicly traded securities of Chinese military and surveillance companies by requiring the President to impose OFAC sanctions following the listing of such companies by the Department of Defense and Treasury.

- The IMF Reform and Integrity Act, introduced by Rep. Bill Huizenga (MI-02), prohibits an International Monetary Fund (IMF) quota increase for China unless China abides by the principles of the IMF and is committed to Paris Club rules.

- The Special Drawing Rights Oversight Act, introduced by Rep. French Hill (AR-02), limits Treasury’s unilateral authority to allocate Special Drawing Rights, which could be used without conditions to send China billions of dollars in hard currency and allow its borrowers to repay Chinese loans.

- The International Nuclear Energy Financing Act, introduced by Republican Leader McHenry, responds to Chinese financing of energy infrastructure abroad, including nuclear power, by requiring the U.S. Executive Director at the World Bank to support financial assistance for the generation and distribution of nuclear energy.

- The Neutralizing Unfair Chinese Export Subsidies Act, introduced by Rep. Lee Zeldin (NY-01), requires a Treasury strategy and progress reports to advance international negotiations to bring China into compliance with the OECD Arrangement on Officially Supported Export Credits.

- The Taiwan Non-Discrimination Act, introduced by Rep. Anthony Gonzalez (OH-16), requires the U.S. to support Taiwan’s membership and meaningful participation in the IMF.

- The Chinese Currency Accountability Act, introduced by Rep. Warren Davidson (OH-08), makes any increase in the Chinese renminbi’s weighting in the IMF’s Special Drawing Rights currency basket conditional on Treasury certifying that China is complying with key provisions of the IMF’s Articles of Agreement, the Paris Club, and the OECD Arrangement on Officially Supported Export Credits.

- The 21st Century Dollar Act, introduced by Rep. Hill, requires Treasury to assess the risk regarding internationalization of the Chinese renminbi and a U.S. strategy on maintaining the U.S. dollar’s position as the global reserve currency.

“This is bad process, bad policy, and represents an unserious approach born of Democrats’ desperation for a win—after failing on everything from inflation to the COVID response,” McHenry added.

McHenry has also pushed back against President Joe Biden and progressives’ “nefarious assault on bitcoin and digital currencies.

“We have to stop the nefarious efforts of this administration and those in the progressive left trying to stop digital assets, cryptocurrencies and, and blockchain technology,” McHenry told Breitbart News in an interview in January.

McHenry, with Rep. Tim Ryan (D-OH), introduced the Keep Innovation in America Act, a bipartisan bill that would fix the digital asset reporting requirements in the bipartisan infrastructure bill, otherwise known as the Infrastructure Investment and Jobs Act.

The legislation would clarify the definition of “broker” so that non-brokers in the digital currency industry such as miners, validators, hardware and software developers, and protocol developers do not have to comply with onerous requirements.

The North Carolina congressman said, “We have to have a whole we have to have a holistic look at this. In the next year, though, if we can stop bad policy from happening, it would be the biggest win for freedom and the biggest win for web 3.0.”

Sean Moran is a congressional reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

COMMENTS

Please let us know if you're having issues with commenting.