All U.S. consumers are financially worse off now than last year with growing personal debt following President Joe Biden’s inflation, a Morning Consult’s State of Consumer Banking and Payments report revealed Tuesday.

The report found that rising interest rates, soaring inflation, and the banking crisis has Americans feeling worse off financially than last year.

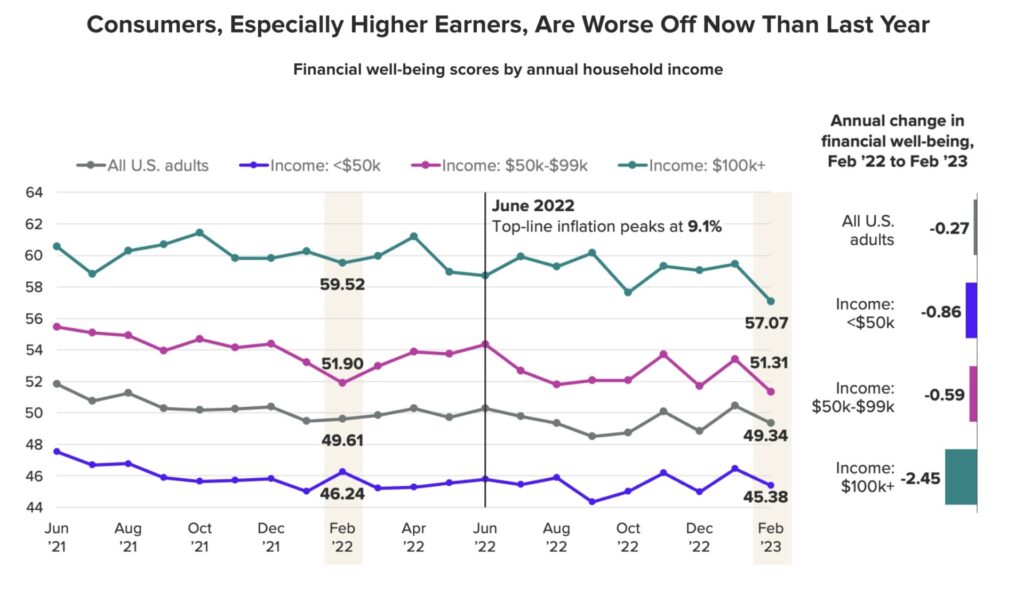

The financial well-being scores by annual household income dropped across all income levels in 2023. The hardest hit appears to be those earning larger incomes, though all consumers have felt the impacts of Biden’s fiscal and energy policies:

- Income <$50k (-0.86)

- Income $50k-$99K (-0.59)

- Income $100k+ (-2.45)

- All adults (-0.27)

One of the key drivers in negative well-being was Biden’s inflation, fueled by a manufactured energy crisis. In March, the Federal Reserve continued to increase interest rates by a quarter of a percent (25 basis points), a decision subject to speculation by financial experts, as the central bank weighed reducing soaring inflation and the stability of the banking system.

The report shows interest rates have most greatly impacted households earning over $100,000 a year. High earners are more likely to hold financial assets impacted by increased interest rates.

The middle class has also been hurt by inflation. In 2022, Biden’s 40-year-high inflation cost American households an average of $5,200 extra, or $433 per month, according to Bloomberg.

While the study found that high-income earners were most impacted by Biden’s inflation in 2022, younger consumers were burdened with personal debt.

“The share of millennials who reported having credit card, auto, mortgage, educational, medical, personal, ‘buy now, pay later,’ home equity and other types of debt was higher compared to any other generation, across all debt types examined,” the report found.

A driver of personal debt for younger generations was student loans. Thirty-three percent of millennials and 21 percent of Gen Zers revealed to the study that they have debt from attending institutions that often employ far-left professors. Sixteen percent of Gen Xers, the oldest of the younger generations, still retain student debt.

The report sampled 4,400 Americans per month from July 2021 to March 2023. No margin of error was provided.

Follow Wendell Husebø on Twitter @WendellHusebø. He is the author of Politics of Slave Morality.

COMMENTS

Please let us know if you're having issues with commenting.