CFPB Sparks Anger by Pushing Regulation on Payday Lenders

The Consumer Finance Protection Bureau announced a long-awaited crackdown on payday loans Thursday, angering critics.

The Consumer Finance Protection Bureau announced a long-awaited crackdown on payday loans Thursday, angering critics.

Richard Cordray, the controversial head of the Consumer Finance Protection Bureau (CFPB), responded Sunday to claims he has his eye on running for Ohio governor, saying he is focused on “making sure people are treated fairly” in the marketplace.

According to its director Richard Cordray, the Consumer Financial Protection Bureau (CFPB) is “something that has to be kept separate from partisan politics.” Cordray has continuously referred to the Bureau as “an independent agency” and prides himself on working to protect all consumers, regardless of political affiliation. But what he is trying so desperately to hide is that the CFPB is the most political and partisan agency in the federal government.

U.S District Judge William Pauley criticized the Consumer Financial Protection Bureau (CFPB) on Tuesday for its “indifference” on “how to distribute money left over from its 2015 settlement with Sprint Corp over unauthorized customer charges.”

Consumer Finance Protection Bureau Director Richard Cordray spent time with House Democratic lawmakers Wednesday, having met in recent months with a menagerie of far-left interest groups — meetings likely to fuel rumors the controversial Democrat is planning to run for governor of Ohio.

Iain Murray, vice president for strategy at the Competitive Enterprise Institute, told Breitbart News that the Consumer Financial Protection Bureau (CFPB) is an unconstitutional agency that needs to be eliminated.

The Consumer Financial Protection Bureau (CFPB) faces increasingly dire legal challenges. One court case could eliminate the consumer finance agency altogether.

Democrats remain divided over whether to work with Republicans to revamp the controversial Consumer Financial Protection Bureau (CFPB).

The Consumer Financial Protection Bureau granted $20 million in contracts to Greer, Margolis, Mitchell, Burns — a liberal advocacy firm with close ties to 2016 candidate Hillary Clinton and former President Barack Obama.

The Trump White House is weighing its options to fire Consumer Financial Protection Bureau (CFPB) Director Richard Cordray.

The federal bureaucracy is comprised of about 2.6 million permanent employees protected by Civil Service and about 4,000 political appointees. Many of these bureaucrats are actively engaged in sabotaging President Trump’s agenda.

Two Texas Republican lawmakers submitted matching bills in the House and Senate Tuesday to shut down the Consumer Financial Protection Bureau, an agency outside the direct oversight of Congress and the control of the president.

A federal appeals court on Tuesday ruled a key part of Barack Obama’s Dodd-Frank law unconstitutional, calling it a “grave threat to individual liberty.” This tees up yet another case for an evenly divided Supreme Court, the balance of which will be decided by whether Donald Trump or Hillary Clinton is elected in November.

Contents: Wells Fargo found to have defrauded millions of customers; Reasons given why no criminal prosecutions of bankers for criminal fraud

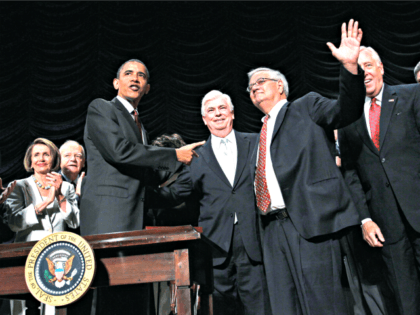

During Saturday’s Weekly Address, President Obama and Senator Elizabeth Warren (D-MA) touted the creation of the Consumer Financial Protection Bureau, with President Obama saying that “if you’re a hardworking American who plays by the rules, you should expect Wall Street

CFPB Director Richard Cordray says the agency is proposing “a rule aimed at ending payday debt traps by requiring lenders to take steps to make sure consumers have the ability to repay their loans rule to end payday debt traps.”

One of the unusual aspects of Dodd-Frank is that, in effect, it removed the CFPB from the Congressional appropriations process and gave CFPB what amounts to an unlimited budget.

This foray into the potholes and backroads of Tennessee is a new area of regulatory control, even for the CFPB. But, as American Banker reported, Congress granted the CFPB the authority to do so in an obscure passage of the Consumer Financial Protection Act of 2010, known more commonly as the Dodd-Frank Act.

The federal government aims to “protect” consumers by regulating away a payment option that’s popular with low-income Americans.

While some optimistic members of Congress have recently claimed that Operation Choke Point is winding down, out in the real world small business owners like Brian Lynn are learning otherwise.

The really dangerous development of the administrative state is that bureaucrats no longer fear the wrath of our elected representatives, many of whom are so interested in making the State bigger and richer that they’ll no longer countenance even token attempts at holding it responsible for its actions, because that would empower the people who want to make it smaller.

The Obama Administration’s “Operation Choke Point” is being used to target yet another legal industry: the tobacco industry.