Roger Marshall, Dick Durbin Lobby Biden Admin to Weaponize Government Against Credit Card Bill Opponents

Sens. Dick Durbin and Roger Marshall are pushing Joe Biden to weaponize the federal government against opponents of their credit card bill.

Sens. Dick Durbin and Roger Marshall are pushing Joe Biden to weaponize the federal government against opponents of their credit card bill.

President Joe Biden’s agencies are threatening banks with federal investigations if they do not grant cheap loans to risky illegal immigrants.

Sen. Pat Toomey (R-PA) has asked the Consumer Financial Protection Bureau (CFPB) to turn over documents in an effort to determine if the agency is replacing career senior officials with hand-picked activists, as Biden promised to be nonpolitical with the agency.

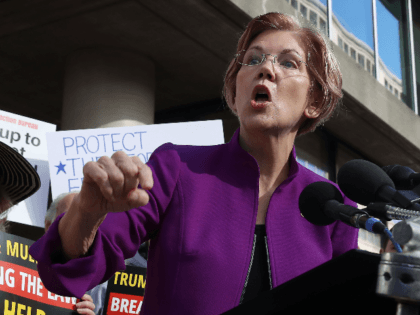

The agency designed by Elizabeth Warren was too unaccountable to pass constitutional muster, the Supreme Court said Monday.

Democrats in the House of Representatives voted on Wednesday against an amendment to a proposed bill that would prevent the Consumer Financial Protection Bureau (CFPB) from forcing credit reporting agencies to evaluate Americans based on political opinions or religious beliefs.

The Supreme Court announced on Friday that it will take up a case on the constitutionality of the Consumer Financial Protection Bureau (CFPB).

The Supreme Court is taking up the question of whether the agency created by Elizabeth Warren is unconstitutional

Official White House records undercut a claim Joe Biden made during the fourth Democrat presidential primary debate of whipping votes for legislation that created the Consumer Financial Protection Bureau (CFPB).

Many pundits joked that when former Vice President Joe Biden gave his final answer in the Democrat debate on Tuesday night in Westerville, Ohio, he missed an opportunity to tell the story of “Corn Pop” again.

Sen. Elizabeth Warren (D-MA) snubbed former Vice President Joe Biden during Tuesday’s CNN-New York Times Democrat presidential primary debate, thanking only President Barack Obama for securing the votes to establish the Consumer Financial Protection Bureau (CFPB).

Rep. Lee Zeldin (R-NY) told Breitbart News in an exclusive statement Friday that Consumer Financial Protection Bureau (CFPB) Director Kathy Kraninger must “reverse” and withdraw from the agency’s consent judgment on the National Collegiate Master Student Loan Trusts (NCMSLTs).

Sen. Thom Tillis’s office told Breitbart News the Consumer Financial Protection Bureau has overstepped its bounds on the consent judgment against the National Collegiate Master Student Loan Trusts.

The Supreme Court on Monday denied review of a major challenge to the constitutionality of the CFPB and Dodd-Frank, resulting from the understandable recusal of Justice Brett Kavanaugh, who was still a judge on the federal appeals court handling the case on its way to the justices when the case was pending before that court.

The future direction of the Consumer Financial Protection Bureau (CFPB) is in question after Kathleen Kraninger was confirmed as the new director of the powerful independent agency in a straight party-line vote on Thursday by the United States Senate, 50 to 49.

President Trump’s nominee to become the next director of the controversial Consumer Financial Protection Bureau (CFPB) cleared a key hurdle when the Senate voted along party lines by a 50 to 49 margin to invoke cloture, ending debate and setting up a final vote on the confirmation of Kathleen Kraninger.

Republican Mike DeWine defeated Democrat Richard Cordray Tuesday night to win the election for governor of Ohio.

A David vs. Goliath lawsuit on the constitutionality of the Consumer Financial Protection Bureau (CFPB) has reached the Supreme Court.

An NBC News/Marist Poll in Ohio has good news for Republicans in the gubernatorial race, and bad news in the U.S. Senate race.

Late Saturday afternoon the White House announced President Trump’s “intent to nominate” Kathy Kraninger, an aide to Office of Management and Budget (OMB) director Mick Mulvaney, to head the Consumer Financial Protection Bureau (CFPB), where Mulvaney has also served as acting director since November

The New York Times reported on Friday that Mick Mulvaney, Office of Management and Budget (OMB) director and acting director of the Consumer Financial Protection Bureau (CFPB), is pushing President Trump to name Kathy Kraninger, his deputy at the OMB, to head the controversial independent agency where his appointment as acting director is about to end due to statutory requirements.

Despite numerous media reports that Mick Mulvaney was behind the push to discard the simple logo of the Consumer Financial Protection Bureau in favor of a more traditional government seal, it was his Democrat predecessor who began the shift.

Hollywood actor Alec Baldwin fired off a tweet saying President Donald Trump’s administration is filled with “pirates, whores, and thieves.”

Lawsuits challenging the constitutionality of parts of the Consumer Financial Protection Bureau (CFPB) are likely going to the Supreme Court late this year, as the left-leaning majority of a D.C.-based federal appeals court sided with the powerful agency.

The potential nomination of National Credit Union Adminstration Chairman (NCUA) Mark McWatters to become the new director of the Consumer Financial Protection Bureau (CFPB) has encountered some unexpected difficulties.

The potential nomination of National Credit Union Administration (NCUA) chairman Mark McWatters as the director of the controversial Consumer Financial Protection Bureau (CFPB) has run into trouble as one industry group has raised public objections to him, while others are critical behind the scenes.

Acting Consumer Financial Protection Bureau (CFPB) Director Mick Mulvaney ordered a 30-day regulatory and hiring freeze on Monday.

President Donald Trump re-ignited his long-running feud with CNN this past weekend. He tweeted: .@FoxNews is MUCH more important in the United States than CNN, but outside of the U.S., CNN International is still a major source of (Fake) news,

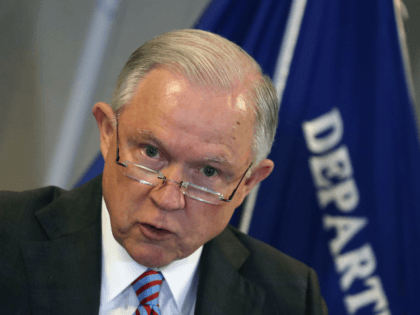

Attorney General Jeff Sessions’ Department of Justice (DOJ) responded late Monday to a lawsuit by Deputy Director Leandra English of the Consumer Financial Protection Bureau (CFPB) to block President Donald Trump’s appointment of Mick Mulvaney as acting director of the CFPB, making a compelling case as to why the president’s appointment is valid, the English’s lawsuit is a frantic attempt by an Obama holdover to keep CFPB under the control of DC’s Swamp.

WASHINGTON, DC – Obama holdover Leandra English is claiming to be the acting head of the powerful Consumer Financial Protection Bureau (CFPB) and, on Sunday, filed a lawsuit against the president of the United States, seeking an emergency court order declaring her the lawful director and requiring everyone to treat her as such.

President Donald Trump may nominate Office of Management and Budget Director Mick Mulvaney to head the Consumer Financial Protection Bureau (CFPB) temporarily, according to Bloomberg News.

CFPB Director Richard Cordray announced that he will resign at the end of November; Republicans frequently chastised the CFPB.

The Consumer Finance Protection Bureau announced a long-awaited crackdown on payday loans Thursday, angering critics.

Richard Cordray, the controversial head of the Consumer Finance Protection Bureau (CFPB), responded Sunday to claims he has his eye on running for Ohio governor, saying he is focused on “making sure people are treated fairly” in the marketplace.

According to its director Richard Cordray, the Consumer Financial Protection Bureau (CFPB) is “something that has to be kept separate from partisan politics.” Cordray has continuously referred to the Bureau as “an independent agency” and prides himself on working to protect all consumers, regardless of political affiliation. But what he is trying so desperately to hide is that the CFPB is the most political and partisan agency in the federal government.

U.S District Judge William Pauley criticized the Consumer Financial Protection Bureau (CFPB) on Tuesday for its “indifference” on “how to distribute money left over from its 2015 settlement with Sprint Corp over unauthorized customer charges.”

Consumer Finance Protection Bureau Director Richard Cordray spent time with House Democratic lawmakers Wednesday, having met in recent months with a menagerie of far-left interest groups — meetings likely to fuel rumors the controversial Democrat is planning to run for governor of Ohio.

Iain Murray, vice president for strategy at the Competitive Enterprise Institute, told Breitbart News that the Consumer Financial Protection Bureau (CFPB) is an unconstitutional agency that needs to be eliminated.

The Consumer Financial Protection Bureau (CFPB) faces increasingly dire legal challenges. One court case could eliminate the consumer finance agency altogether.

Democrats remain divided over whether to work with Republicans to revamp the controversial Consumer Financial Protection Bureau (CFPB).

The Consumer Financial Protection Bureau granted $20 million in contracts to Greer, Margolis, Mitchell, Burns — a liberal advocacy firm with close ties to 2016 candidate Hillary Clinton and former President Barack Obama.