President Barack Obama has attacked Gov. Mitt Romney’s record in the private equity industry as CEO of Bain Capital. But ten years ago, as he struggled to raise funds for his long-shot U.S. Senate campaign, then-State Senator Obama decided to embrace the private equity industry and its wealthy Chicago political donors. At one point, Obama even sponsored a resolution in the Illinois Senate calling calling private equity firms like Bain “the best opportunity for long-term economic vitality” and for “the creation of jobs.”

Obama’s campaign ads dismissively compare Romney’s work at Bain to that of a “vampire” draining jobs and money from vulnerable companies and workers. Afterpushbackfrom a handful of pro-free market Democrats in late May, the President himself publicly defended his campaign’s attacks on private equity firms like Bain.

But records from Obama’s time as a state senator in Illinois, alongwith recollections of those who worked with him, present a very different stance. They indicate that Obama worked hard to position himself as a strong supporter of the venturecapital industry. Obama attended industry social functions and used hisposition in the state senate to propose bills consistentwith the legislative goals of the venture capital industry in the state.

“The Barack Obama I knew in Springfield was very pro-private equity,private capital, and high technology” Republican State Senator Kirk Dillard, who servedwith Obama in the Illinois State Senate, said in a telephoneinterview with Breitbart News about Obama’s record last week. “Mr. Obama clearly had many friends in the private equitybusiness when he was a legislator,” Dillard added.

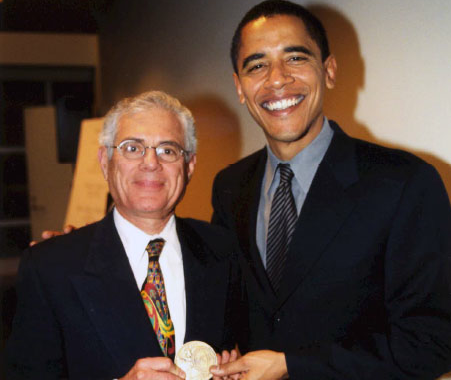

Maura O’Hara, the Executive Director of the Illinois Venture Capitalist Association,concurred with Dillard’s assessment: “When he was in the State Senate I would describe him as a supporter of our industry.” She recallsmeeting Obama in 2002 at the IVCA’s annual award dinner. That year, theIVCA’s lifetime achievement award for “service to the privateequity/venture capitalcommunity” was given to Jack Levin of Kirkland & EllisLaw Firm. State Senator Obama was asked to deliver the award becauseboth he and Mr. Levin had attended Harvard Law School, albeit severaldecades apart. A photo from the event shows Obama grinning as he standswith his arm around Mr.Levin. Both men hold the award up between them.

In 2000, Obama had run as a reformer against incumbent U.S. Representative Bobby Rush (D-IL)–and lost by a wide margin. A few years later, when he began contemplating a run for the U.S. Senate under the tutelage of political consultant David Axelrod, Obama faced a rich primary opponent from the financial world in Blair Hull, and a daunting fundraising task. And so he began to court the wealthy elite himself–a tactical shift that the far-left Obama worried might compromise him. As Obama recalled in his second memoir, The Audacity of Hope:

I worry that there was also another change at work. Increasingly I found myself spending time with people of means–law firm partners and investment bankers, hedge fund managers and venture capitalists…And although my own worldview and theirs corresponded in many ways–I had gone to the same schools, after all, had read the same books, and worried about my kids in many of the same ways–I found myself avoiding certain topics during conversations with them, papering over possible differences, anticipating their expectations. (136-7)

Obama’s effort to show support for private equity went beyond socializing. Between2001 and 2003, State Senator Obama introduced two bills and one resolutiondesigned to boost the private equity business in Illinois. The first bill,introduced by Obama in early 2001, created a tax credit of up to 20 percent for anyone who invested in aby the full Senate.

The following year, Obama introduced a bill titled the “Venture Investment Fund-Repeal.” The bill itself is somewhat cryptic,but its purpose was to repeal the “Illinois Venture Investment Fund.” (Ironically, this was a public venture capital fund similar to the Department of Energy program under Obama that funded Solyndra, the failed solar panel company which hasdogged Obama’s campaign for nearly a year.) At the time Obama introducedthe bill, the Illinois Venture CapitalAssociation had issued a legislative position paperwhich made four recommendations. Point one was the elimination ofpublic venture capital managed by bureaucrats rather than professionals. According to the position paper, “The role of Illinois’government is to create a positive investment and entrepreneurialenvironment, but not to attempt to manage these funds [emphasis added].” The IVCA recommended investing the public money with private equity funds instead (i.e. with its members).Obama’s attempt to repeal the public venture funds died in committee,though the fund was eliminated in a consolidation move by the Illinois GeneralAssembly about a year later.

In March 2003, Obama introduced a State Senate Resolution to set up a “Private Equity Task Force.”The language of the resolution can fairly be described as offering a glowing assessment of the importance of private equity andis starkly at odds with the Obama campaigns recent attacks on Bain Capital:

WHEREAS, Private equity is a vital aspect of the Illinoiseconomy providing needed private capital to early and late stagecompanies in various industries, including but not limited to:retail, restaurant, manufacturing, biotechnology,pharmaceutical, medical devices, homeland security, software, wirelesscommunications, transportation, and agriculture; and

WHEREAS, The development of the private equity sector ofthe Illinois economy offers the best opportunity forlong-term economic vitality, for the expansion of jobs, forthe improvement of productivity and a quality standard of living,and for providing the greatest number of citizens with genuineopportunity;

Compare the last paragraph with Obama’s May defense of attacks on Bain Capital, in which he said:andthat’s a healthy part of the free market, [but]…that’s not alwaysgoing to be good for businesses or communities orworkers.”

Of course, not every investment is going to work out, but Obama’s 2002 resolution specifically stated that private equity is “the best opportunity forlong-term economic vitality…and for providing the greatest number of citizens with genuineopportunity.” In other words, it is the best thing for communities and workers.

The message that Obama’s prospective campaign donors received was that Obama was no longer positioning himself as the political reformer who would shake up Chicago and Washington–and that there was little daylight in between his own attitude towards private equity and the likely approach of rival Blair Hull.

It not certain that Obama wrote the task force resolution himself. Peoplefamiliar with the legislative process in Illinois say that such a resolution would normally by written by a senator or his/her staff. Butwhen asked about the tone of the resolution, those who served with Obamahad little doubt it sounded like something he might have said at the time. Retired State Senator Dave Sullivan said, “This Senate resolution is theBarack that I know.” Senator Dillard, another co-sponsor ofthe resolution, was equally firm: “My memory is that Senator Obama was achampion of private equity and his creation of a Senate Resolution tocreate a task force proves it.”

When the Task Force resolution was adopted on May 30, 2003, Obama made a brief speech [pdf, page 161] in which he indicated that he had put it forward on behalf of “various persons in the industry”:

This bill forms a Private Equity Task Force. As many of you know,venture capital and private equity is one of the key mechanisms by whichwe finance new businesses in the State of Illinois. For a variety ofreasons, Illinois has been lagging behind some of our competitor statesin the formation of venture capital and its deployment in terms ofseeding and funding new companies. This is an issue which has peaked [sic] theinterest of various persons in the industry and so they have asked thatwe form this Private Equity Task Force to examine these issues.

Obama’s attempt to court private equity in the early 2000swas such thatseveral people who knew him at the time believe he is still, at heart, afan. “In my mind, he still believes in the industry,” Maura O’Haraof the IVCA said. Others who worked for the Obama campaign in 2008, andwho did not want to be quoted on the record agreed with her assessment.Republicans who knew him were less circumspect about the reasons for hiscurrent campaign rhetoric. “The President has private equityamnesia from his days as a University of Chicago professor, legislator,and he and the First Lady’s days working at the prestigious SidleyAustin Law Firm,” said Dillard. Former senator Sullivan offered a curt explanation forObama’s switch in tone: “I imagine it polls well.”

A story published Saturday by the New York Times notes that “Obama commercials painting [Romney] as a ruthless executive who pursuedprofits at the expense of jobs are starting to make an impact on someundecided voters.” The mainstream media has coordinated its attacks with the Obama campaign, though many of those attacks, including a Washington Post investigation into outsourcing at Bain, have been debunked.

Given Obama’s record in Illinois, it is fair to askwhen his own effusive admiration for private equity equity flip-flopped into hiscurrent disdain for “vampire” capitalism. When did he stop believingthat private equity was the best chance for creating economic vitality,jobs, and genuine opportunity? And did he ever, in fact, believe it?

COMMENTS

Please let us know if you're having issues with commenting.