The public is slowly waking up to the fact that negative interest rates are becoming the new normal. This trend has only intensified over the last month as Japan finally joined the EU, along with a handful of other nations, in lowering its key interest rate below zero.

Surging sales of old-fashioned household safes in Japan are a harbinger that conditions are likely going to get harder for the average man. The central banks of the world are now operating in the Twilight Zone of economic theory, where savers must now pay for governments to hold their money. This can only end badly.

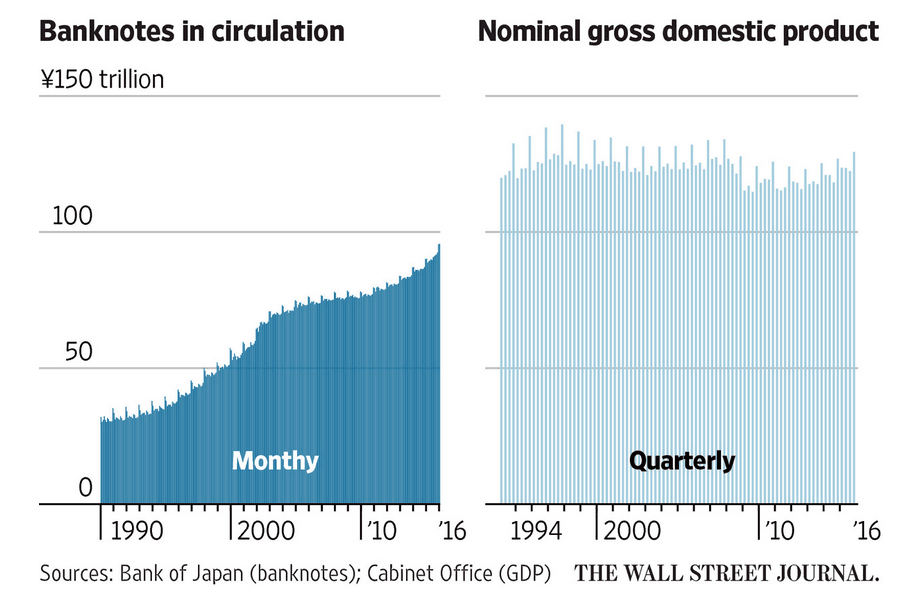

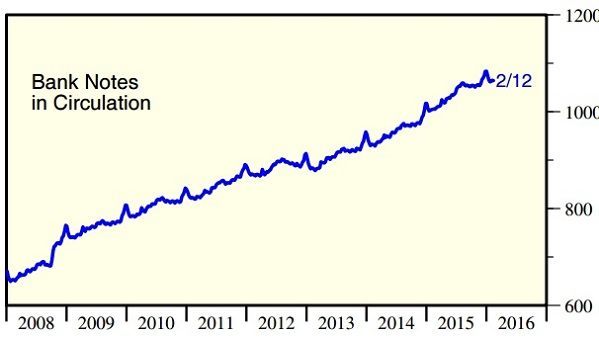

Demand for physical currency is growing as interest rates decline across the globe. Japan has seen its banknote demand consistently grow while its GDP has stagnated for over two decades. Europe has followed the same trajectory, as their consumers also prefer to hold cash rather than spend it in the face of uncertainty—not at all what policy makers had hoped would happen. These are all telltale signs of central bank failure, not success.

The central banks of the world want to force negative rates much lower. They have not had any meaningful pushback thus far because the majority of the public has been reluctant to opt out, but this is changing. The choice to leave the banking system will only grow exponentially if rates were to further deteriorate. Banks, in response, are now rolling out new, higher pricing charges, in addition to their already outrageous ATM fees, to compensate for falling yields. These negative rates could eventually force a tipping point that could take down the current financial system if the public starts to demand physical cash.

There are still moderately positive rates to be found in the world (like in the U.S.), but for most foreign depositors, they are unfortunately becoming financial prisoners of a system with no legal means of escape. Many view physical cash as the last lifeboat off the sinking global economy.

Insurance and pension firms, in particular, are restricted with where they can allocate funds. Short of them opening their own depository and storing physical cash rather than digital currency, they are subject to the whims of their respective central banks. These institutions are in fact too large to even partially exit the system.

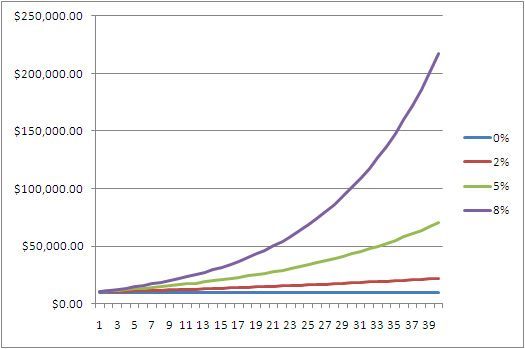

The financial world cannot function on negative rates for an extended period of time. The miracle of compound growth does not work for a normal life expectancy when rates fall below 2 percent. The only way to make up for low returns is to significantly increase the amount of savings to make up for the shortfall. This unintended consequence creates a negative feedback loop where savers will now have to save even more, further lengthening the economic stagnation.

History may not repeat, but it certainly rhymes. The U.S. government used to have a gold-backed currency where individuals could redeem their paper currency for an equivalent amount of gold, which at the time (1933), was convertible at $20.67 per ounce. This convertibility constrained the government from easily implemented financial shenanigans.

FDR made holding gold illegal through Executive Order 6102. Aside from a few exceptions, the public was ordered to turn in all of their gold or face fines of $10,000 ($239,473.68 in 2015 dollars) and/or up to five to ten years of imprisonment. After calling in all of the nation’s gold, the government revalued it all at $35 per ounce, effectively robbing the public of its wealth (a convenient fact often omitted from history textbooks).

These types of actions can happen again and are increasingly looking like they will happen again. Trial balloons are being presented to the public all in the name of stopping “criminal behavior.” Large denomination currency, such as $100 bills and €500 euros, may soon be outlawed, just like gold once was.

Negative interest rates are just another means to keep already questionable governments afloat. Bank bail-ins, rather than bailouts, will likely be employed during the next financial crisis. The laws for this type of move are already in place.

Cyprus was likely not a one-off event, and Greece was a warning as to what can happen when confidence is lost. In each of these countries it could be a generation or more before the public once again feels confident in holding the bulk of their savings in any financial institution. This fear is real and lasting. Many Americans probably have some relative who scared from the Great Depression, refused to keep their money in a bank despite FDIC insurance guarantees decades later.

The solutions that worked in the past are no longer working today. Central banks are essentially a one-trick pony that resort to lowering rates to solve every economic downturn. The whole idea of normalizing rates when things get better can never really materialize; no one wants to get blamed for causing the next recession by raising rates. History has shown that despite the evidence of massive problems, the U.S. Federal Reserve did NOTHING to deflate the Internet and housing bubbles. The current bond bubble will likely be no different.

In many third-world countries it is customary for people to keep precious metals and large-denomination foreign currencies as home-kept savings, instead of digital deposits in a local bank. These countries are used to nationalization solutions or conveniently debased monetary decisions to “fix” government financial problems. Similar cures may be coming to the first world in the next few years.

Governments will now use the word “hoarders” to malign the public that refuses to be fiscally robbed of their hard-earned savings, just as they labeled people in the past who didn’t want to turn in their gold. Purchasing a household safe may soon be a one-way ticket to the terrorist watch list, or an invitation for a middle of the night no-knock raid.

Opting out is what is on the horizon for many who, for self-preservation reasons, can no longer continue to operate within the global financial system. Underground economies are swelling, and the need for tools to protect oneself, like a good safe, are the result of a controlling and manipulative central bank. When cash is made illegal, and permission must be given to perform even the most mundane transactions, then liberty as we know it will be dead. Unfortunately, we may already be past the point of no return.

*This article in no way is an endorsement to buy or sell any security.

COMMENTS

Please let us know if you're having issues with commenting.