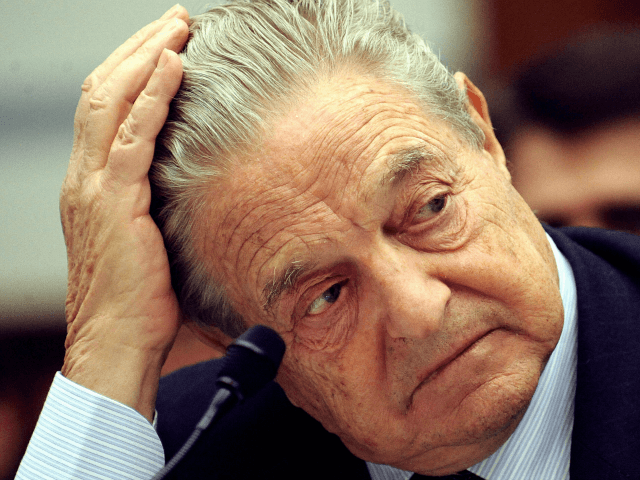

George “Puppet Master” Soros, who tried to use fear tactics to create panic among UK investors and voters in the run-up to the Brexit vote, suffered big financial losses when the British people chose to “leave” the European Union last week.

Soros famously made over $1 billion in 1992 on “Black Wednesday,” as the European Union was being formed by shorting the British pound currency so intensely he caused millions of other investors to sell the currency in a panic. As a result, the United Kingdom was forced to devalue the British pound by about 10 percent overnight.

The Puppet Master recently told the UK Guardian newspaper that he was just “fortunate” to have made a substantial profit for his hedge fund “at the expense” of the Bank of England and the British government.

Soros regularly swaggers that the secret to his successfully making over $35 billion in trading financial markets was developing a theory called “reflexivity” to manipulate investors in crisis situations to take actions that are against their own self-interest. Essentially, reflexivity is the sophisticated equivalent of “shouting fire in a crowded theater” to panic the crowd into racing for the doors and leaving their valuables behind.

In the two weeks leading up to the June 23 Brexit vote, Soros apparently used a “reflexivity” fear campaign to affect the value of global stocks and the British pound.

Soros published an article in the UK Guardian claiming that a vote to leave the EU would trigger an economic disaster: “It is reasonable to assume, given the expectations implied by the market pricing at present that after a Brexit vote the pound would fall by at least 15% and possibly more than 20%.”

The timing of Soros’s comments was coupled with the release of a wildly questionable British Treasury economic “model” that estimated a Brexit vote to leave the EU would reduce UK household Gross Domestic Product by $6,321 by 2030.

The reflexivity scare tactics did seem to work over the next few days following the vote. With panic spreading in the markets as stock prices tumbled, the exchange rate of the British pound plunged.

The Puppet Master just admitted that while he was scare-mongering investors into selling, his $25 billion personal investment fund went “long” the British pound before the June 23 referendum.

Soros apparently loaded up on the pound sterling through futures contracts that allow 99 percent leverage, with a margin down payment of only $900 to control $90,625 worth of British currency. He has not disclosed how large his “long” British pound bets were before the June 23 Brexit vote, but he bet $10 billion in futures on his 1992 “short” bet against the pound.

But this time, Soros’s reflexivity investment strategy failed miserably, as the British people refused to be cowed by the Puppet Master and voted to leave the EU. The exchange rate of the British pound fell from about $1.50 to the dollar on Thursday, June 22 to $1.31 on Monday, June 27.

Puppet Master Soros has not disclosed how much he wagered against the bravery of the British people on June 23. But if he bet $10 billion, the Puppet Master just lost $1.27 billion.

COMMENTS

Please let us know if you're having issues with commenting.