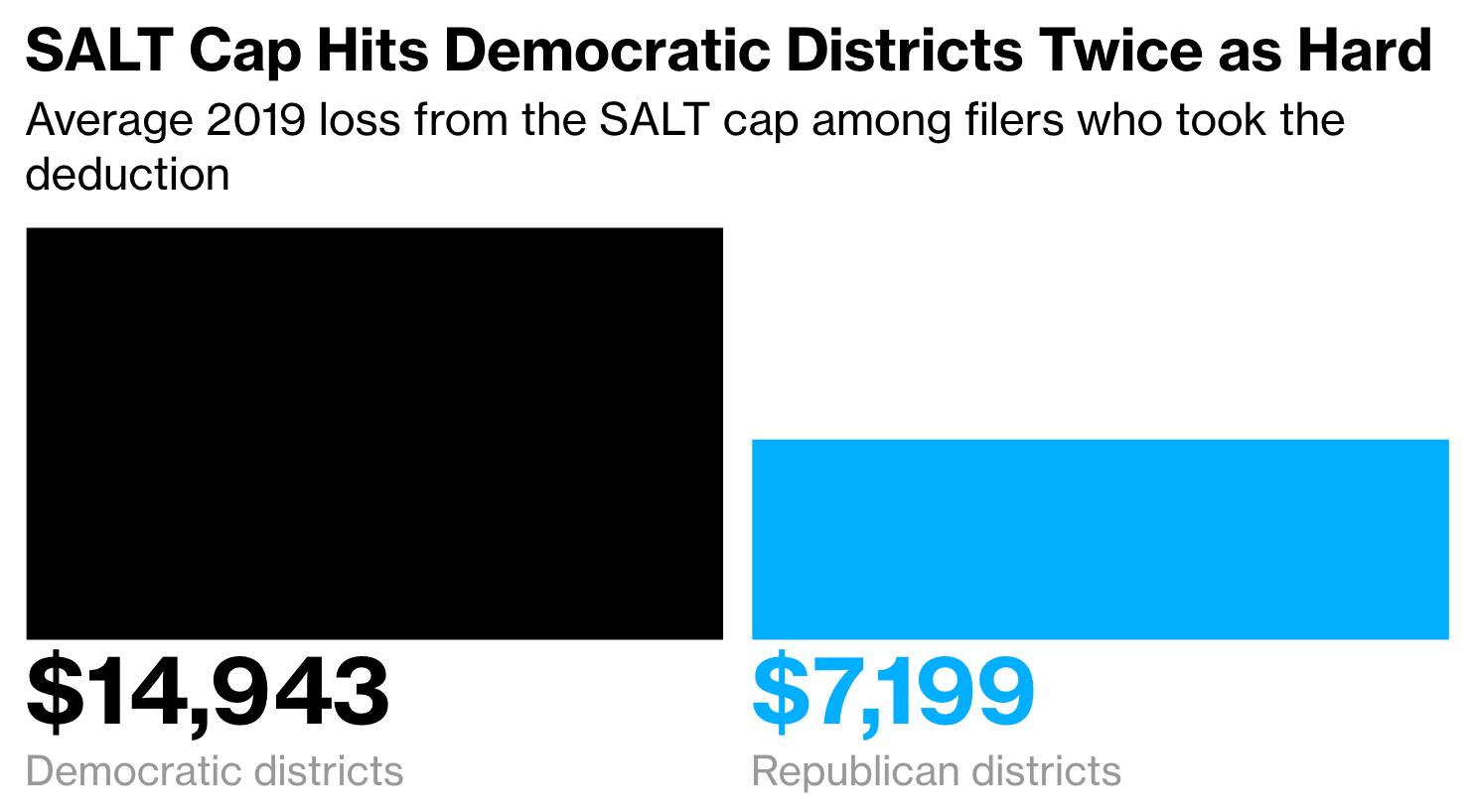

Democrats say cutting hundreds of billions of dollars in taxes for mostly wealthy income-earners in coastal states is “essential” to getting reelected in this year’s midterm elections.

In November, House Democrats passed President Joe Biden’s “Build Back Better Act” which includes billions in tax breaks to the wealthiest residents of blue states. Specifically, the plan would give a tax cut to about 67 percent of the nation’s richest Americans — those earning more than $885,000 every year — costing taxpayers about $625 billion.

Under Biden’s plan, those in the top one percent would receive an average tax cut of more than $16,000 this year. The tax cuts for the wealthy would be a result of the plan’s increasing the State and Local Tax (SALT) deduction cap.

Ahead of the midterm elections in November, House Democrats are warning their rich donors that they must get out and vote for them to secure the massive tax cut. Rep. Sean Patrick Maloney (D-NY) called the tax cuts for the rich “essential” in an interview with Bloomberg News.

“We need to get that done. It’s not the only thing, but it’s a big thing,” Maloney said, who represents one of New York’s wealthiest areas — Westchester County. Rep. Haley Stevens (D-MI) called the tax cut “really important” for her constituency.

“If you want your state and local deductions back, you have to vote for Democrats. Republicans screwed you last time, and they’ll do it again,” Maloney said.

At the same time, a number of Democrats are blasting the effort, including Rep. Alexandria Ocasio-Cortez (D-NY), Sen. Bernie Sanders (I-VT), and Rep. Jared Golden (D-ME).

To try to enrich affluent donors, Dems went out and lied to their constituents, pretending the SALT cap hits most middle class families, rather than admitting it mostly affects the rich.

Now the lie has caused a political problem for those same Dems. https://t.co/mPM0AMBeaC

— David Sirota (@davidsirota) January 10, 2022

Sanders has said:

At a time of massive income and wealth inequality, the last thing we should be doing is giving more tax breaks to the very rich. Democrats campaigned and won on an agenda that demands that the very wealthy finally pay their fair share, not one that gives them more tax breaks.

Meanwhile, Democrats want to squeeze an extra $200 billion out of American taxpayers by mostly targeting working and middle class earners with more Internal Revenue Services (IRS) audits.

The plan ensures nearly 600,000 more working and middle class Americans earning $75,000 or less a year would be audited by the IRS. Of those new IRS audits, more than 313,000 would target the poorest of Americans who earn $25,000 or less a year.

In 2017, former President Trump had the SALT deduction capped at $10,000. Since then, Democrats have sought to deliver their wealthy, blue state donors with a massive tax cut by eliminating the cap altogether or greatly increasing it.

Biden, for instance, had sought to include tax cuts for his billionaire donors in a Chinese coronavirus relief package earlier this year. The plan was ultimately cut from the package. House Speaker Nancy Pelosi (D-CA), in May 2020, also tried to include the plan in a coronavirus relief package.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

COMMENTS

Please let us know if you're having issues with commenting.