California Democrats may soon find themselves on the defensive in their war against the Trump administration, as the Republican-controlled Congress is moving toward blocking California’s state-run “forced savings” program.

The program, known as “Secure Choice”— modeled after Covered California, the California version of ObamaCare —requires all employers with 5 or more employees to participate. Employers must set up, enroll and maintain retirement accounts for their employees, which will be run by the state government, and not subject to the intense restrictions and expensive compliance requirements of ERISA (the Employee Retirement Income Security Act of 1974).

State- and city-run retirement accounts have been criticized by GOP representatives in Congress, reports Pensions & Investments Online. The California program relies on a Department of Labor (DOL) rule passed on August 25th, 2016 that allows states to set up private-sector retirement savings programs.

But on Feb. 7, Congress acted, as Republicans introduced motions to repeal the rule under the Congressional Review Act of 1996, which it has been using to overturn a number of Obama-era regulations that failed to give adequate notice to Congress.

Rep. Tim Walberg (R-MI), who chairs the U.S. House Subcommittee on Health, Employment, Labor and Pensions, and committee member Rep. Francis Rooney (R-FL) released a joint statement Feb. 8: “Our nation faces difficult retirement challenges, but more government isn’t the solution.”

H.J. Res. 66, introduced by Walberg, would remove the safe harbor for states, and H.J. Res. 67, introduced by Rooney, would block the rules for cities.

Five states — Connecticut, Illinois, Maryland, Oregon, and most recently California — have passed laws to set up these plans for private-sector workers. Cities such as New York, Philadelphia and Seattle are considering similar measures. However, as Investment News reports, scrapping the DOL rule may not impede programs already in effect — only those not yet set up, like California’s.

According to the same Investment News story, John Scott, director of retirement savings at the nonpartisan Pew Charitable Trusts think tank, said: “I think it [repeal] would muddy the waters for the states, but wouldn’t close off the state activity.”

A number of these state programs have a poison pill to self-destruct if they are required to comply with ERISA. The whole point of setting up the state-sponsored, automatic-enrollment, payroll-deduction individual retirement account (IRA) programs, known as “auto-IRAs,” was to obtain a special exemption from ERISA if certain conditions are met, thereby limiting liability. That provision gives state lawmakers license to take control of IRAs in their state without complying with the cumbersome, expensive requirements of ERISA — which they claim allows them to offer a lower cost product to low-income, or “low-security” workers.

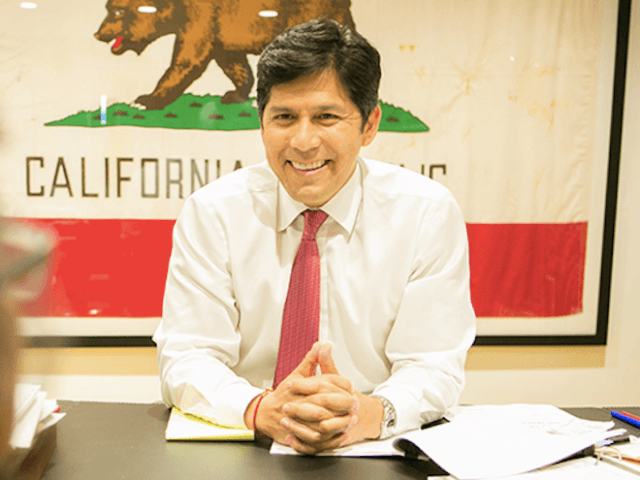

Kevin De Léon, the Senate President Pro Tem, told the Los Angeles Times that he will defy the Trump administration regardless of the outcome of the parliamentary battle.

“They are trying to do this for Wall Street in the middle of the night, behind closed doors, without a hearing,” De León said. “If this is really about helping workers, they should hold hearings, study it and permit public testimony.”

In an interview with the Sacramento Bee, De Léon stated that no option is off the table—not even a ballot initiative:

“If we continue to deny working Californians an opportunity to save so they can retire with some dignity that could be a potential option – to let the people vote,” de León said in an interview at his Capitol office on Thursday.

Other liberals have raised the issue of state’s rights, but that’s not likely to dissuade GOP lawmakers.

The one big unknown is perhaps the most significant — namely, where President Trump stands on the issue.

With the President holding the “trump card” — whether or not he signs the resolution — De Léon’s pet project could be in serious jeopardy.

Tim Donnelly is a former California State Assemblyman.

Author, Patriot Not Politician: Win or Go Homeless

FaceBook: https://www.facebook.com/tim.donnelly.12/

Twitter: @PatriotNotPol

COMMENTS

Please let us know if you're having issues with commenting.