LONDON (AP) — Macronomics — it’s the new French president’s proposed cure for a decade’s worth of relative economic gloom.

Emmanuel Macron’s victory in Sunday’s election puts him in place to pursue his economic agenda, from cutting taxes on companies and labor, to investing more in technology and promoting freer trade and integration in the European Union.

The aim is to get the French economy growing again at least at the levels seen before the global financial crisis erupted in 2008. Since then, growth has barely averaged 1 percent a year, with many blaming the relatively inflexible jobs market. Germany and Britain, the countries France most compares itself with, have done much better.

That level of growth is too low to create jobs quickly enough to bring down the unemployment rate, which has been stubbornly above 10 percent for years, double Germany’s. Joblessness is nearly 25 percent among those aged under 25, three times more than Germany’s.

For most working people, the relative decline has been clear in their monthly wages. At the turn of the millennium, the average income in France was on a par with Germany’s — now it’s lagging by around 10 percent, according to some measures.

And public debt has steadily swelled and stands at a historically high level of just under 100 percent of annual GDP. It all adds up to a disappointing decade for a country that has strong potential, from high economic productivity to a broad industrial sector.

Macron, a centrist who has worked as an investment banker and economy minister, offers France a “real opportunity for reform” that will “both pep up France’s economy and strengthen his position in Europe,” says Charles Grant, the director of the Centre for European Reform.

Macron’s efforts center on reducing spending by the French state to 52 percent of annual economic output, from the current 55 percent, which is the highest in the EU. He wants to keep the budget deficit within the rules governing the euro, below 3 percent of annual GDP.

He has proposed further changes to the labor market, notably by moving France’s collective wage bargaining from the industry to the company level, which would give firms greater flexibility in reaching deals.

He wants to lower the corporation tax, to 25 percent from an estimated 33.3 percent, as well as employment tax, making it cheaper to hire. In a more direct effort to reduce unemployment, he’s proposing stricter rules on jobless benefits but more job training. Finally, he aims to invest 50 billion euros ($55 billion) to modernize the country, for example in green technologies, health and transportation.

Healing France’s economic ills will be crucial to avoid the kind of disillusionment that bolstered support for far-right presidential candidate Marine Le Pen, who wanted to bring France out of the EU, with uncertain consequences for the wider region. The scale of French people’s desire for change was made clear in the fact that Le Pen and far-left candidate Jean-Luc Melenchon got a combined 41 percent of the vote in the first round of the election.

Macron may be starting out lucky. The French economy seems to have been gaining momentum in recent months, with surveys of business activity by financial firm IHS Markit showing growth at a six-year high. That seems partly due to earlier reforms on training and hiring, but is also thanks to a wider pick-up in European growth.

Macron can’t rely on tailwinds from an unpredictable global economy to meet his hopes, hence his passionate embrace of change. According to Oxford Economics, his proposals could add 1.2 percentage points to France’s annual economic growth by 2022, the year of the next presidential election.

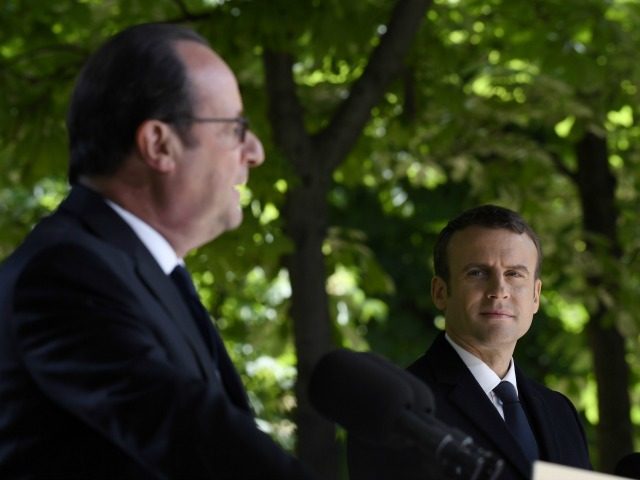

But turning around the French economy is no easy feat. Macron’s two immediate predecessors, conservative Nicolas Sarkozy and socialist Francois Hollande, failed to do so, condemning them to single-term presidencies.

Macron’s ability to succeed in his plans hinges on getting a working parliamentary majority in elections next month. That is far from guaranteed: his fledgling Republic on the Move party is contesting its first legislative election against rivals who want to hobble Macron’s presidency before it has started by blocking his proposals.

The worst-case scenario for Macron would be that the June elections deliver a majority to his staunchest opponents, tying his hands and reducing him to more of a figurehead role.

Grant, from the Centre for European Reform, says Macron won’t find it easy and that he, as much as anyone from his time as economy minister under Hollande, knows how difficult it will be.

“As Macron discovered when he was a minister, vested interests, trade unions and party activists are stubborn and conservative,” said Grant. “He managed to liberalize coach services, shopping hours and the legal profession, but wanted to do much more.”

Already, French unions have made clear their opposition, above all to Macron’s labor reforms, which they see as an attack on their long-earned and cherished rights. On Monday, just a few hours after Macron’s win, several thousand protesters took to the streets of Paris to demonstrate against his liberal economic agenda.

Fergus McCormick, co-head of sovereign ratings at the DBRS ratings agency, said Macron will have to be transparent about what his government is doing and why. Macron has promised to consult unions but also seems impatient to act, hoping parliament will give him powers to push through labor laws by decree, as early as this summer.

“We know from past attempts at labor market reform and other structural change in France that explaining the reforms to the French public is a critical component of any initiative,” he said.

“To be successful, the new administration will need to be clear that it is attempting to address the root causes of the discontent.”

COMMENTS

Please let us know if you're having issues with commenting.