New sanctions against Chinese telecom giant Huawei announced by the U.S. Commerce Department on Monday could strike a “lethal blow” against the company by blocking its supply of semiconductors, geotechnology chief Paul Triolo of the Eurasia Group said to CNN.

Triolo said the new sanctions against Huawei represent the “potentially most serious effort by the U.S. government to choke off the company’s ability to obtain advanced semiconductors for all of its business line.”

The new sanctions essentially finish the job of cutting Huawei off from its supply of Kirin chips, a custom-designed advanced processing chip supplied until now by the Taiwan Semiconductor Manufacturing Company. Huawei began seeking alternative suppliers after restrictions imposed by the U.S. in May, but Monday’s order from the Commerce Department comprehensively blocked all Huawei entities from purchasing the chips from any other viable sources.

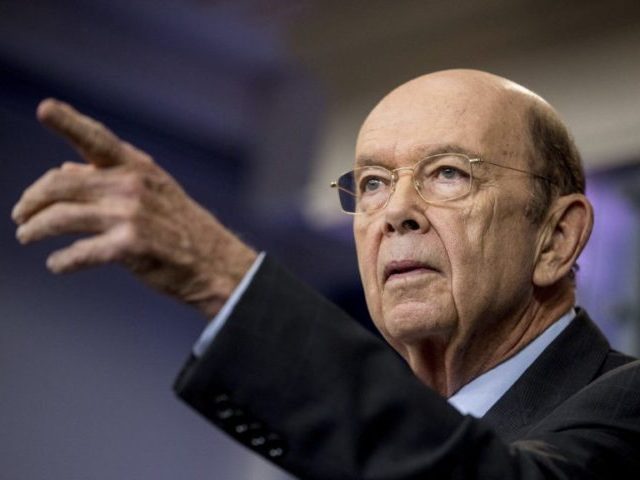

“Huawei and its foreign affiliates have extended their efforts to obtain advanced semiconductors developed or produced from U.S. software and technology in order to fulfill the policy objectives of the Chinese Communist Party. As we have restricted its access to U.S. technology, Huawei and its affiliates have worked through third parties to harness U.S. technology in a manner that undermines U.S. national security and foreign policy interests. This multi-pronged action demonstrates our continuing commitment to impede Huawei’s ability to do so,” explained Commerce Secretary Wilbur Ross.

Andy Purdy, a senior executive with Huawei’s U.S. division, predicted the company would take a sizable “hit in revenue” from the tightened sanctions but would “bounce back.”

Some of the analysts quoted by CNN were not so sure, predicting that the loss of third-party chip supplies would doom Huawei’s smartphone business, and would significantly disrupt U.S. semiconductor companies as well, since sales to China are a major source of revenue for them. Some Japanese and South Korean companies also stated on Tuesday they are bracing for losses of revenue from canceled contracts with Huawei.

Qualcomm, in particular, is said to be seeking a waiver from the Commerce Department because it sells billions of dollars worth of chips to Huawei. A possible silver lining is that Qualcomm also does brisk business with other Chinese smartphone manufacturers who compete with Huawei, and can be expected to fill the void left by vanishing Huawei handsets.

“We believe this step to significantly (almost completely) curtail Huawei’s ability to source any semiconductor from anyone,” wrote Credit Suisse technology research director Manish Nigam in a note quoted by Ars Technica.

“Huawei is probably finished as a maker of 5G network equipment and smartphones once its inventories run out early next year,” predicted Dan Wang of Gavekal Research in his report on the sanctions, which was unsubtly titled A Death Sentence for Huawei.

American corporate executives are also bracing themselves against retaliatory action by the Chinese government. Ars Technica’s sources ranked Apple and Qualcomm high as potential targets.

“China firmly opposes the deliberate smearing and suppression of Chinese enterprises including Huawei by the US side. For some time now, the US has been abusing national security concept and state power to impose all sorts of restrictive measures on Chinese companies like Huawei without producing any solid evidence. This is stark bullying,” the Chinese Foreign Ministry fumed on Tuesday.

COMMENTS

Please let us know if you're having issues with commenting.