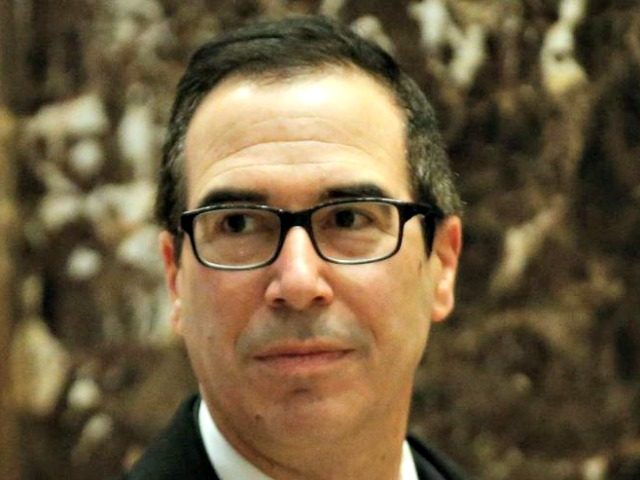

The highlight of Treasury Secretary Steven Mnuchin’s confirmation hearing so far was his rousing defense of community banks against overbearing federal regulations.

“Regulation is killing community banks,” he declared, and if the process is not reversed, we could “end up in a world where we have four big banks in this country.” He went on to offer examples of how regulations enacted after the 2008 financial crisis had some unexpected negative consequences.

Mnuchin ran through a list of regulatory agencies — “the OCC, the FDIC, Consumer Protection Bureau, the Federal Reserve”— and noted that “in certain cases, there is overlapping regulation.”

“My biggest concern, and I fully support regulation for banks with FDIC insurance, but my biggest concern is that this regulation is killing community banks,” he said. “We’re losing the community banking business. We’re losing the ability for small and medium-sized banks to make good loans to small and medium-sized businesses in the community, where they understand those credit risks better than anybody else.”

“I think that we all appreciate the engine of growth is with small and medium-sized businesses. In my role at FSOC, in working with the different regulators, I would make sure that we did what we could to have proper regulation, but eliminate overlap, as well as make sure that the banks are lending to small and medium-sized businesses, and we don’t end up with a world where we only have four big banks in this country,” Mnuchin said.

He was referring to his prospective chairmanship of the Financial Stability Oversight Council, a new regulatory body created by the Dodd-Frank regulations to decide which private institutions are vital to the stability of the U.S. financial system, and so merit enhanced federal oversight.

Senator Mike Crapo (R-ID) noted the importance of Mnuchin’s role within FSOC, which he criticized as “heavily focusing on some of its statutory mandates while ignoring others” since its inception.

Crapo highlighted the statutory mandate to “advise Congress and make recommendation in such areas that will enhance the integrity, efficiency, competitiveness, and stability of U.S. financial markets.”

“To date, frankly, I’m not aware of FSOC fulfilling that role,” he said. “We don’t get a lot of advice from FSOC. We get a lot of directive in the country. Will you pledge, as the chairperson of FSOC, that you will ensure that the council considers ways to make the U.S. financial markets more efficient, and then advise and work with Congress to achieve those outcomes?”

“I absolutely will, Senator,” Mnuchin replied. “Let me just comment on, for instance, the Volcker Rule as an example. I do support the Volcker Rule. I think the concept of proprietary trading does not belong in banks with FDIC insurance.”

The Volcker Rule is another artifact of the Dodd-Frank legislation, which as Mnuchin indicated limits bank ownership of hedge funds and private equity funds. In essence, it prevents banks from using the money they’re holding for investments that benefit the bank instead of its customers, which is the sort of activity that contributed to the immense losses in the 2008 financial crisis.

“The Federal Reserve just put out its own report that the Volcker Rule has completely limited liquidity in many markets,” Mnuchin continued. “The Federal Reserve is concerned that the interpretation of the Volcker Rule doesn’t allow banks to create enough liquidity for customers. So that’s something I would absolutely want to look at.”

COMMENTS

Please let us know if you're having issues with commenting.