Senate Republicans continue to draft a health care bill. Here are a few key planks of the evolving legislation.

1. Increased tax credits for low-income and older Americans

Sen. John Thune (R-SD) will draft a tax credit scheme that would offer more generous tax credits to low-income and older Americans compared to the House-passed American Health Care Act (AHCA). Thune hopes to send several different plans to the Congressional Budget Office (CBO) to figure out the best way to structure the tax credits.

The tax credits offered by the AHCA and the Senate bill would allow Americans to purchase health insurance on the individual market. The AHCA’s tax credits ranged from $2,000 to $4,000 based on age, not income. Thune’s plan would tie the tax credits to income and age and would phase out for the credits for wealthier Americans, as well as provide more generous health care tax credits for older Americans.

2. Slower rollout of Obamacare’s Medicaid expansion

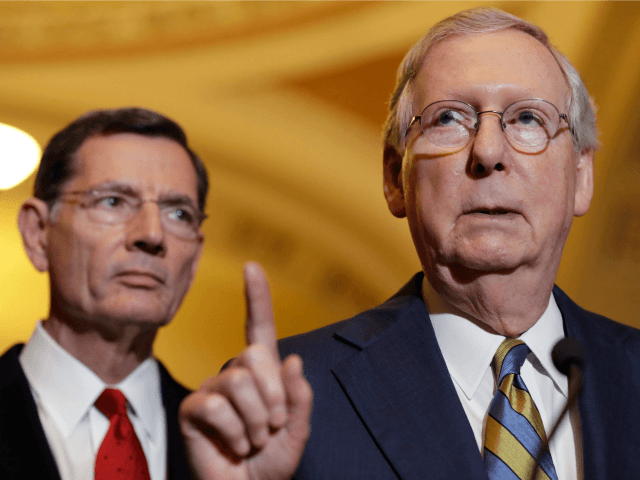

Sen. Rob Portman (R-OH) plans a seven-year roll back of Obamacare’s funding, compared to the AHCA which has a three-year phase out. Senate Majority Leader Mitch McConnell also backed a three-year cut to Medicaid expansion.

3. Retain some of Obamacare’s taxes

If Senate Republicans plan to spend more on health insurance tax credits and a slower phase-out of Obamacare’s Medicaid expansion, then the upper chamber will have to find more revenue to make up the difference. The Senate might keep some of Obamacare’s taxes for a longer period than the AHCA to make up the missing revenue.

Sen. John Barrasso (R-WY), a member of Senate leadership, said, “Certainly there’s an agreement that you eliminate every tax that has to do with increasing the costs of insurance premiums — so the health insurance tax, the medical device tax, the prescription drug tax — there is some question about what you do with the taxes related to high-income individuals, and that’s part of the debate.”

The AHCA would repeal most of Obamacare’s taxes in 2017 while retaining the 0.9 Medicare surtax on wealthy Americans until 2023 and delay the implementation of the “Cadillac tax” on expensive health care plans until 2026.

Nearly four dozen conservative groups wrote to Senator Hatch this week, urging the Senate to repeal Obamacare’s taxes.

The alliance said, “True repeal of Obamacare means the Obamacare taxes and the Senate should resist the urge to deprive taxpayers of relief to pay for higher spending. We commend you on your stance to repeal these Obamacare taxes and urge any final package accelerate or at least maintain the House-passed tax reductions.”

Prominent conservative groups, such as FreedomWorks, Americans for Prosperity, and Club for Growth, played a significant role in the revolt against the initial version of the House’s American Health Care Act (AHCA), which many conservatives chided as Obamacare-Lite and Ryancare.

4. More funding to combat the opioid crisis

Senators worried about Medicaid’s reduced funding now seek higher funding to combat the opioid crisis in America. At this time it remains unclear how much the Senate will fund the program.

Sen. Portman said, “In addition to my efforts to give governors more time and flexibility to adjust to a new system, I’m working with my colleagues to provide governors with a dedicated new funding stream to ensure those using expanded Medicaid resources to treat their addiction can continue to receive treatment as they work to get back on their feet.”

5. Stabilize the Obamacare exchanges

Senate Republicans plan to stabilize the collapsing Obamacare exchanges while they plan the phase out many parts of the Affordable Care Act. Republicans might include subsidies to insurance companies that offer discounts to low-income Americans.

The White House has yet to decide whether they will allow the payments will continue. The AHCA provided the subsidies to insurers through 2020, and the Senate bill will likely include them as well.

Sen. Lamar Alexander (R-TN) said, “The payments will help to avoid the real possibility that millions of Americans will literally have zero options for insurance in the individual market in 2018.”

6. More funding for pre-existing conditions

Sen. Susan Colins (R-ME), a moderate Republican, told reporters last week that the House bill “grossly underfunds” high-risk pools to help patients with pre-existing conditions. She added that the bill would need at least $15 billion in its first year.

The AHCA spends over $100 billion to help lower premiums, and provide care for those with high-risk conditions.

The CBO reported that the AHCA would cause 23 million Americans to lose health insurance over the next years and reduce the deficit by $119 billion. The Senate bill’s more generous tax credits for lower-income and older Americans along with a slower rollback of Obamacare’s Medicaid expansion would cover more Americans than the AHCA. More protections for pre-existing conditions along with the increase in tax credits would lower premiums for lower-income and older Americans compared to the House-passed bill. Conversely, younger and healthier Americans would most likely pay higher premiums than under the AHCA.

Republicans hold a slim majority in the Senate; they can only afford to lose two votes before Vice President Mike Pence would have to break the tie to pass a health care bill through the upper chamber. The Senate will not vote on their legislation before they have a Congressional Budget Office (CBO) analysis, meaning that the Senate will have to finalize the bill this week to vote before the July 4th recess.

The Senate appears to have President Donald Trump’s blessing, as he told Senators this week that the House’s AHCA was “mean,” urging them to create a “more generous” bill.

McConnell wants to vote on the bill before the July 4th recess so that Congress can focus on other priority issues such as tax reform and the budget, even if it is unclear the Senate has the votes to pass the legislation.

COMMENTS

Please let us know if you're having issues with commenting.