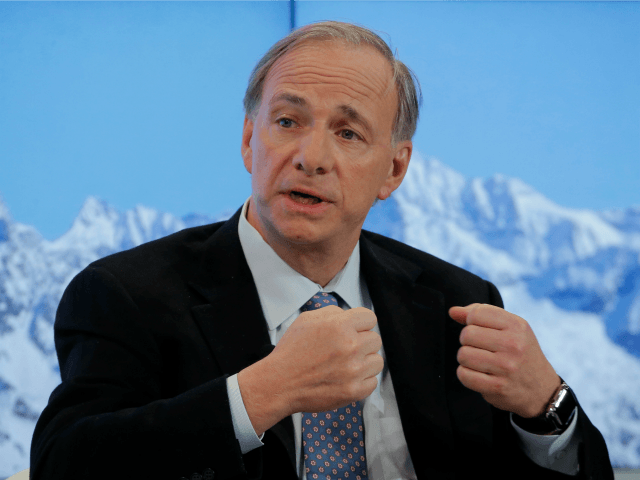

Billionaire investor Ray Dalio thinks stock are declining “due to justifiable fears that the Fed will tighten faster than is priced in the credit markets.”

Dalio is the founder of Bridgewater Associates, the world’s largest hedge fund.

In a post on LinkedIn Monday, Dalio explained that news last week of faster job growth and higher wage growth fed fears that the Fed would raise rates to keep down inflation.

Over the past week or so, we had reports of strong growth and rising wages (good things!), which sent bonds and stocks down (bad for most investors) due to justifiable fears that the Fed will tighten faster than is priced in the credit markets. The surge in growth and wages came because of both the fiscal stimulation and the rekindling of animal spirits, thrusting the economy into late-cycle capacity constraints, which is leading to the expectations of faster Fed tightening. In other words, fiscal stimulation is hitting the gas, which is driving the economy forward into the capacity constraints, which is triggering interest rate increases that are hitting the brakes, first in the markets and later in the economy. This confluence of circumstances will make it difficult for the Fed to get monetary policy exactly right. This is classic late-cycle behavior (when it’s difficult to get monetary policy exactly right, which leads to recessions), though it is more exaggerated because the durations of assets are uniquely long, which means that when interest rates are low, prices of assets are more sensitive to changes in interest rates than when interest rates are high.

Despite this warning that the Fed will have trouble getting policy right, Dalio appeared to downplay the importance of the recent declines.

“Still, these big declines are just minor corrections in the scope of things,” Dalio wrote. “There is a lot of cash on the side to buy on the break, and what comes next will be most important.”

COMMENTS

Please let us know if you're having issues with commenting.