Fed Pumps Another $1.5 Trillion into Repo Market

$500 billion Thursday. $1 trillion Friday. And $1.6 trillion every week for at least the remainder of the month.

$500 billion Thursday. $1 trillion Friday. And $1.6 trillion every week for at least the remainder of the month.

At a private event in 2016, Bloomberg called Democrat rival Elizabeth Warren “scary,” and assured the banks that he was on their side.

Sen. Elizabeth Warren (D-MA) sent a letter to a number of U.S. banks, asking them to detail the preparations they are making for what she considers the impending climate change crisis, Reuters reported on Wednesday.

A new report claims that tech giant Google may begin offering personal checking accounts to users next year in partnership with Citigroup.

The “temporary liquidity operations” are looking a lot less temporary with each passing day.

Elizabeth Warren takes notice of the banks attempting to make the most out of the crisis in the short-term funding market.

The Supreme Court is taking up the question of whether the agency created by Elizabeth Warren is unconstitutional

The market appeared to be on steadier footing on Tuesday, with demand falling to the lowest level in almost two weeks.

No sign of stability in the short-term funding market.

The repo market is still throwing a fit and no one knows why.

Financial institutions used to rely primarily on credit scores when giving out loans. Now they are considering unconventional criteria like whether applicants shop at discount stores, subscribe to magazines or pay their phone bills on time, according to a new report.

Police have arrested a Pennsylvania couple after they allegedly spent nearly $120,000 that was accidentally deposited into their account on May 31, reports said.

Joe Biden’s younger brother James received a series of “unusually generous” bank loans during the 1970s, while the former vice president served on the Senate Banking Committee.

BERLIN (AP) — Germany’s struggling Deutsche Bank says it will cut 18,000 jobs by 2022 in a sweeping restructuring aimed at restoring consistent profitability and improving returns to its shareholders.

In answer to a question from a shareholder activist, Jamie Dimon said his bank was not debanking conservatives for their politics.

Bank of America’s 205,000 will be paid at least $20 an hour, chief executive Brian Moynihan said Tuesday.

JPMorgan Chase announced earlier this month that it would stop doing business with private prisons, following pressure from Democrats and progressive activists who know that the private prison sector provides key services to Immigration and Customs Enforcement (ICE).

Rep. Alexandria Ocasio-Cortez (D-NY), a self-declared proponent of “democratic socialism,” took pride Tuesday in questioning Wells Fargo CEO Timothy Sloan about the bank’s role in financing private projects that she considers objectionable, such as oil pipelines and prisons.

Philadelphia has reportedly become the first city in the United States to ban cashless stores and restaurants in an attempt to be more “inclusive” to Americans without bank accounts.

Regulators gave banks the greenlight to help out borrowers while the government is shut down.

International banking giant HSBC has hit back at critics of a globalist marketing campaign blasted as anti-Brexit, insisting that “quintessential Britishness” revolves around importing foreign goods.

Some D.C. restaurants, museums, and even banks are offering freebies to furloughed non-essential federal employees during the shutdown.

Oliver ‘Olly’ Robbins, the top bureaucrat who has become Theresa May’s key adviser on Brexit, may be snapped up by an investment banking corporation after the EU negotiations are complete.

Jamie Dimon, the bank’s chief executive, said that trade war talk was more about “psyche” than “economics.”

The Fed says that it has not eased up on the stress tests, even though the economy appears much healthier than in any period since the financial crisis. According to a senior Fed official, this year’s stress scenarios were the toughest to date.

Fifth Third’s $4.7 billion deal to purchase Chicago’s MB Financial is a sign that large regional banks are feeling pressure to grow and believe the regulatory environment has turned positive for bank mergers and acquisitions.

Wells Fargo stemmed the tide of the push for new financial restrictions on gun makers and sellers by stressing that it is not a bank’s job to set U.S. gun policy.

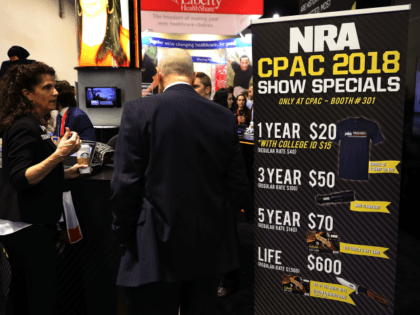

Investors operating under the auspices of the Interfaith Center on Corporate Responsibility (ICCR) are asking banks, gun makers, and gun retailers to cut ties with the NRA.

Amazon is “in talks with big banks” to create their own checking account product, according to a report.

The Fed slammed Wells Fargo with a far-reaching order that limits its growth and requires the replacement of four board members.

An economic agenda dedicated to putting Americans first is not only pushing unemployment down to record lows, it’s narrowing pay gaps also.

PARIS (AP) — Marine Le Pen, head of France’s right-wing National Front, said Wednesday that the party’s long-time bank, Societe Generale, has closed its accounts in what she said amounts to a “banking fatwa” to suffocate the party.

While the Republican tax bill unveiled Thursday is undoubtedly business-friendly, there is one set of American companies that come in for a new and costly tax: the big banks.

China appears to be souring on the decades-old decision to invest heavily in Venezuela, now arguably the world’s worst economy, with its state media suggesting Wednesday that keeping commitments to Venezuela “is at the cost of great risk” and the nation’s banks should reconsider business there.

Citigroup has warned clients that Theresa May’s position as prime minister is “unsustainable”, warning them to prepare for the government to collapse within a matter of months.

Regulation does not reduce risk. It just moves it around.

Treasury Secretary tells senators the administration wouldn’t break up the banks along the lines of the original Glass-Steagall Act

“He is the president of the United States, he is the pilot flying the airplane,” the chief executive of J.P. Morgan Chase said.

Goldman’s deposit-taking and lending operation is tiny compared to its investment banking business.

“The Trump administration’s [economic] agenda is the right agenda,” the chief executive and chairman of J.P. Morgan Chase & Co. said.