Breitbart Business Digest: We’re All Wallerites Now

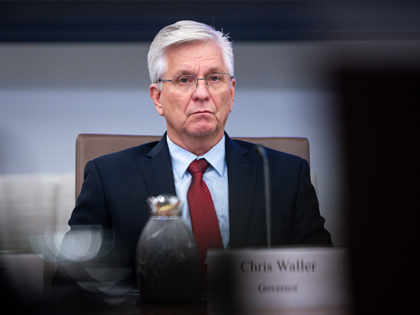

The Federal Reserve’s latest Summary of Economic Projections reveals that the inflation hawks have stood down, and Fed Governor Christopher Waller was right all along.

The Federal Reserve’s latest Summary of Economic Projections reveals that the inflation hawks have stood down, and Fed Governor Christopher Waller was right all along.

By the time Federal Reserve Chairman Jerome Powell climbs the stage at Jackson Hole this Friday, the familiar choreography will be missing one element: consensus.

Federal Reserve Governor Christopher Waller on Wednesday laid out a pro-market vision for modernizing U.S. payments that echoes the Trump administration’s call to “re-privatize” the economy.

The central bank’s future may hinge on a forgotten legal quirk—and a historical echo from 1948.

The July jobs report was a disaster for the American worker, the U.S. economy, the Federal Reserve, and Jerome Powell.

The monolithic thinking about tariffs and inflation at the Fed has been shattered, as Fed Governor Chris Waller shows leadership by breaking with Jerome Powell.

Waller says that tariffs will not create lasting inflation and the Fed should cut at its meeting later this month.

Fed chair tells lawmakers inflation could rise again due to Trump’s tariffs, keeping rate cuts on hold for now.

For much of this year, the Federal Reserve has held interest rates steady after a series of cuts in late 2024. But that fragile consensus may be breaking.

President Trump has a rare opportunity to break the cycle of the Fed’s bureaucratic groupthink. Here are three decisive moves he can make.

If Christopher Waller’s view prevails at the Fed, it will mean that Washington no longer has to choose between stable prices and national economic strategy. Tariffs can be a tool, not a threat.

Progress on inflation has been very slight, so any rate cuts will have to wait until the Fed has several more months of data on inflation, Waller said.

Fed Governor Christopher Waller argues that there is no reason to fear that we are sailing into a recession, which is the thing that usually prompts rate cuts from the Fed.

Will the Fed defend the position it staked out in December or capitulate to the view of bond traders?

This week’s economic data very likely pushed the timing of a rate cut further out on the calendar.

The prospects of a soft landing for the economy is no reason for the Federal Reserve to rush into rate cuts.

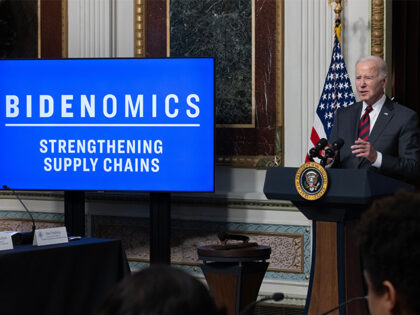

The most striking thing about President Biden announcing a special White House council on supply chains is that it took until this Monday to happen.

Does the rule that you cannot fight the Fed apply if the Fed is fighting itself?

The Federal Reserve is not buying the optimism about the economy that the White House has been marketing under the brand Bidenomics.

Federal Reserve Governor Chris Waller on Wednesday drained some of the drama of the coming Halloween meeting of the Federal Open Markets Committee.

Long and variable? Maybe not. Fed Governor Christopher Waller have a speech titled “Big Shocks Travel Fast: Why Policy Lags May Be Shorter Than You Think” on Thursday night in New York.

Someone forgot to tell the mall rats that the economy is supposed to be in a recession any day now.

The services sector index for February shows that progress on inflation has definitely stalled as demand for services remains strong.

A highly anticipated speech by Fed Governor Christopher Waller was scrapped after a participant in the Zoom call started showing porn to the audience.