More Fed on Fed Violence

Wednesday brought another set of clashing positions on interest rates by Federal Reserve officials.

Raphael Bostic, the head of the Federal Reserve Bank of Atlanta, released an essay on Wednesday indicating that he’s increasingly confident that inflation is on a downward trajectory toward the central bank’s two percent target.

Federal Reserve Bank of Atlanta President Raphael Bostic speaks during an interview in Atlanta, Georgia, on Nov. 3, 2023. (Elijah Nouvelage/Bloomberg via Getty Images)

“After synthesizing all the data and anecdotal input, our staff forecasts inflation to decelerate to 2.5 percent by the end of 2024 and closer to 2 percent by the end of 2025,” Bostic argues. “Altogether, the research, data, survey results, and input from business contacts tell me that tighter monetary policy and tighter financial conditions more broadly are biting harder into economic activity. At the same time, I don’t think we’ve seen the full effects of restrictive policy, another reason I think we’ll see further cooling of economic activity and inflation.”

His neighbor to the north, Richmond Fed Chief Thomas Barkin, is not as convinced. In an interview with CNBC, Barkin argued that the central bank should exert itself to keep the option of further hikes open just in case inflation resurges.

“If inflation comes down naturally and smoothly, awesome,” Barkin said at the CNBC CFO Council Summit Wednesday. “But if inflation is going to flare back up, I think you want to have the option of doing more on rates.”

In short, Bostic thinks the Fed can most likely retire the interest rate hiking cycle while Barkin thinks there may still be need for further hikes.

Both Barkin and Bostic will be voting members of the Federal Open Market Committee (FOMC) next year, so their views are particularly salient.

Bostic + Waller vs. Barkin + Bowman

The Bostic-Barkin schism appears to be a repeat of the Waller-Bowman division we discussed at length in Tuesday’s Breitbart Business Digest—albeit with a bit of alliteration.

In a speech in Washington, DC, on Tuesday, Fed Gov. Chris Waller argued that recent economic data appeared to support the idea that the economy was slowing enough from the blistering pace of the third quarter—the estimate for which was revised up to 8.9 percent nominal growth and 5.2 percent real growth—that inflation could be expected to continue to fall without the need for additional rate increases.

“The October data I have cited on economic activity and inflation are consistent with the kind of moderating demand and easing price pressure that will help move inflation back to 2 percent,” Waller said.

Fed Gov. Michelle Bowman, speaking at a breakfast in Salt Lake City, argued that a lot of the disinflationary forces that had worked on the economy over the past year have likely run their course. As a result, further rate increases may be necessary to keep inflation on its downward trajectory.

Clockwise from top left: Raphael Bostic, Thomas Barkin, Michelle Bowman, and Christopher Waller.

“At our last meeting, I supported the FOMC’s decision to hold the target range for the federal funds rate at the current level as we continue to assess incoming information and its implications for the outlook,” Bowman said. “But my baseline economic outlook continues to expect that we will need to increase the federal funds rate further to keep policy sufficiently restrictive to bring inflation down to our 2 percent target in a timely way.”

Of course, the big question on Fed policy is where the chairman stands. These clashing perspectives from governors and presidents are likely to focus even more market attention on the “fireside chat” Jerome Powell is scheduled to hold at Spelman College on Friday.

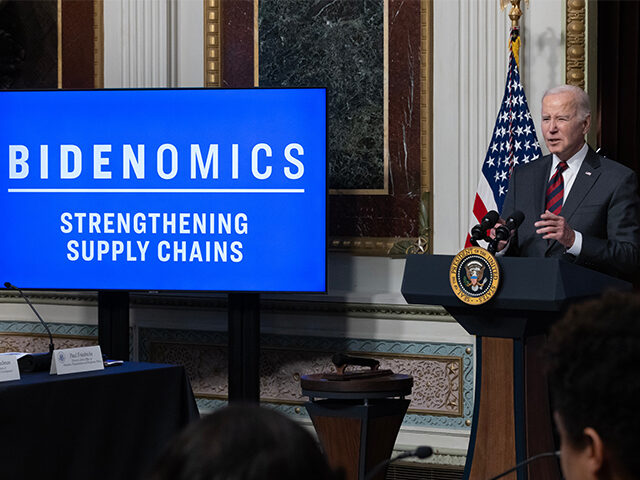

Biden Shows Up With a “White House Council on Supply Chain Resilience”

The most striking thing about President Biden announcing a special White House council on supply chains is that it took until Monday to happen.

The weakness of U.S. supply chains that were stretched out over the globe and all too often shackled to China has been well-known to trade hawks for over a decade. Many critics of globalized trade arrangements and China’s ascendence to the shopfloor of the world have long made this a centerpiece of their position.

These vulnerabilities became undeniable, however, during and after the pandemic, when shortages both serious and ridiculous emerged and then stuck around month-after-month. The traffic jam at U.S. ports was so embarrassing to the Biden administration that the ships were kindly instructed to wait somewhere beyond the horizon for an open berth.

So, why didn’t Biden get the supply chain crisis its own cabinet-level council back in 2021 or 2022? The reason is obvious: while the costs of supply chain disruptions are widespread, the cause of fixing them lacks a leftwing constituency plugged into the White House. Climate change, abortion on demand, and transgender rights are just more salient issues to the folks who run the Biden administration than the boring ins-and-outs of logistics and economic growth.

Making the launch of the supply chain council even more ridiculous, Biden pitched it as part of his plan to take on inflation. This would have made sense a year or two ago, but at this point the disinflationary effects of improved supply chains are in, at least for the time being.

You do not have to take our word for it. Here’s Gov. Waller in that speech Tuesday: “Elevated inflation was partly the result of supply-side problems related to the pandemic, and some of the improvement in inflation that we have seen has been due to the easing of those problems. But most data indicators and anecdotal evidence suggests that supply side problems are largely behind us so they will provide little support in the future in returning inflation to our 2 percent goal.”

COMMENTS

Please let us know if you're having issues with commenting.