Trump to Ban ‘Large Institutional Investors’ from Buying Up U.S. Homes

President Donald Trump is moving to ban “large institutional investors” from buying up United States homes meant for Americans.

President Donald Trump is moving to ban “large institutional investors” from buying up United States homes meant for Americans.

Vice President JD Vance says the link between mass immigration and increased housing costs is “clear as day” as rents across the United States continue to decline for the fourth consecutive month.

Vice President JD Vance says that mass immigration under former President Joe Biden significantly skyrocketed the cost of rent and home prices.

Donald Trump’s reforms to the U.S. housing market are showing real impact as the number of migrants seeking FHA mortgages has plummeted.

On Tuesday’s broadcast of New York’s Power 105.1’s “The Breakfast Club,” 2024 Democratic presidential candidate Vice President Kamala Harris argued that her proposed down payment assistance for first-time homebuyers won’t “have an unintended effect, because that increases the demand for

The fourth consecutive monthly decline as home affordability continues to be a major problem.

High mortgage rates are holding back the supply of homes for sale, putting homes out of reach for many Americans.

Share prices in China’s tottering real estate market perk up as municipal governments start buying up distressed properties.

How restrictive can monetary policy really be if home prices climbed for an 11th month to an all-time high?

Despite a record pace of Fed rate hikes, home prices kept rising in 2023.

The highest mortgage rates in 23 years were not enough to keep home prices from rising.

Average Americans cannot afford to buy a home in a growing number of communities across the United States, according to a report.

All three of the major indexes of home prices hit new record highs in July.

Home prices are down the most on a year-over-year basis since 2012.

The latest evidence of an earlier than expected recovery for the housing market.

Home prices have been declining as the Federal Reserve’s interest rate hikes have pushed up rates on home loans.

A much bigger jump in home sales than expected.

Higher mortgage rates have thrown sand into the gears of the housing market.

All of the 20 cities tracked by the S&P Dow Jones Indices experienced seasonally-adjusted month-over-month price declines.

Home prices are still up a lot compared with a year ago but the housing market is cooling and now seeing month-to-month declines.

Home prices are likely to keep declining as interest rates climb higher.

Home prices decelerated more than expected but are still up by double-digits across the country.

The mortgage debt rose 1.9 percent this past quarter as the housing market continues to soar coming out of the pandemic.

High home prices and rising mortgage rates are pushing more people to rent, driving up rents.

Home prices are rising at a record pace.

Home prices re-accelerated in December.

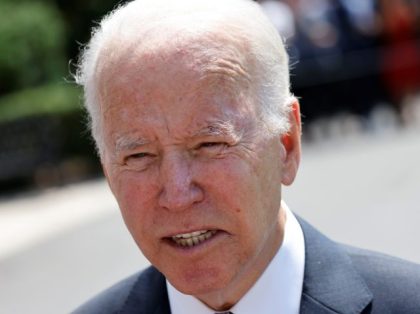

Biden promised to make housing more affordable. That’s not working out.

Home price gains are at an unsustainable 18.6 percent nationally.

Another blow to family affordability in Biden’s America.

Housing prices accelerated their surge in April, hiting the fastest pace ever recorded.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering the entire U.S., reported an 11.2 percent annual gain in January, up from 10.4 percent in the previous month. That is the fastest pace for home prices since 2006, the peak of the housing bubble.

Home prices rose 10.4 percent compared with a year earlier, according to the S&P CoreLogic Case-Shiller Home Price Index.

Despite the slowdown and higher interest rates, home prices are still rising faster than incomes.

A new study suggests that the birth rate is collapsing in the San Francisco Bay Area, partly due to high housing prices, as women are delaying childbirth until they can afford living space in which to raise children.

A new study suggests that policymakers looking to tame the rising cost of U.S. houses may want to cut back on immigration. It also finds that the friendlier an area’s population is to new immigrants, the more house price inflation is exacerbated.

A new study by the Real Estate Center at Texas A&M University finds that rising costs of land is contributing to higher home prices in the Lone Star State.