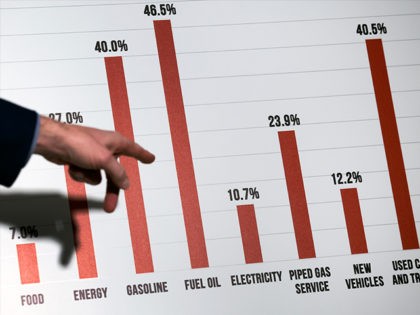

Consumer Sentiment Surges as Inflation Fears Ease

Americans are less worried about inflation and that is giving a boost to consumer sentiment. The University of Michigan’s consumer sentiment index rose to 69.7 in December, nearly 14 percent above the November reading and a few points ahead of