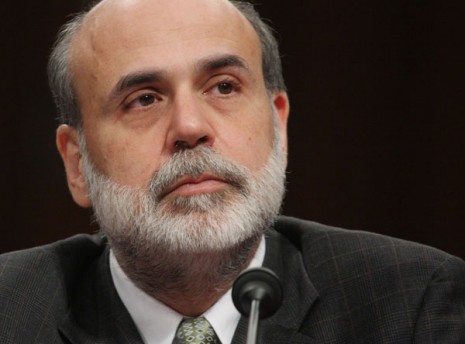

(AP) Bernanke says US job market weak despite gains

By MARTIN CRUTSINGER

AP Economics Writer

WASHINGTON

Chairman Ben Bernanke says the U.S. job market remains weak despite three months of strong hiring and that the Federal Reserve’s existing policies will help boost growth.

Further job gains will likely require more robust consumer and business demand, Bernanke said Monday during a speech at the National Association for Business Economics spring conference in Arlington, Va.

Bernanke’s comments suggest the central bank is prepared to keep interest rates near zero for some time.

“Despite the recent improvement, the job market remains far from normal,” Bernanke said. “The number of people working and total hours worked are still significantly below pre-crisis peaks.”

Recent job gains have lifted hopes for the economy. Employers added an average of 245,000 jobs a month from December through February. The unemployment rate has fallen roughly a percentage point since summer, to 8.3 percent.

But the economy grew at an annual pace of just 3 percent in the October-December quarter. And economists believe growth has slowed in the January-March quarter to around 2 percent growth.

Bernanke said the combination of modest economic growth and rapid declines in unemployment is something of a puzzle. Normally, it takes growth of roughly 4 percent annual growth to lower the rate by that much over a year.

He offered some reasons for the unexpected decline in unemployment. Employers may be hiring rapidly because they cut too many jobs during the recession. He also said that government revisions may later show stronger growth over the past year.

But Bernanke cautioned that he doesn’t expect the unemployment rate to keep falling at the current pace without much stronger economic growth. He also noted that the rate is still roughly 3 percentage points higher than its average over the 20 years preceding the recession.

His comments offer insight into the reasoning behind the Fed’s plan to hold short-term interest rates near zero through 2014. The central bank has stuck with that timetable despite three months of strong job growth and other signs of economic improvement.

The Fed is concerned that the recovery could falter again as it did last year. Americans aren’t seeing big pay increases, gas prices are rising, and Europe’s debt crisis could weigh on the U.S. economy.

As long as inflation remains tame, analysts believe the Fed will likely hold interest rates down to give the economy more support.

Many economists believe that Fed officials will not make any changes in policy at their next meeting on April 25-26 and will only ease credit conditions if the economy slows further.

While the recent job market gains may continue, economists believe the record-low rates will continue as well, at least through much of this year.

One reason for that view: a pullback from the 2014 timetable could jolt investors and trigger a sudden rise in interest rates set by financial markets. That would slow the economy just as it is struggling to mount a sustainable recovery.

COMMENTS

Please let us know if you're having issues with commenting.