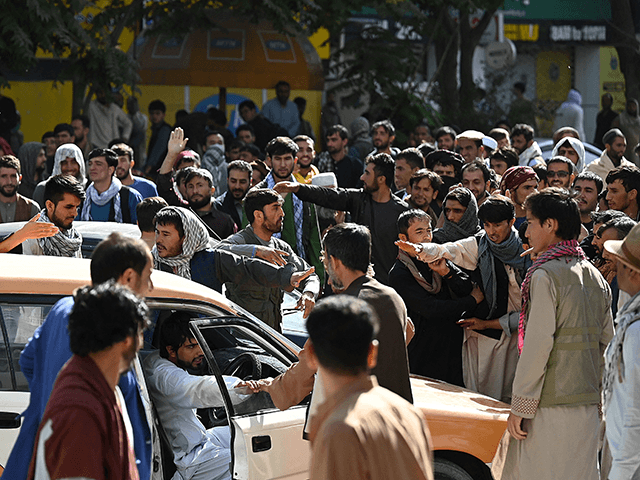

Hundreds of people took to the streets of Kabul, Afghanistan, to protest an ongoing, months-long closure of banks in the national capital and across the country on Saturday, Afghanistan’s Khaama Press reported.

Men and women denounced the continued closure of “the [Afghan] central bank, private banks, and money-changing markets” nationwide on August 28, according to the newspaper.

“They asked for their money as they have been facing severe problems due to lack of money,” Khaama Press revealed.

Hundreds of protesters gathered outside New Kabul Bank in Kabul on Saturday, including “many civil servants demanding their salaries, which they said had not been paid for the past three to six months,” the Press Trust of India (PTI) reported.

#AFG Hundreds of Afghans outside of the New Kabul Bank. Cash- crisis is causing panic among Afghans. pic.twitter.com/tQMtw2xYB3

— BILAL SARWARY (@bsarwary) August 30, 2021

The Taliban reportedly ordered all banks in Afghanistan to reopen as early as August 25, according to PTI. Khaama Press reported the terror group, which seized control of Afghanistan on August 15, directed all Afghan banks to “reopen and resume functions as normal from Saturday, August 28, onward.”

Despite the alleged reopening order, “no one has been able to withdraw cash” from the banks, according to PTI.

“ATM machines are still operating, but withdrawals are limited to around $200 every 24 hours, contributing to the formation of long lines,” the Indian news agency revealed.

“Despite the direction and assurance of security by the Taliban to private banks, the banks’ employees do not dare to come to jobs and resume functions as normal,” according to Khaama Press.

“The banks’ owners say that they cannot resume operation until the central bank of Afghanistan — De Afghanistan Bank — opens,” the newspaper added.

Afghanistan’s economy has deteriorated in recent months and especially over the past two weeks after the Taliban terror group invaded Kabul and ousted the city’s U.S.-backed government, declaring itself Afghanistan’s sole, legitimate ruler. The shocking development prompted the U.S. to block the Taliban’s access to “virtually all of the Afghanistan central bank’s $9 billion (€7.66 billion) in reserves, most of which are held in the US,” the German broadcaster Deutsche Welle (DW) reported August 24. The International Monetary Fund (IMF) likewise suspended Afghanistan’s access to its funds. Both actions precipitated an acute shortage of U.S. dollars in Afghanistan.

“With no new shipment of dollars arriving to shore it up, the local currency, afghani, has crashed to record lows, sending prices soaring. Prices of staples like flour, oil and rice have risen by as much as 10 percent-20 percent in a few days,” DW revealed August 24.

In addition to inflation woes, Afghans are grappling with suddenly restricted access to much-needed remittances from family members in foreign countries, such as Pakistan, Iran, the United Arab Emirates (UAE), Germany, and the U.S. Wire transfer services including Western Union and MoneyGram suspended their operations in Afghanistan following the Taliban’s toppling of Kabul on August 15. The cash transfers are a “lifeline” for already struggling Afghans, according to DW. Remittances accounted for roughly four percent of Afghanistan’s GDP in 2020, according to the World Bank.

COMMENTS

Please let us know if you're having issues with commenting.