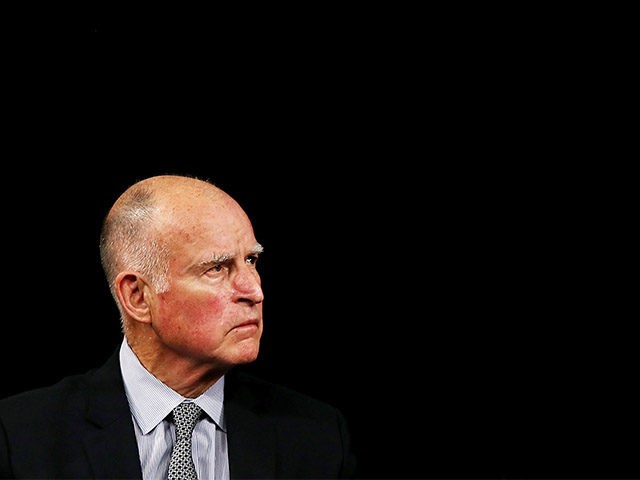

The highest taxed state in the nation is about to pay more in taxes as California Governor Jerry Brown won agreement from Democrat leaders to push through a long-overdue transportation bill funded by raising gas taxes and Department of Motor Vehicles (DMV) usage fees.

At a joint press conference at the Capitol Wednesday, the Sacramento Bee reports that Gov. Brown acknowledged California’s roads are pothole-ridden and crumbling, committing to push a “$5.2 billion road-funding package” through both houses of the legislature, which will be a tough sell for some moderate Democrats in swing districts.

Brown’s proposal would hike the state’s gas tax and set up a “user fee” based on a sliding scale tied to a vehicle’s value.

The Los Angeles Times is reporting that the proposal includes “a 12-cent-per-gallon increase in current gas excise taxes on Nov. 1. Future increases would be made through a new tax calculating methodology and annual inflation adjustments. Those changes would begin in 2019 and would be fully implemented in 2020.”

These taxes would be on top of the increased vehicle use fee, which the Times states would “average $51.00 per year based on the value of the car.”

The sliding scale fee for the right to drive on California’s roads starts at $25 for cars valued under $5,000, and rises to $175 for vehicles whose value exceeds $60,000. All electric vehicle owners will be billed $100 — a huge opt-out for those who pay zero gas taxes while driving very expensive cars.

Brown’s plan also includes money to expand public transit, which is sure to be unpopular when the roads are in such a poor state of repair.

The Times adds that Gov. Brown is pushing the plan as a “pay-as-you-go proposal,” but most Californians are going to ask why so much money has been wasted on priorities that have nothing to do with the “public good” – -like free college tuition for illegal aliens; huge pay and pension increases for public sector unions; and politicians’ pet projects like the High-Speed Rail Authority.

One bit of irony: Brown’s transportation proposal includes a constitutional amendment to guarantee that the legislature does not divert the transportation funds to any other purpose — even though those safeguards already exist. (They have been suspended many times.)

The San Diego Union-Tribune reports that “In 2002, voters overwhelmingly passed Proposition 42, a constitutional amendment meant to ensure that motor vehicle sales taxes be used only for transportation purposes … After such suspensions happened twice, in 2006, voters by an even bigger margin approved Proposition 1A” — another constitutional amendment that forces the legislature to repay any funds diverted during a “state financial hardship” as a loan to the transportation fund.

The irony is that the Democrats are promising to protect taxpayers from … Democrats, i.e. from themselves.

Democrat leaders have given themselves an April 6 deadline to pass the proposal, to be certain they have ample time to have the package approved ahead of the June 15 budget deadline.

What they may not be thinking about is the political impact of proposing a huge tax increase that will hit the working poor the hardest — the dreaded gas tax — just before the April 15 tax deadline.

If Republicans hold the line, every Democrat will have to vote in favor of what is sure to a very unpopular tax. When former Governor Gray Davis tripled the “car tax” (aka ‘vehicle license fee’) 14 years ago, he was ousted by a recall election, and replaced with Arnold Schwartzenegger — who worked with the Democrat-controlled legislature to rescind the unpopular increase.

Ever since the Oroville Dam became the symbol of Gov. Jerry Brown’s failure to take care of a basic core duty of state government— that is, maintaining and expanding infrastructure for the common good — Californians have been asking what happened to the (Proposition 1) Water Bond money; why the state can give illegal aliens a free ride to college, but can’t fix potholes ; and why infrastructure money was spent on pet projects like the California High-Speed Rail Authority.

Meanwhile, the California media are treating the suggestion that Brown hasn’t ruled out running for president in 2020 — when he would be 82 — as newsworthy.

Tim Donnelly is a former California State Assemblyman and author, who’s doing a book tour for his new book: Patriot Not Politician: Win or Go Homeless.

FaceBook: https://www.facebook.com/tim.donnelly.12/

Twitter: @PatriotNotPol

COMMENTS

Please let us know if you're having issues with commenting.