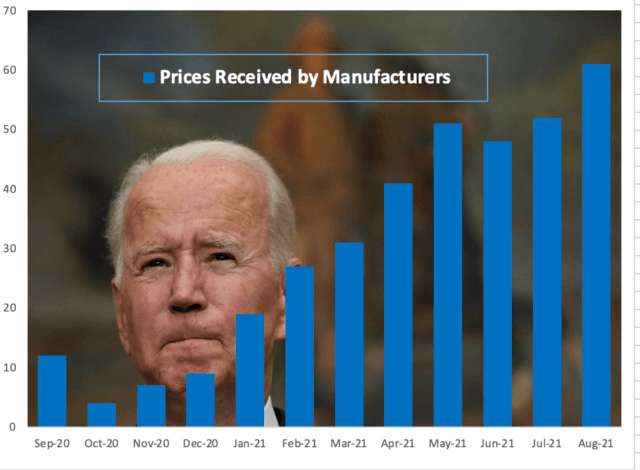

Inflationary pressures on goods manufactured in central U.S. rose to a record level in August, according to a survey from the Federal Reserve Bank of Kansas City released Thursday.

The Kansas City Fed’s index for prices received jumped to a seasonally adjusted 61 from July’s 52, the previous record high. Fifty-nine percent of manufacturers surveyed said they were increasing prices, 42 percent said they had not changed their prices in the month, and none reported lower prices.

The prices paid index jumped to 80, up from 78 in July. This was the second-highest reading recorded after May’s 86. Eighty-two percent of manufacturers reported paying higher prices for materials, 16 percent reported no change, and two percent reported lower prices.

The survey covers manufacturers located in the western third of Missouri, the northern half of New Mexico, and all of Colorado, Kansas, Nebraska, Oklahoma, and Wyoming.

The survey’s index of general activity unexpectedly ticked down to 29 from 30 the previous month. That still indicates robust expansion, in contrast with other regional Fed surveys that have shown bigger slowdowns.

“Regional factory activity growth remained positive in August,” said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City. “Manufacturing finished goods prices rose at a record pace. Firms reported solid expectations for future production overall, but 20% of firms reported a recent decrease in activity due to the recent surge in COVID-19 cases.”

The region has been plagued by shortages of supplies and labor. In last month’s survey, 89 percent of firms reported supply chain issues and 91 percent reported labor shortages.

The August survey introduced another obstacle to growth: the Delta variant. While this month just 20 percent of firms reported a recent decrease in activity due to the coronavirus surge, 35 percent said they expected to be hit over the next six months.

The region’s manufacturing sector expansion was boosted by activity in durable goods factories, particularly primary metals, computer and electronic products, and transportation equipment, the Kansas City Fed noted.

The production index, however, declined sharply in August to 22 from 41 the previous month, a sign that output growth is slowing amid ongoing supply chain and labor market difficulties.

The volume of shipments index dropped to 25 from 37. New orders were a bright spot, with the index increasing to 34 from 26.

Eighty percent of firms said they expected the prices of materials to increase over the next six months, 13 percent predicted no change, and 7 percent predicted prices would fall. As for their own prices, 60 percent said they thought they would be increasing prices, 34 percent foresee stable prices, and five percent said they thought prices would decline.

COMMENTS

Please let us know if you're having issues with commenting.