Treasury Secretary Scott Bessent delivered an expansive vindication of the Trump administration’s economic record on Wednesday, arguing that a combination of tariffs, tax cuts, and deregulation had produced what he called a “historic turnaround” after years of malaise under President Biden.

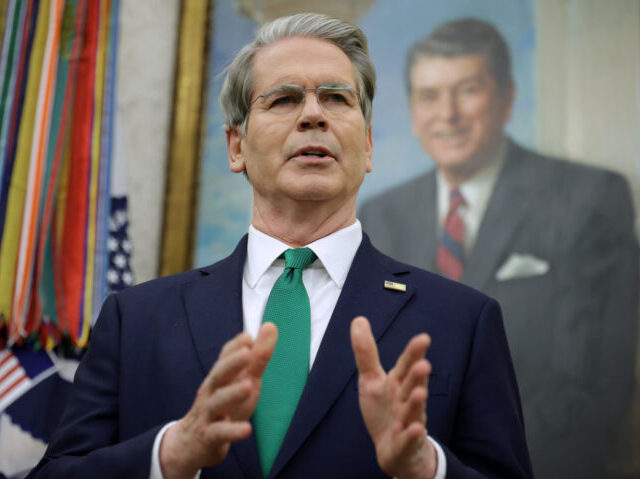

Speaking to business leaders at the Economic Club of Minnesota, Bessent laid out a vision of an economy revitalized by strategic government intervention in trade, sweeping changes to the tax code, and a sharp pivot away from regulations he said had stifled entrepreneurship and innovation.

The speech represented one of the most comprehensive articulations to date of the administration’s economic philosophy, which Bessent distilled into what he called the “three I’s” of investment, innovation, and income — a formulation designed to contrast with what he described as the Biden era’s problems of immigration, interest rates, and inflation.

“In just one short year, President Trump has delivered a historic economic turnaround to put our country back on the path to prosperity,” Bessent told the audience, citing economic growth of roughly 4 percent in the first two full quarters of Trump’s term and nearly 3 percent in the fourth quarter, despite a government shutdown led by Democrats.

Bessent spoke hours after the government released data showing productivity had surged beyond even the most optimistic expectations and the trade deficit had fallen to the narrowest gap since 2009. The Atlanta Fed’s GDPNow tracker has the economy expanding at a 5.4 percent rate in the fourth quarter of 2025.

“We’re starting the see the effects of the president’s policies kick-in,” Joe Lavorgna, counselor to the Treasury Secretary, said in an interview with Breitbart News after Bessent’s talk. “These data points that we’re seeing at the end of 2025 set us up with strong momentum going in to 2026.”

Lavorgna argued that the improved productivity would allow the Federal Reserve to more aggressively cut interest rates this year.

“The Trumpian productivity surge should allow interest rates to decline,” he said.

The Minneapolis appearance offered Bessent a platform to press the administration’s case in a state that has trended Democratic in recent elections but where economic anxieties have created potential openings for Republicans.

Asked by financial journalist Michelle Caruso-Cabrera during the question-and-answer portion of the program why he was speaking in a “blue state,” Bessent said he did not think it was a “foregone conclusion” that Minnesota would remain blue.

Trump’s Triumphant Trade Strategy

At the heart of Bessent’s message was a full-throated defense of the president’s use of tariffs, a policy that initially drew criticism from many economists who warned of potential inflationary pressures and retaliatory measures from trading partners. Instead of retaliation, however, nearly all U.S. trading partners have cut deals with the U.S. Fed officials have admitted that they overestimated the inflationary effects of tariffs.

Bessent argued that the strategy was already bearing fruit, pointing to what he said was a 12 percent surge in business investment through the first three quarters of 2025 — the largest non-pandemic increase in more than a decade. He attributed the rise to companies responding to President Trump’s message to “hire your workers here, build your factories here, make your products here.”

The Treasury Secretary highlighted major investment commitments from companies with operations in Minnesota, including Amazon, which invested $120 billion in the last fiscal year, and Minnesota-based companies like Medtronic, 3M, and General Mills, which he said had collectively invested more than $3.4 billion.

He also pointed to a trade agreement with China under which Beijing has committed to purchasing at least 25 million metric tons of American soybeans annually for three years — a deal he suggested would particularly benefit Minnesota farmers and agricultural giants like Cargill, the nation’s largest private employer, which is based in the state.

“Open your markets to U.S. agriculture; increase your agricultural purchases,” Bessent said, describing the message President Trump has consistently delivered in trade negotiations. “That’s how he scored a victory for Minnesota soybean farmers.”

A Tax Code Overhaul

Bessent devoted considerable attention to the recently passed tax legislation, which he referred to as the Working Families Tax Cut Act, arguing that its provisions would reshape the investment landscape and put more money in Americans’ pockets.

The law allows businesses to immediately expense the costs of factories, equipment, and farm structures, as well as research and development expenses — changes Bessent said would lower the cost of capital and spur what he termed a “CapEx Comeback.”

“More investment means more supply, and more supply means lower prices for the consumer goods families rely on,” he said, making an explicit connection between business investment and consumer welfare that echoed supply-side economic arguments.

But perhaps the most novel element of the legislation, in Bessent’s telling, was the creation of so-called Trump Accounts — a program that would provide every newborn American citizen with a $1,000 contribution from the Treasury to be invested in an index fund.

Bessent projected that the initial investment would grow to at least $500,000 by retirement age, creating what he described as an “ownership economy where all citizens become shareholders in America’s wealth.”

“Today, 38 percent of American adults do not own stocks,” Bessent said. “But with Trump accounts, over time, we can get that number down to zero.”

He urged business leaders in the room to match the Treasury contribution for their employees’ children, noting that companies could direct the donations to specific communities or ZIP codes.

The proposal represents an unusual hybrid of conservative investment-oriented policy and more progressive universal benefit programs, though Bessent framed it squarely as an extension of Mr. Trump’s populist economic vision.

Deregulation and Community Banks

On regulatory policy, Bessent emphasized the administration’s efforts to help community banks, nearly half of which have disappeared since 2010 — a trend he attributed to regulatory burdens imposed in the wake of the financial crisis.

“The unintended consequence of ‘too big to fail’ was ‘too small to succeed,'” Bessent said, arguing that Mr. Trump had taken executive action to create a more level playing field between small and large financial institutions.

The Treasury secretary also addressed concerns among some economists about whether productivity gains from technological innovation would translate into wage growth for workers, citing the economist Lawrence Lindsey’s observation that the gap between output growth and labor input growth was simply a measure of productivity — which Bessent suggested would ultimately benefit workers through higher wages.

A Focus on Wages and Benefits

Bessent drew sharp contrasts with the Biden administration on wages and take-home pay, arguing that real weekly wages had declined 2 percent during Biden’s presidency but had risen more than 1 percent under Trump, with blue-collar wages growing at one of the fastest rates in decades.

The tax legislation, he said, prevented a $4.5 trillion tax increase, allowing the average American to keep an additional $7,200 in annual wages and the average family of four to retain $10,900 more in take-home pay.

The law also expanded the child tax credit, eliminated taxes on Social Security benefits for 88 percent of retired Americans and codified campaign promises to eliminate taxes on tips and overtime pay.

In a notable announcement, Bessent said that tax season would begin on Jan. 26, one of its earliest starts in a decade, allowing Americans to receive refunds and benefit from adjusted withholdings more quickly.

“Millions of Minnesotans and Americans may see the largest tax refunds of their lives,” he said.

Taking Aim at Fraud

Bessent also used the Minnesota platform to address what he described as a massive welfare fraud scandal in the state, calling it “ground zero for what may be the most egregious welfare scam in our nation’s history to date.”

He said billions of dollars intended for families in need, housing for disabled seniors, and services for children had been diverted to fraudsters under Gov. Tim Walz, and pledged that the Treasury would work to recover stolen funds and prosecute those responsible.

The comments represented an aggressive foray into state-level politics for a Treasury secretary, but they aligned with Bessent’s broader message that Minnesota needed to reverse course on policies he said had led to net outbound migration and made the state less competitive.

He cited Minnesota’s status as having the second-highest corporate tax rate in the country as evidence of what he described as “failed experiments with big government, overregulation.”

“President Trump’s hope, and ultimately his invitation, is that Minnesota becomes the North Star State again,” Bessent said.

A Partnership Model

Throughout the speech, Bessent emphasized what he characterized as a fundamental difference in approach between the Trump and Biden administrations toward business.

“For four years under Biden, Minnesotans had a president who prioritized punishment over partnerships in his dealings with the business community,” he said. “President Trump is the best partner an American job creator could ever have.”

Looking ahead to 2026, Mr. Bessent projected that the foundation laid in Trump’s first year would produce continued momentum, with robust, non-inflationary growth driven by capital investment, rising productivity, and easing prices.

“The Trump economy is back — and its best days are still ahead,” he concluded, urging Minnesota business leaders to invest directly in America’s workforce, infrastructure, and industrial base.

COMMENTS

Please let us know if you're having issues with commenting.